Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeKey Findings:

- A financial transaction taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. (FTT) would raise transaction costs, which would result in a lower trading volume, lower liquidity, potentially increased volatility, and lower price of assets. Lower volume limits revenue potential, lower liquidity harms traders’ ability to buy and sell shares at the best price level, and increased volatility can increase risks.

- An FTT might be targeted at limiting high frequency trading or speculative short-term investment. However, it is highly unlikely that an FTT would only discourage “undesired” trading and would almost certainly result in a host of unintended consequences. The tax code is, moreover, not an appropriate policy tool to limit certain financial transactions.

- Estimating revenue from a state-level FTT is difficult given the unknown reaction by the financial markets and high risk of tax avoidance.

- States can either tax financial transactions by taxing data processing or stock exchanges, or tax the trader buying and selling financial products. States can either levy the tax at a flat rate or by value (ad valorem).

- An FTT results in a version of tax pyramidingTax pyramiding occurs when the same final good or service is taxed multiple times along the production process. This yields vastly different effective tax rates depending on the length of the supply chain and disproportionately harms low-margin firms. Gross receipts taxes are a prime example of tax pyramiding in action. as the same instrument is traded multiple times, meaning that even at low rates, an FTT would add a significant tax burden.

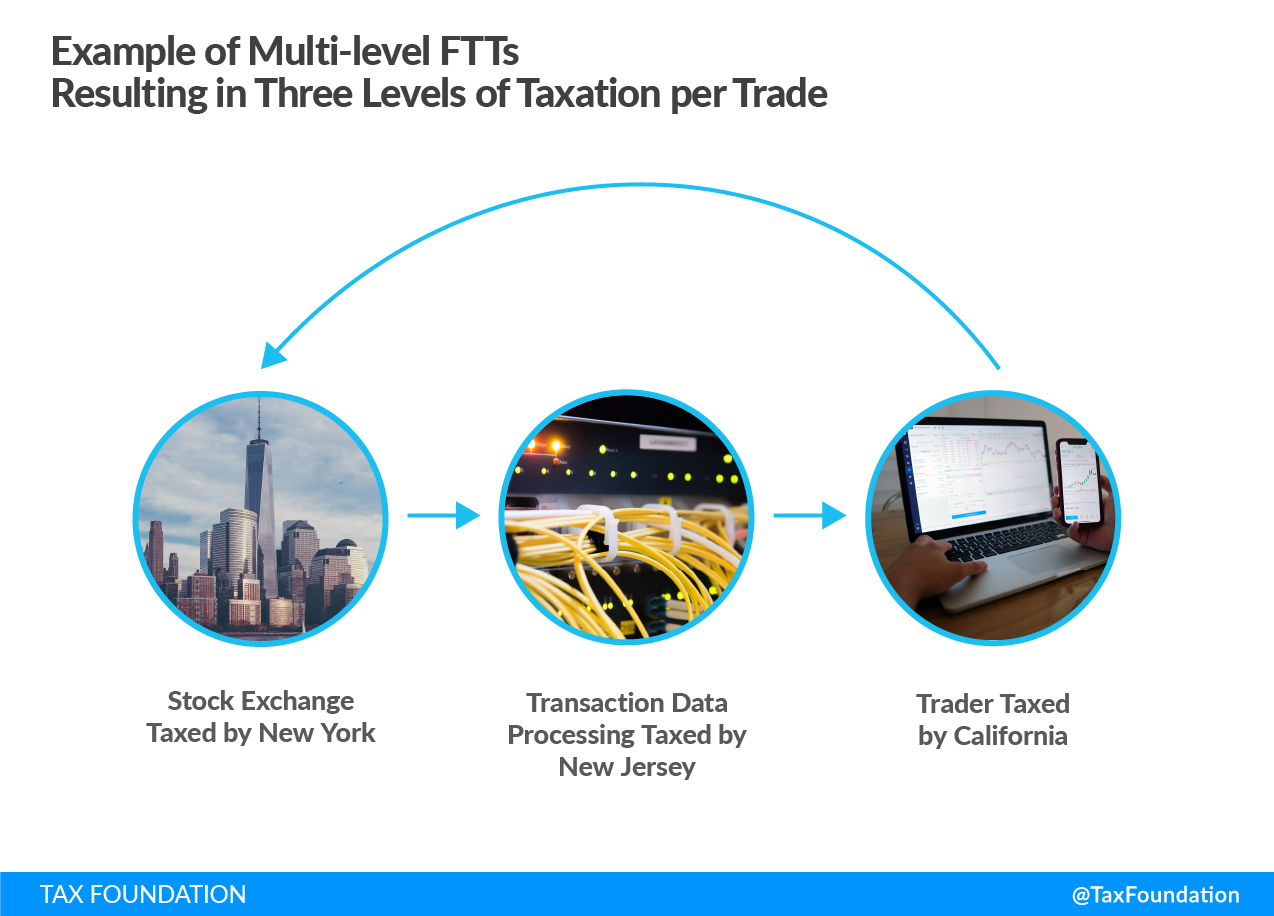

- If several states implement FTTs, the transfer of a security being taxed multiple times could emerge. A trade could be taxed by the home state of the buyer or seller, by the state that hosts the data processing centers, and by the state that hosts the stock exchange.

