All Related Articles

Profit Shifting: Evaluating the Evidence and Policies to Address It

The OECD has been working to assess the impact of their program of work, and it will be critical for this assessment to take into account impacts not only on revenues, but also on growth and investment.

7 min read

FAQ on Digital Services Taxes and the OECD’s BEPS Project

What is a digital services tax (DST)? What countries have announced, proposed, or implemented a DST? What are some of the criticisms of a DST? What are alternatives to a DST? What is the OECD BEPS project and what is its main objective? What is the main objective of OECD Pillar 1? What is the main objective of OECD Pillar 2?

8 min read

Navigating Alaska’s Fiscal Crisis

4 min read

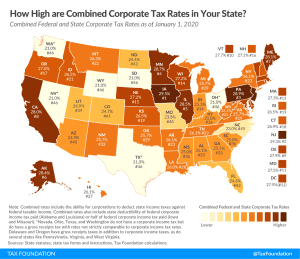

State Corporate Income Tax Rates and Brackets, 2020

Forty-four states currently levy a corporate income tax. Rates range from 2.5 percent in North Carolina to 12 percent in Iowa. Over the past year, several states, including Florida, Georgia, Indiana, Mississippi, Missouri, and New Jersey, implemented notable corporate income tax changes.

7 min read

Analysis of Sen. Warren and Sen. Sanders’ Wealth Tax Plans

New modeling finds that the wealth taxes proposed by Sen. Warren and Sen. Sanders would raise significantly less revenue than promised, face serious administrative and compliance challenges, and would increase foreign ownership of U.S. capital.

38 min read