Oil and gas companies are probably used to not being the most popular entities in public life, but it would seem they become easy targets when high gas prices are high – even more so when those prices begin to have political ramifications. President Obama has repeatedly called for taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. provisions targeted at the oil industry to be repealed, including during his State of the Union address in February. Since then the White House has continued to single out oil and gas companies, sending a letter to members of the leadership in Congress this week, urging them to “eliminate unwarranted tax breaks for the oil and gas industry” and instead increase subsidies for other forms of energy.

All of this begs the question, how much money are we talking about? According to Fiscal Fact No. 260, “Who Benefits from Corporate ‘Loopholes?’”, there were about $2.2 billion in tax expenditures that were specific to the oil and gas industry in 2010. For some perspective, Special Report No. 183, “Oil Industry Taxes: A Cash Cow for Government,” shows us that in 2008 (the most recent year included) the U.S. oil industry collectively paid over $91.5 billion in domestic taxes. That’s on top of $72 billion paid in foreign taxes on income earned abroad.

It is true that the oil industry benefits from special tax provisions, but so do many other industries. Many tax benefits are poor policy and should be eliminated. There are also many tax benefits that are not limited to a specific industry, and these too could be scrubbed from the tax code. That is what policy experts are talking about when they discuss corporate tax reform: broadening the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. by eliminating tax expenditures and lowering the tax rates. This type of reform is needed for the whole system, not just one politically unfavorable industry.

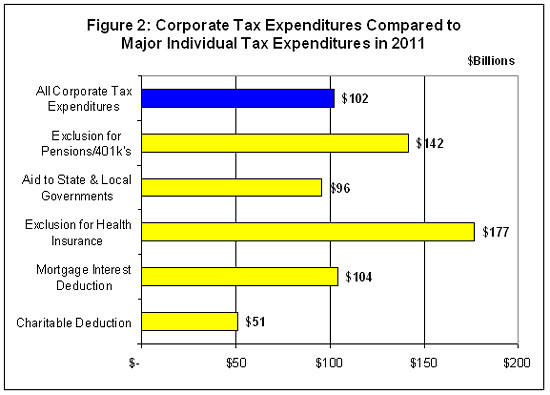

While the validity of any particular tax break might be debatable (anyone want to argue over the temporary 50% expensing for equipment used in the refining of liquid fuels?) it’s clear that the scope of oil and gas tax provisions are nowhere near as big as those campaigning to end them would suggest. Even if we include all corporate tax expenditures that are industry specific (not just to oil and gas), that total is dwarfed by the amount generally available to all firms.

And while it is easy to point fingers at the oil industry or corporations in general, Americans should remember that the biggest beneficiaries of tax expenditures are individual taxpayers themselves.

Read more on environment and energy taxes here.

Share this article