Introduction

Many states face budget shortfalls resulting from the coronavirus pandemic. Estimates vary about the severity of these shortfalls, but it is clear that states will collect less revenue than projected in fiscal years (FYs) 2021 and FY 2022.[1] In an effort to close these budget holes, states are expected to look for new sources of tax revenue. In a few states, legislators have floated financial transaction taxes (FTT) as one potential source of revenue. These taxes, sometimes known by other names like Securities Transfer Taxes and Stock Transfer Taxes, are levied on the transfers of financial instruments—traditionally securities.

The idea to tax financial transactions is not new to the pandemic; it has a very long history. A stamp duty was introduced in England in 1694 as a measure to raise revenue for the king’s wars, and this tax is still levied today. Many Americans may know that the Stamp Act, which was an attempt to enforce the stamp duty in the British colonies, contributed to the outbreak of the War of Independence.[2] Historically, in the U.S., the federal government, New York State, and New York City have levied FTTs at different times. The federal government repealed the tax in 1965 and New York (both state and city) effectively repealed theirs in 1981.

Historical examples both in the U.S. and abroad suggest that lawmakers should be careful when designing taxes for the financial market. A well-functioning financial market provides a key service for businesses and entrepreneurs in need of capital or risk management. In addition, it provides savers with a chance to get a better return than they would get with a standard savings account—especially with interest levels near zero.

Nonetheless, imposing an FTT to raise revenue has been, and is being, discussed by lawmakers at both the federal and state levels. During the Democratic Party’s presidential primary contest in 2020, a few candidates supported FTTs at the federal level.[3] At the state level, lawmakers in New York and New Jersey are discussing levying such taxes.[4] There is also federal opposition to FTTs. In October 2020, Representatives Patrick T. McHenry (R-NC) and Bill Huizenga (R-MI) introduced the Protecting Retirement Savers and Everyday Investors Act, which would prohibit states from imposing FTTs that could affect residents of other states.[5]

Transaction taxes more generally are quite common at the state level. Many states impose a version of a transaction tax known as the real property transfer tax, which is commonly a low-rate levy on the transfer of real property.

The issues with levying a tax on financial transactions are related to the nature of the financial markets. First, financial transactions are a flawed tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. as the tax is levied every time a security is transferred, resulting in tax “pyramiding” similar to the effect of a gross receipts taxGross receipts taxes are applied to a company’s gross sales, without deductions for a firm’s business expenses, like compensation, costs of goods sold, and overhead costs. Unlike a sales tax, a gross receipts tax is assessed on businesses and applies to transactions at every stage of the production process, leading to tax pyramiding. . “Pyramiding” refers to a tax that is levied on the same economic activity many times over—in this case, each time a share is traded. Second, an FTT would raise transaction costs, which would result in a lower trading volume and lower liquidity as even low rates could be punitive, especially for low-margin high frequency trading (HFT).[6] Low liquidity (or quoted depth) makes it more difficult for traders to buy and sell shares at the best price level. Third, taxing trades might result in investors holding on to the securities to avoid the tax, regardless of whether they should actually be holding on to them.[7] Disincentivizing trading is not ideal as economists generally think of trades as highly valuable activity that benefits both parties. Fourth, an FTT would result in income being taxed multiple times. FTTs tax the act of trading itself, on top of existing capital gains, personal income, and corporate income taxes.

States can limit the adverse effects of an FTT by making certain design choices but are unlikely to avoid them completely. They must consider a number of tax policy trade-offs related to this design. Choice of tax base will impact market participant behavior and choice of rate will impact market volume and liquidity. This paper discusses those trade-offs and presents arguments against an FTT as both a revenue tool and deterrent of “undesired” trading.

Tax Elements

Depending on design, an FTT works by taxing financial transactions when they are transferred through a sale and purchase, or even at issuance (although this is less common). The type of securities taxed (stocks, bonds, or derivatives) are determined by the choice of tax base. A narrow design that limits an FTT to just one class of securities can encourage investors to move to other classes, making such a tax non-neutral. If, for instance, only stock trades are taxed, investors can avoid the tax by moving to derivatives with a similar exposure but without a tax. Broader bases are more neutral.

States must also consider another tax base issue: whether to tax the buyer or seller of the asset, the stock exchange, or the data processing center. The choice is largely dictated by whether a state is home to a stock exchange or trading server farms. It only makes sense for a state to tax financial transactions by taxing the data processing if that activity happens within the state’s jurisdiction, or to tax the stock exchanges if they operate within the state.

