Among the unfinished business awaiting lawmakers when they return from their two-week recess are technical corrections to the 2017 tax law. Last month, the Internal Revenue Service and Treasury Department issued final regulations for the new law’s expensing provision, noting that the error known as the “Retail Glitch” must be fixed by legislative change, not by administrative change. The retail glitch makes it more expensive for businesses to make improvements to the interiors of their buildings.

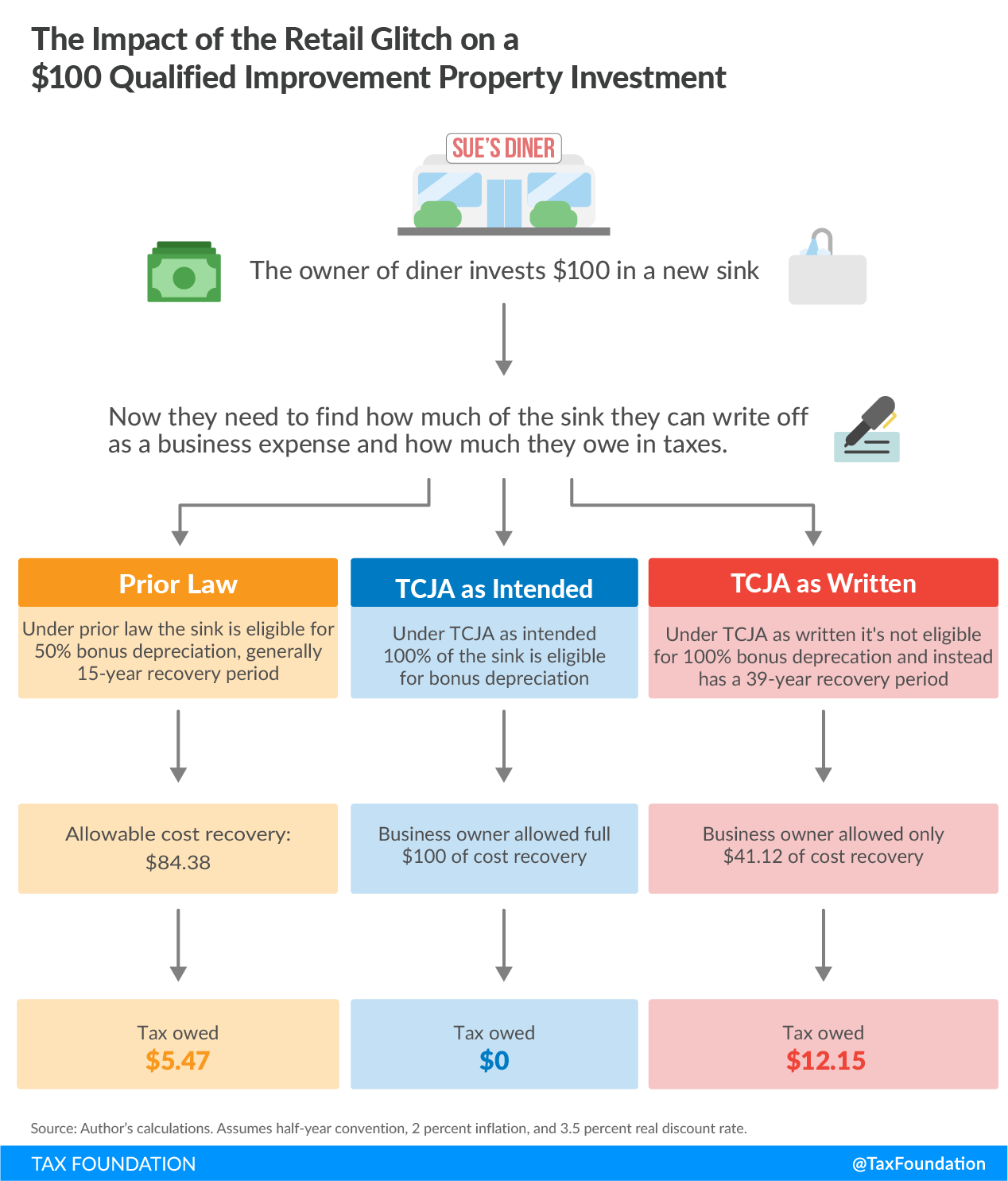

A quick review of the issue at hand: Lawmakers intended to clean up the various definitions of “improvement property” that existed under old law, combine them under one new definition, and assign the new definition a 15-year cost recoveryCost recovery refers to how the tax system permits businesses to recover the cost of investments through depreciation or amortization. Depreciation and amortization deductions affect taxable income, effective tax rates, and investment decisions. period so that it would be eligible for the new 100 percent bonus depreciation provision. This plan fell short because of a missing reference: the new definition of qualified improvement property (QIP) was not assigned the 15-year recovery period intended. Without a specific assignment, QIP instead has a 39-year cost recovery period and is ineligible for 100 percent bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. .

Simply put, this means businesses that invest in qualified improvement property now face higher costs than under previous law and than what Congress intended, because of the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. treatment their investments receive.

For example, rather than deducting the cost of a new sink in the year it’s installed, the business has to take deductions for the new sink over 39 years (in most cases). As illustrated above, when a company is required to deduct the cost of their investment over a number of years, the present value of the depreciation deductions is less than the initial investment cost, meaning businesses cannot fully recover their costs (in present value terms) and thus face an increased tax burden.

It is important for lawmakers to address this error, which mistakenly increased taxes on qualified improvement property and thus discourages businesses from undertaking these types of investments. Fixing the retail glitch would mean businesses no longer face more restrictive cost recovery treatment for their investments than before tax reform.

Share this article