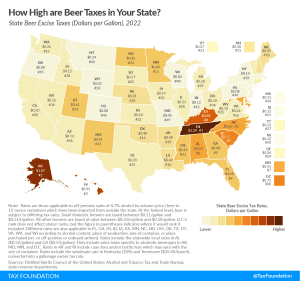

Beer Taxes by State, 2022

Tennessee, Alaska, Hawaii, and Kentucky levy the highest beer excise tax rates in the nation. How does your state compare?

3 min read

Tennessee, Alaska, Hawaii, and Kentucky levy the highest beer excise tax rates in the nation. How does your state compare?

3 min read

The mix of tax sources states choose can have important implications for both revenue stability and economic growth, and the many variations across states are indicative of the different ways states weigh competing policy goals.

29 min read

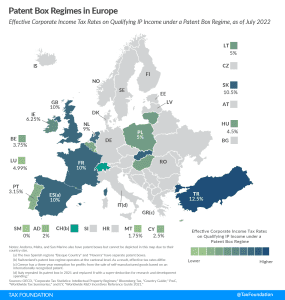

Patent box regimes (also referred to as intellectual property, or IP, regimes) provide lower effective tax rates on income derived from IP. Most commonly, eligible types of IP are patents and software copyrights. Currently, 13 of the 27 EU member states have a patent box regime.

4 min read

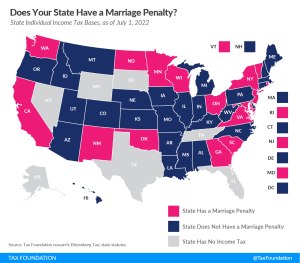

A marriage penalty exists when a state’s income brackets for married taxpayers filing jointly are less than double the bracket widths that apply to single filers. In other words, married couples who file jointly under this scenario have a higher effective tax rate than they would if they filed as two single individuals with the same amount of combined income.

3 min read

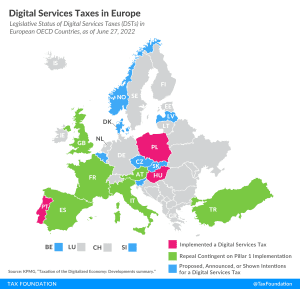

About half of all European OECD countries have either announced, proposed, or implemented a digital services tax.

7 min read

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

43 min read

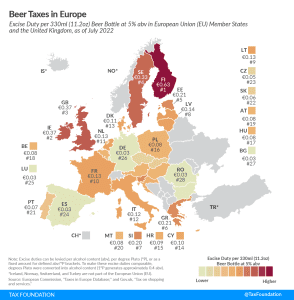

’Tis the season to crack open a cold one. Ahead of International Beer Day on August 5th, let’s take a minute to discover how much of your cash is actually going toward the cost of a brew with this week’s tax map, which explores excise duties on beer.

3 min read

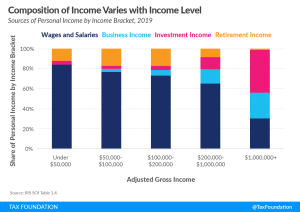

Reviewing reported income helps to understand the composition of the federal government’s revenue base and how Americans earn their taxable income. The individual income tax, the federal government’s largest source of revenue, is largely a tax on labor.

10 min read

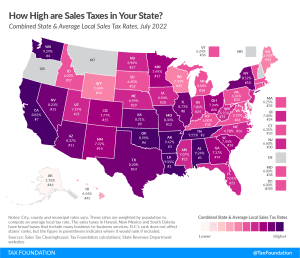

While many factors influence business location and investment decisions, sales taxes are something within policymakers’ control that can have immediate impacts.

12 min read

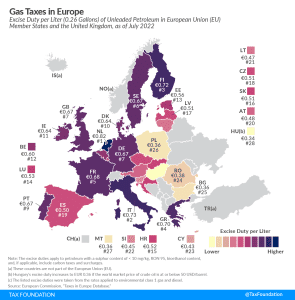

The Netherlands has the highest gas tax in the European Union, at €0.82 per liter ($3.69 per gallon). Italy applies the second highest rate at €0.73 per liter ($3.26 per gallon), followed by Finland at €0.72 per liter ($3.24 per gallon).

5 min read