Traditionally, FTTs are levied at very low rates to limit adverse effects. However, even low rates pyramid quickly. Imagine, for instance, an investor that chooses to change their risk profile and sells a security worth $100 in order to purchase another with that same $100. The $100 is being taxed twice: first, when the individual sells, and then again when the money is used to buy the new security. Imagine this happening millions of times a day. In addition, even at low rates, FTTs could dramatically increase transaction costs which, due to technological advances, are at historical lows. Increasing transaction costs, even though they might still be low by historical comparison, have consequences because it would make a large amount of trades unprofitable. An estimate by Urban Institute economist James Nunns suggest that a 0.5 percent FTT on stocks would reduce stock trades by as much as 85.1 percent.[8]

The effective tax rate is determined by tax type. If a state imposes an FTT at a percentage of a security’s value (ad valorem), a tax is paid corresponding to this value when it is traded. If levied at a fixed price per transaction, the tax burden remains constant regardless of the price of the security. For instance, if levied at 0.05 percent ad valorem, an investor selling an asset worth $1,000 could pay a tax of $0.50. If the rate is flat, for instance at a rate of $0.0001 per security, the tax would remain constant regardless of the value of the traded security, resulting in lower valued securities having a higher effective rate.

As a rule of thumb, taxes with broad bases and low rates result in the most neutral tax and limits opportunities for tax avoidance and evasion. States are, however, bound by their jurisdictional limits. This limitation exposes states to a situation similar to the now-repealed Swedish FTT. Sweden implemented an FTT effective between 1984 and 1991, with a narrow base that only taxed trades intermediated by Swedish brokerages. This resulted in a substantial portion (30 percent) of the market moving to London.[9] That was more than 30 years ago, when remote work tools were much less developed than they are today, and when costs associated with relying on foreign exchanges were higher. It is much cheaper for a business to relocate today, or for other exchanges to be utilized, which increases the risk of avoidance.

General Design Considerations

First and foremost, an FTT would increase costs on every transaction. Over the last few decades, transactions costs have decreased substantially and today make up only a couple of basis points. An FTT of, for instance, 50 basis points (or 0.5 percent) based on value (or 5 cents of a security valued at $100) would increase transaction costs many times over, resulting in substantial reductions of trading volume. James Nunns estimated that a proposal by Sen. Bernie Sanders (I-VT) to tax stock transfers at 0.5 percent, bond transfers at 0.1 percent, and derivatives at 0.005 percent, would yield an 85.1 percent reduction in stock trades, 62.9 percent in bonds, and 86.0 percent in derivatives.[10] The methodology accounts for different transaction costs across the various types of derivatives, but assumes a uniform elasticity, which may result in some inaccuracy.[11] Importantly, this estimate was based on a federal tax, which would limit tax avoidance opportunity by applying to all U.S. transactions and U.S. persons. Because it is easier to move activity from New York to Georgia than from New York to, for example, Austria, a state-level tax would be at a much higher risk of experiencing significant declines in volume and subsequent lower revenue from an FTT.

One type of trade that would be particularly affected is high frequency trading (HFT), which is responsible for a considerable portion of total trading volume. It is estimated that HFTs make up about half of U.S. equities trades.[12] Eliminating or heavily reducing this activity would not only result in reduced revenue from the levy, it could also have negative effects on the market for everyone else by increasing transaction costs even more.[13]

Reduced volume may not be considered a design flaw as some supporters of FTTs consider the tax a measure to rein in speculation and limit volatility. Volatility is the variability of the returns of a security over time and describes how much a security’s price moves up and down over time. However, the evidence of FTTs limiting volatility is mixed, and it is unclear whether an FTT would increase or decrease volatility. In theory, increasing transaction costs would reduce speculation, but this effect may be offset by traders requiring larger price movements before they consider it to be profitable to trade to “correct” these movements.[14] Furthermore, if the tax does not exempt market makers (New Jersey and New York proposals, discussed below, do not), quoted depth may decline, leading to larger price swings from a given order size.[15]

Some proponents even argue that financial transactions offer no marginal value to the economy, and that volume declines as a result of an FTT can be a positive side effect.[16] In this light, an FTT aimed at limiting HFTs or speculative short-term investment is basically a “sin” tax aimed at encouraging social change, just like tobacco taxes are supposed to curb smoking. However, it is highly unlikely that an FTT would only discourage “undesired” trading, whereas it would almost certainly result in a number of unintended consequences. The tax code is, moreover, not an appropriate policy tool to limit certain financial transactions.[17]

Another issue with the FTT is tax pyramiding. Because an FTT works like a gross receipts tax, it would have an unequitable effect on different types of assets. Securities that are traded more often (like Treasury securities) would be taxed more often and thus be less attractive to investors.[18] This distortion could lead investors to hold onto securities for longer than they would have otherwise done, which would negatively impact market prices and risk assessments in addition to decreasing liquidity and volume. Besides the risk of limiting volume and liquidity, depending on the tax design, it may also encourage traders to move to over-the-counter (OTC) trades (those that occur outside of an exchange). If the state limited this effect by including OTC in the FTT base, it would significantly increase compliance costs for both the state government and the taxpayers.[19]

