States collect property taxes in a number of ways: some impose a rate or a millage on the fair market value of property, while others impose it on some percentage (the assessment ratio) of the market value, yielding an assessed value.

Regardless of how they are collected, property taxes are an important revenue tool for state and local governments. In fiscal year 2014, they comprised the largest source of state and local taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. collections, at 31.3 percent. They also make up the largest revenue source for local governments.

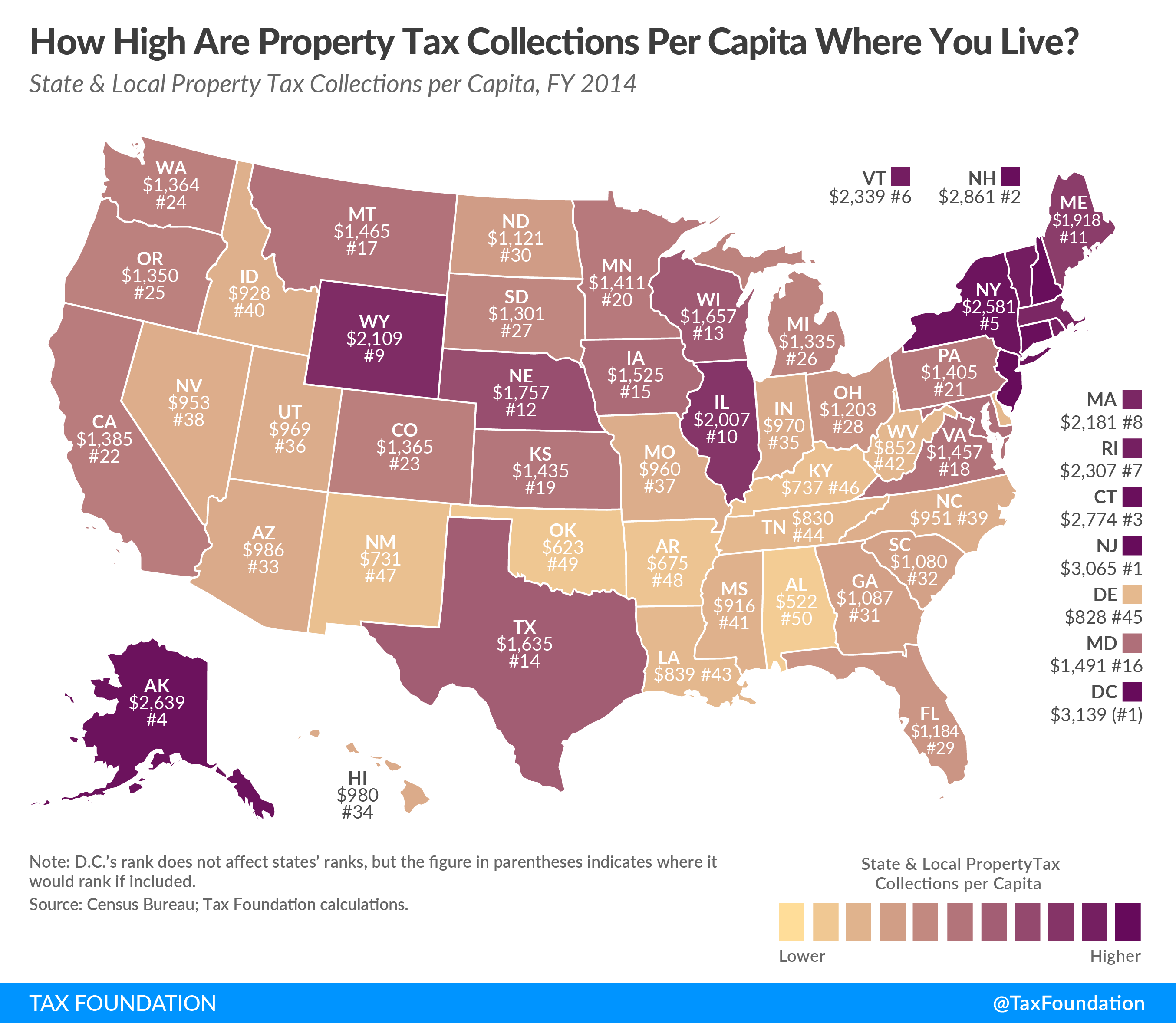

On average, U.S. state and local governments collect $1,462 per capita in property taxes, but collections can vary widely from state to state. The highest per capita collections are found in D.C. ($3,139), New Jersey ($3,065), and New Hampshire ($2,861). On the other end of the spectrum, the lowest per capita collections are found in Arkansas ($675), Oklahoma ($623), and Alabama ($522).

It’s important to keep in mind that property taxes vary not only among states, but within states as well, with higher property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. bills tending to cluster around urban and higher-income areas.

Like all other taxes, there are multiple ways to measure property taxes beyond collections, including effective property tax rates, median property taxes paid by county, and property tax collections as a percent of total state and local tax collections.

Share this article