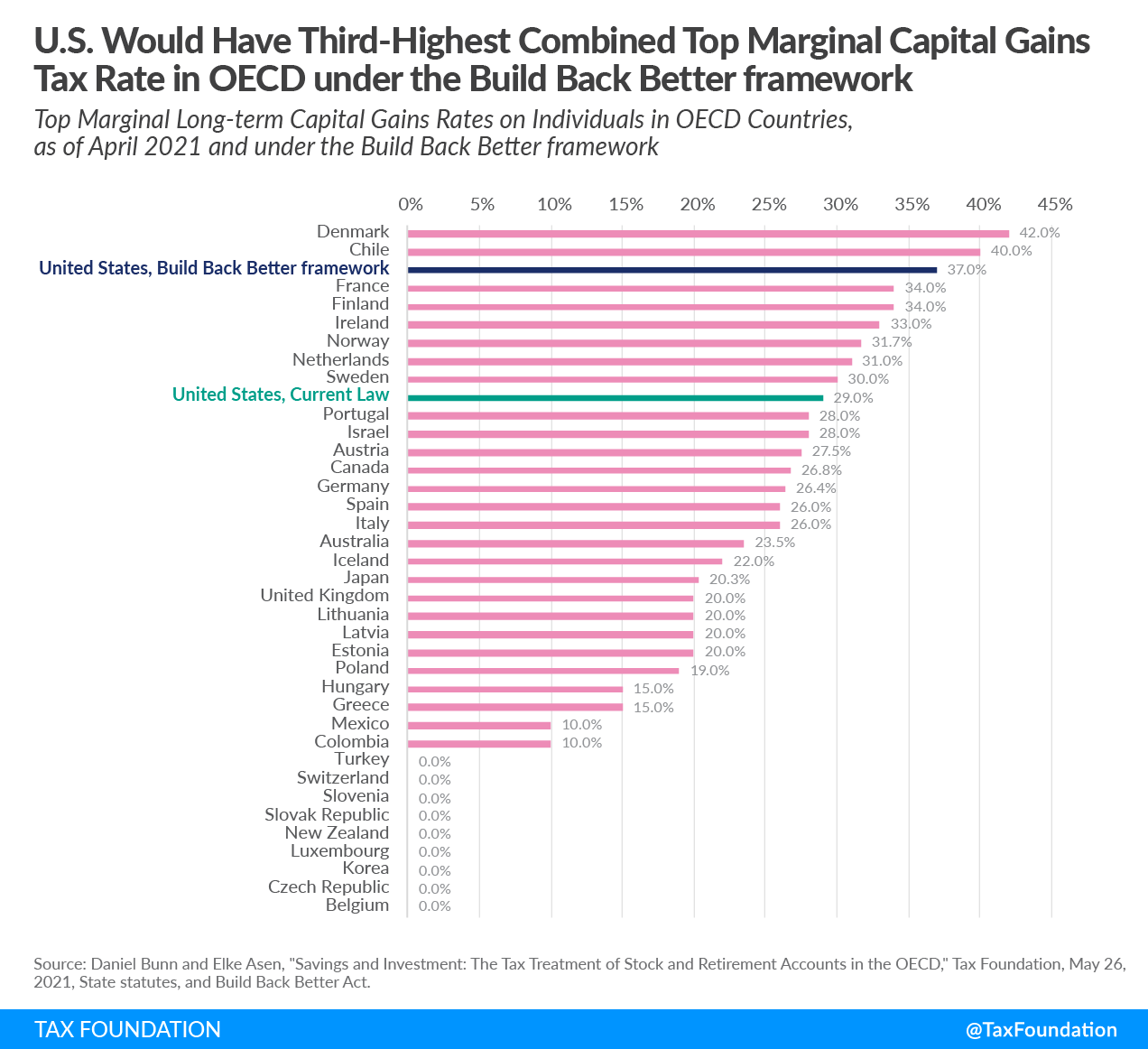

Under the new Build Back Better framework, the United States would taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. capital gains at the third-highest top marginal rate among rich nations, averaging nearly 37 percent.

In the U.S., long-term gains currently face a top marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. of 23.8 percent at the federal level, the result of a maximum 20 percent capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. rate plus a 3.8 percent net investment income tax. The Build Back Better proposal would apply a new surcharge of 8 percentage points to modified adjusted gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” (MAGI) above $25 million, including on capital gains income. The resulting 31.8 percent top marginal tax rate would be the highest federal tax rate on capital gains since the 1970s—and above the generally estimated revenue-maximizing rate of 28 percent.

When including state-level policies, the average top marginal combined tax rate on capital gains in the U.S. would rise to 37 percent, up from 29 percent under current law.

Under the Build Back Better proposal, the U.S. would have the third-highest top marginal tax rate on long-term gains among nations in the Organisation for Economic Co-operation and Development (OECD). The OECD average excluding the United States currently sits at 18.9 percent, with the highest rate levied by Denmark at 42 percent.

Note: This post was originally published on October 4th, but has been updated on October 29th to reflect the recent proposals in the Build Back Better framework.

Share this article