All Related Articles

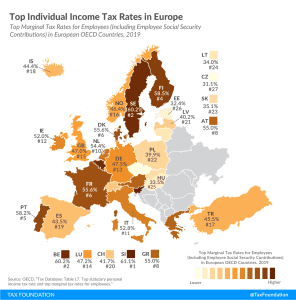

Tax Relief for Families in Europe

Most countries provide tax relief to families with children—typically through targeted tax breaks that lower income taxes. While all European OECD countries provide tax relief for families, its extent varies substantially across countries.

2 min read

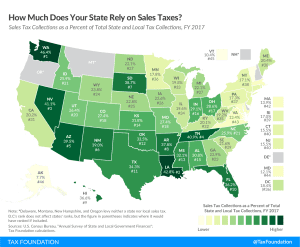

To What Extent Does Your State Rely on Sales Taxes?

Consumption taxes, like sales taxes, are more economically neutral than taxes on capital and income because they target only current consumption.

3 min read

The U.S. Tax Burden on Labor, 2020

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay about 30 percent of their wages in taxes.

15 min read

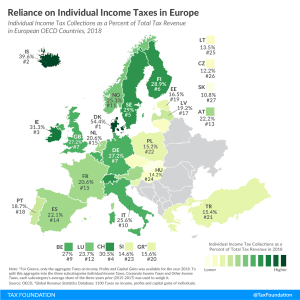

To What Extent Does Your State Rely on Individual Income Taxes?

While the current crisis has caused consumption to drop dramatically, it is generally true that income taxes are more volatile than consumption taxes in an economic downturn and income taxes tend to be more harmful to economic growth than consumption taxes and property taxes.

3 min read

A Comparison of the Tax Burden on Labor in the OECD, 2020

A higher tax burden on labor often leads to lower employment rates and wages. That’s important for policymakers to remember as they look for ways to help their economies recover from coronavirus-induced shutdowns. If their goal is to encourage employment, policies that lower the tax burden on labor could prove a powerful tool.

20 min read

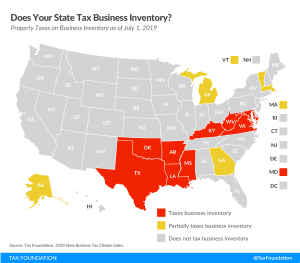

Does Your State Tax Business Inventory?

Inventory taxes are levied regardless of whether a business makes a profit, adding to the burden of businesses already struggling to stay afloat.

2 min read