Currently, a tremendous amount of trades is conducted on a daily basis in the U.S. In 2019, an average of $322 billion was traded daily on the U.S. equities market, with an additional $895 billion worth of trades in bond markets.[20] Given these large numbers, even a low-rate tax can raise significant revenue: at the federal level, the Joint Committee on Taxation (JCT) and the Congressional Budget Office (CBO) estimate that a 0.1 percent tax on all securities would raise $777 billion over 10 years.[21]

While such revenue may be enticing to some lawmakers, there are serious questions about the actual revenue return. An introduction of an FTT would likely have a considerable effect on the amount of trades, which would result in less revenue. The decline is hard to determine, but several estimates of price elasticity can be found in the literature—most of which focus on national FTTs.[22] An analysis by the International Monetary Fund (IMF) found that FTTs “create many distortions that militate against using an STT [Securities Transaction Tax] to raise revenue,” as the tax increases cost of capital, reduces asset value, and reduces trading volume. [23] The precise impact depends on market specifics, as they determine elasticity. While the elasticity under a national tax is uncertain, if a single state imposes an FTT, it would likely have a higher elasticity due to the relative ease with which activity could move to non-taxed jurisdictions. Both people and companies consider tax levels when they choose where to reside, and movement between states is relatively simple.

According to the IMF study, securities that are traded more often are particularly impacted. Among the securities traded most frequently are government securities and, as a result, the cost of issuing debt for the federal government could increase.[24]

At the state level, negative effects on volume from an FTT would be likely more impactful relative to a federal-level tax because it is much easier for transactions to avoid state-level taxation by moving activity out of state jurisdiction than it is to avoid federal jurisdiction covering all U.S transactions and U.S persons. Reduced volume does not, moreover, only affect revenue collected from the FTT; it would also offset some of that revenue by lowering state income tax revenue on capital gains.

Proponents often laud the fact that the burden of an FTT primarily falls on the wealthy, as the wealthy are more likely to hold and trade financial assets. While it is true that a significant amount of the tax burden would fall on the wealthiest Americans, it is not that simple. Like most taxes, the statutory incidence is not the same as the economic incidence, and the impact of an FTT would be felt by a much larger group of investors.

The IMF concluded that, in addition to FTTs’ inefficiency as revenue tools, their costs would be borne not only by wealthy investors but also by pensions, mutual funds, and other vehicles of middle-class savings.[25] The Congressional Budget Office concluded that household wealth would decline as a result of asset prices declining, [26] but the impact on returns could also negatively impact wages.[27] Moreover, depending on the design of an FTT (and the degree to which it captures trades), it would increase the cost of consumer goods as it increases the cost of capital and limits companies’ ability to manage risks by increasing the cost of derivatives.[28] For instance, many businesses purchase options to lock in a price of a commodity—farmers selling wheat or airlines purchasing fuel.[29] These effects all limit the progressive effects of the FTT.

Last, an FTT would increase the cost of equity over debt. Debt is already treated preferably by the tax code (by allowing tax deductions of interest payment) and an FTT could exacerbate that.

Taxing Data Processing

Taxing data processing is an unconventional design approach to an FTT, and such tax has never been levied by any U.S. state. Nonetheless, in 2020, A4402, a proposal to tax data processing of financial transactions, was introduced in New Jersey. In the first version of the bill, it would, if enacted, have imposed a 0.25 cent tax per transaction on entities that process at least 10,000 transactions in a year in New Jersey. The tax rate was since amended to 0.01 cents per transaction.

This proposed FTT in New Jersey would be a flat-rate tax imposed per instrument, not per trade, meaning that a purchase of 1,000 shares would generate $0.10 in taxes.[30] A 100th of a cent is a low rate, but it would quickly pyramid as the same instrument is traded—and therefore taxed—multiple times. If enacted, it would be particularly burdensome for low-margin HFT operations as their business model depends on low transaction costs.

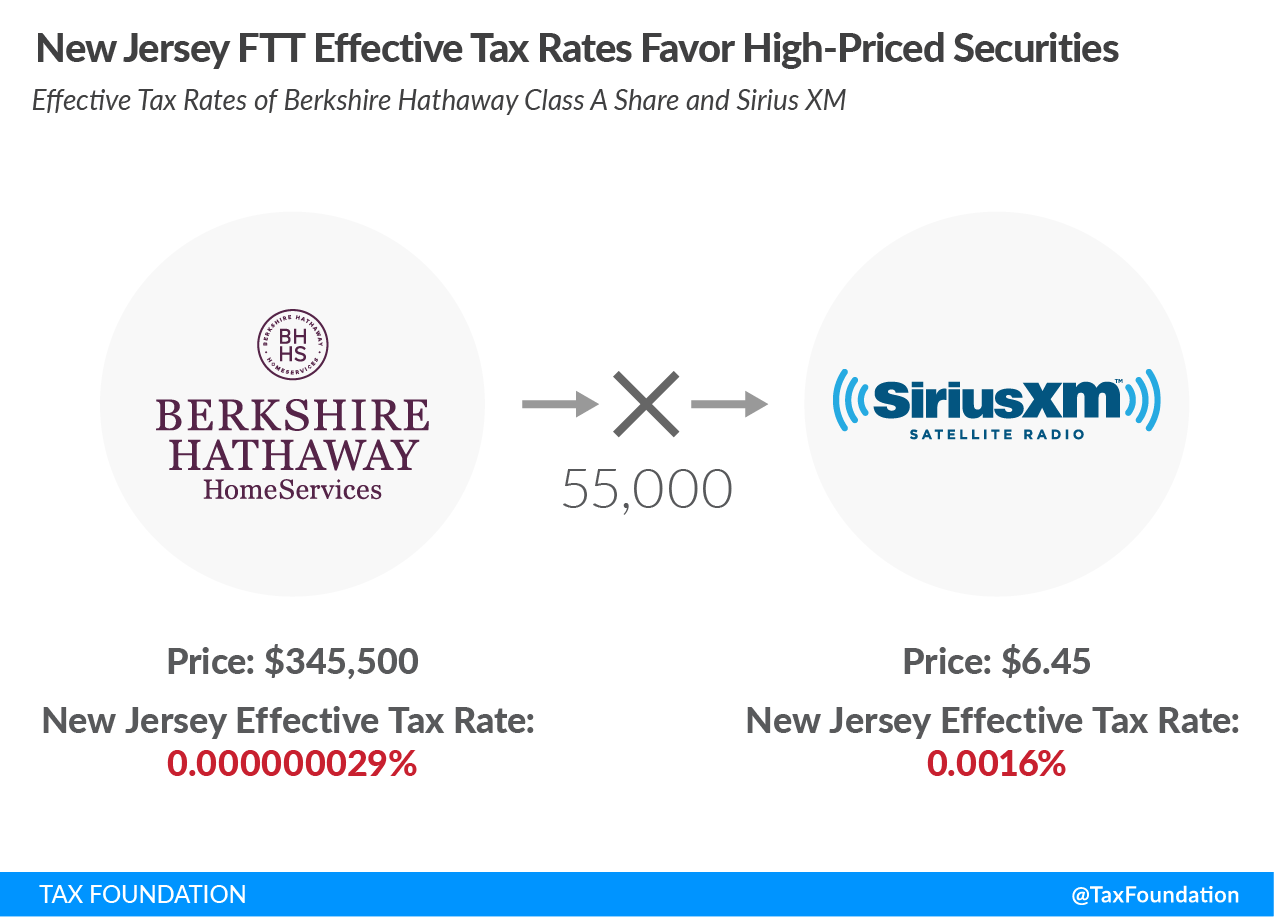

Because the tax is imposed at a flat rate per transaction, the effective rate would be much higher on stocks that trade at lower prices—largely, though not invariably, associated with small and midcap stocks. The effective rate on the sale of a Berkshire Hathaway Class A share ($345,500 at opening bell on December 3) would be 0.000000029 percent, while the rate on the sale of a share in Sirius XM ($6.45 at opening bell on December 3) would be nearly 55,000 times higher at 0.0016 percent.

In fact, at a price point of, for instance, $100 a share, New Jersey’s tax on financial transactions would be more than two times higher than the Section 31 fee currently imposed by the federal government to support all regulatory activity conducted by the Securities and Exchange Commission (SEC), which is the closest the U.S. currently comes to imposing a FTT.[31]

A more neutral design would have a tax rate based on the value of the security, as the effective rate would not change depending on the price of a security. However, even then, the non-neutral nature of the tax and its massive impact on volume make a data processing FTT a problematic proposal.

One reason FTTs on data processing may be interesting to lawmakers is that the majority of the burden would fall on the residents of other states. Taxing data processing (and to a lesser extent taxing stock exchanges) is a way of exporting the tax burden since the majority of the trades processed by the servers are conducted on behalf of residents of other states. Policymakers have an incentive to export tax burdens, as it avoids the political pressure involved when levying new taxes on constituents.

To be fair, there is a provision in the New Jersey bill guaranteeing that the tax will not be levied on transactions that are taxed by other jurisdictions. This provision would limit revenue production but is positive in terms of avoiding problematic double taxation. It may also indicate that lawmakers are aware that the tax design is flawed. Perhaps for the same reason, New Jersey lawmakers say that the tax is temporary (set to expire by the end of 2022). Unfortunately, temporary taxes have a way of becoming permanent.

A flat-rate FTT on data processing at the state level is highly susceptible to avoidance given the inherently mobile nature of electronic transaction processing and inequitable in its application. A New Jersey tax would only be levied on New Jersey processing, putting them at a competitive disadvantage against those located anywhere else. The same effect would be true for any other state levying a tax on data centers (or exchanges) within their jurisdiction.[32] The major New York-based exchanges, the New York Stock Exchange and the NASDAQ, both currently use servers based in New Jersey to process transactions, making New Jersey the only state meaningfully positioned to generate revenue from such a tax at present—but that status is also one that could change overnight if such a tax were implemented. As high-speed data transmission continues to improve, the low latency associated with New Jersey-based data processing declines in value, and exchanges could easily move their processing elsewhere to avoid billions of dollars in tax liability.[33] Automated high frequency trading operations which rely on ultra-low latency may move with the servers, which would represent a loss to the state.

Taxing Financial Transactions

Another tax design option is the more traditional approach to FTTs: taxing the stock exchange directly. Historically, New York as well as the federal government have taxed the transactions handled by the exchanges. In fact, there is still a stock transfer tax on the books in New York, though it has been fully rebated since 1981.[34] Last year, in New York, some lawmakers had proposed reviving this tax, which has a tax rate of up to 5 cents per share (1.25 cents for stocks worth less than $5).[35] The legislation to repeal the rebate, A.7791 and S.6203, was introduced by Assemblyman Phil Steck (D) and Sen. James Sanders (D).[36]

Assemblyman Steck estimates that repealing the rebate could raise $13 billion annually based on the last 10 years’ average collections.[37] This estimate is likely an overestimation since it does not account for market reaction, and since reported amounts (all automatically rebated) were $5.48 billion in FY 2019 and $4.04 billion in FY 2020.[38] In addition, although the prospects of low-rate-taxes on large amounts of financial activity may sound appealing, the proposal comes with considerable risk in an increasingly mobile economy. A New York tax would only cover New York’s trading floors and they could “simply” move.

Transactions may not even need to move out of the state to avoid the tax, as it has a fairly narrow design. Investors could simply pivot to instruments with a similar exposure, such as derivatives, not included in the tax base. A British STT shares this flaw and has likely contributed to a significant increase in derivatives volumes that now make up 40 percent of the market despite a limit on trading derivatives by pension and life insurance funds.[39] It is possible, however, that the major exchanges themselves could relocate to avoid the tax, taking a sizable share of the state economy with them. Financial activity moving out of New York would not be a small issue. Broadly defined, financial activities make up 29.1 percent of the state’s GDP.[40] Banks and brokers account for 17 percent of state tax revenue[41]—but at both the city and state levels, the industry is in decline. A New York City comptroller’s report covering the final quarter of 2019 noted that the financial industry had seen employment declines for five consecutive quarters, citing lower interest rates, technological innovation, and “the relocation of jobs to lower cost geographies.”[42]

Considering the impact the coronavirus pandemic has had on our business and our daily lives makes an FTT an even less appealing prospect for New York. In an October survey of Manhattan employers, those in finance and insurance industries expected only 52 percent of their employees to return to the city by July 2021.[43] Relocations could increase if New York imposes a narrow high-rate tax on one of its most important, and evidently increasingly mobile, industries.

Taxing Traders

The third option for taxing financial transactions is to tax trades (either at a flat rate or ad valorem) conducted by residents of the state—essentially an excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. on the privilege of trading. This design would be the only option for any state which does not host an exchange or data processing center. Under this design, all residents in a state would pay taxes on each financial trade at a given rate. This tax proposal shares many of the unfortunate effects of the taxes described above but would also be exceedingly vulnerable to tax avoidance, as those most effected—mobile, high-net-worth individuals—leave the state or trade through an out-of-state holding company. Tax competitiveness is an important consideration for state lawmakers,[44] and levying an FTT would certainly reduce any state’s competitiveness and potentially deprive it of some of its largest taxpayers.

The three design options for tax bases discussed share several unintended consequences and perverse incentives. However, the worst outcome for taxpayers would be a situation where several states implement FTTs and the sale of one security is taxed multiple times by multiple taxing jurisdictions. For instance, it could be taxed under an FTT by the home state of the seller, then again by the state that hosts the stock exchange, and finally by the state that hosts the data processing centers. One FTT is likely to have considerable negative effects on the financial markets, but two or three simultaneous levies would almost certainly have a detrimental impact on the efficiency of the financial markets and their ability to provide return on investment for savers, capital to businesses and government, and risk management.

This worst case example, illustrated in Figure 2, would be avoided if Congress passes federal legislation, like the Protecting Retirement Savers and Everyday Investors Act, which would prohibit states from levying an FTT on residents of other states. This particular bill would, if enacted, prohibit the first two FTTs discussed by this paper (taxing data processing and taxing stock exchanges), leaving states with only one option: taxing their own residents.

Conclusion

The financial markets provide a key service to America’s government, businesses, and entrepreneurs. They are a source of capital, they provide opportunities to manage risk, and they allow savers to realize a return from investments.

Imposing an FTT in a single state is highly problematic and is likely to hurt both businesses and investors. Ultimately, an FTT increases transaction costs, lowers asset prices, lowers liquidity, and increases the cost of capital. These effects make the market less efficient and could negatively impact earnings for all investors—including 401(k)s, public pensions, and mutual funds. In addition, an FTT would increase costs to owners of securities, cost of capital to businesses, and, in the long run, reduce wages.

Furthermore, it is highly uncertain how much revenue a state FTT would raise given the high risk of tax avoidance—taxpayers moving activity outside the state’s jurisdiction. A state-level FTT is far more exposed to tax avoidance than a federal FTT would be.

If an FTT is intended to limit speculative investments in an effort to limit market volatility, it is far from certain that it would achieve that goal. Available research on the issue does not indicate that volatility is reduced. Instead, the research indicates that an FTT would be highly distortive to the financial markets, to the extent a state tax can even capture the activity. If you mess with the bull, you get the horns.

Lawmakers looking to close budget shortfalls would be well-advised to consider other and more stable avenues for new revenue.

[1] Jared Walczak, “New Census Data Shows States Beat Revenue Expectations in FY 2020,” Tax Foundation, Sept. 18, 2020, https://taxfoundation.org/state-tax-revenues-beat-expecations-fy-2020/.

[2] TaxHistory.org, “The Seven Years War to the American Revolution,” Tax Analysts, accessed Nov. 6, 2020,

http://www.taxhistory.org/www/website.nsf/Web/THM1756?OpenDocument.

[3] U.S. Congress, Senate, “Inclusive Prosperity Act of 2019, S 1587,” 116th Congress, 1st sess., introduced May 22, 2019, https://www.congress.gov/bill/116th-congress/senate-bill/1587/text; U.S. Congress, House, “Wall Street Tax Act of 2019, HR 1516,” 116th Cong., 1st sess., introduced Mar. 5, 2019, https://www.congress.gov/116/bills/hr1516/BILLS-116hr1516ih.pdf.

[4] Jared Walczak and Janelle Cammenga, “New York and New Jersey Consider Financial Transaction Taxes,” Tax Foundation, July 23, 2020,

https://taxfoundation.org/new-york-financial-transaction-tax-new-jersey-financial-transaction-tax/.

[5] U.S. Congress, House of Representatives, “Protecting Retirement Savers and Everyday Investors Act,” 116th Congress, 2nd sess., Introduced Oct. 27, 2020, https://republicans-financialservices.house.gov/uploadedfiles/protecting_retirement_savers_act.pdf.

[6] Colin Miller and Anna Tyger, “The Impact of a Financial Transaction Tax,” Tax Foundation, Jan. 23, 2020, https://taxfoundation.org/financial-transaction-tax/.

[7] Thornton Matheson, “Taxing Financial Transactions: Issues and Evidence,” IMF Working Paper, March 2011, 13, https://www.imf.org/external/pubs/ft/wp/2011/wp1154.pdf.

[8] James R. Nunns, “A Comparison of TPC and the Pollin, Heintz and Herndon Revenue Estimates for Bernie Sanders’s Financial Transaction Tax Proposal,” Tax Policy Center, Apr. 12, 2016, 4, https://www.taxpolicycenter.org/publications/comparison-tpc-and-pollin-heintz-and-herndon-revenue-estimates-bernie-sanderss/full.

[9] Both a French FTT and a British FTT have avoided this design flaw by broadening the base. See Colin Miller and Anna Tyger, “The Impact of a Financial Transaction Tax.”

[10] James R. Nunns, “A Comparison of TPC and the Pollin, Heintz and Herndon Revenue Estimates for Bernie Sanders’s Financial Transaction Tax Proposal,” 4.

[11] The methodology assumes an elasticity of -1.25 across all securities. In practice, different securities have very different trading elasticities. Still, the usage of a uniform elasticity is reasonable given the lack of available data on current trading elasticities.

[12] Evelyn Cheng, “Just 10% of Trading Is Regular Stock Picking, JPMorgan Estimates,” CNBC, June 13, 2017, https://www.cnbc.com/2017/06/13/death-of-the-human-investor-just-10-percent-of-trading-is-regular-stock-picking-jpmorgan-estimates.html.

[13] Colin Miller and Anna Tyger, “The Impact of a Financial Transaction Tax.”

[14] Mark P. Keightley, “Financial Transactions Taxes: In Brief,” Congressional Research Service, Mar. 27, 2019, 3, https://fas.org/sgp/crs/misc/R42078.pdf.

[15] Market makers help transfer risk for other investors. They also reduce the bid and ask spread, which lowers transactions costs. See Colin Miller and Anna Tyger, “The Impact of a Financial Transaction Tax.”

[16] Josh Bivens and Hunter Blair, “A Financial Transaction Tax Would Help Ensure Wall Street Works for Main Street,” Economic Policy Institute, July 28, 2016, 14, https://www.epi.org/publication/a-financial-transaction-tax-would-help-ensure-wall-street-works-for-main-street/.

[17] Thornton Matheson, “Taxing Financial Transactions: Issues and Evidence,” 37.

[18] Congressional Budget Office, “Letter to Ranking Member, Committee on Finance, U.S. Senate,” Dec. 12, 2011, https://www.cbo.gov/sites/default/files/112th-congress-2011-2012/reports/12-12-2011_Hatch_Letter.pdf.

[19] Colin Miller and Anna Tyger, “The Impact of a Financial Transaction Tax.”

[20] Securities Industry and Financial Markets Association, “2020 Capital Markets Fact Book,” September 2020, 29, https://www.sifma.org/wp-content/uploads/2020/09/US-Fact-Book-2020-SIFMA.pdf; Congressional Budget Office, “Impose a Tax on Financial Transactions,” Dec. 13, 2018,

https://www.cbo.gov/budget-options/2018/54823.

[21] Congressional Budget Office, “Impose a Tax on Financial Transactions.”

[22] Josh Bivens and Hunter Blair, “A financial transaction tax would help ensure Wall Street works for Main Street,” Economic Policy Institute, July 28, 2016.

[23] Thornton Matheson, “Taxing Financial Transactions: Issues and Evidence,” 37.

[24] Leonard E. Burman et al., “Financial Transaction Taxes in Theory and Practice,” National Tax Journal 69:1 (March 2016): 184, https://www.brookings.edu/wp-content/uploads/2016/07/Burman-et-al_-NTJ-Mar-2016-2.pdf; Congressional Budget Office, “Impose a Tax on Financial Transactions.”

[25] Thornton Matheson, “Taxing Financial Transactions: Issues and Evidence,” 36-38.

[26] Congressional Budget Office, “Impose a Tax on Financial Transactions.”

[27] Leonard E. Burman et al., “Financial Transaction Taxes in Theory and Practice,” 215.

[28] Congressional Budget Office, “Impose a Tax on Financial Transactions.”

[29] Mark P. Keightley, “Financial Transactions Taxes: In Brief,” Congressional Research Service, Mar. 27, 2019, 4.

[30] State of New Jersey, “ASSEMBLY, No. 4402,” 219th Legislature, July 16, 2020, https://www.njleg.state.nj.us/2020/Bills/A4500/4402_I1.PDF.

[31] U.S. Securities and Exchange Commission, “Section 31 Transaction Fees,” Sept. 25, 2013,

https://www.sec.gov/fast-answers/answerssec31htm.html.

[32] Chicago has had proposals similar to the New York proposal. See Jared Walczak, “No Good Options as Chicago Seeks Revenue,” Tax Foundation, Sept. 17, 2019, https://taxfoundation.org/chicago-budget-shortfall-2019/.

[33] Alex Alley, “NYSE and Nasdaq threaten to leave New Jersey if transaction tax goes ahead,” Data Center Dynamics, Oct. 20, 2020,

https://www.datacenterdynamics.com/en/news/nyse-and-nasdaq-threaten-leave-new-jersey-if-transaction-tax-goes-ahead/; Elise Young, “NYSE Says It’s Ready to Leave N.J. With Trade Tax Threatened,” Bloomberg, Oct. 19, 2020,

[34] New York State Department of Taxation and Finance, “Stock transfer tax,” https://www.tax.ny.gov/bus/stock/stktridx.htm.

[35] Ibid.

[36] The New York State Assembly, “Assembly Bill A7791B,” May 22, 2019, https://nyassembly.gov/leg/?bn=A07791A&term=&Summary=Y&Actions=Y&Votes=Y&Memo=Y&Text=Y; The New York State Senate, “Senate Bill S6203A,” May 22, 2019, https://www.nysenate.gov/legislation/bills/2019/s6203/amendment/a.

[37] Phil Steck, “New York State Assembly Memorandum in Support of Legislation, A.7791,” https://nyassembly.gov/leg/?default_fld=&leg_video=&bn=A07791&term=0&Summary=Y&Memo=Y.

[38] New York State Department of Taxation and Finance, “Fiscal Year Tax Collections: 2019-2020,” https://www.tax.ny.gov/research/collections/fy_collections_stat_report/2019_2020_annual_statistical_report_of_ny_state_tax_collections.htm.

[39] Leonard E. Burman et al., “Financial Transaction Taxes in Theory and Practice,” 175.

[40] Office of the New York State Comptroller, “2020 Financial Condition Report: Economic and Demographic Trends,” https://www.osc.state.ny.us/reports/finance/2020-fcr/economic-and-demographic-trends.

[41] Susan Arbetter, “A Return of the Stock Transfer Tax: Are There Unintended Consequences?” Spectrum News, Aug. 13, 2020, https://spectrumlocalnews.com/nys/central-ny/politics/2020/08/05/the-return-of-the-stock-transfer-tax–nightmare-or-easy-money-.

[42] Office of the New York City Comptroller, “NYC Quarterly Economic Update Q4 2019,” Mar. 6, 2020, https://comptroller.nyc.gov/reports/new-york-city-quarterly-economic-update/.

[43] Partnership for New York City, “Return to Office Survey Results Released – October,” Oct. 28, 2020, https://pfnyc.org/news/return-to-office-survey-results-released-october/.

[44] Janelle Cammenga and Jared Walczak, “2021 State Business Tax Climate Index,” Tax Foundation, Oct. 21, 2020, https://taxfoundation.org/2021-state-business-tax-climate-index/

Share this article