President Obama released his proposed 2014 budget today, and as we learned last week it contains numerous taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. increases. Most of these have been proposed before either by the President or his party, such as the 28 percent limitation on the value of itemized deductions, the Buffett Rule, and higher taxes on carried interest and oil and gas production. There is also a 94 cent increase in the federal cigarette tax, which Obama hasn’t done since 2009, and a movement to chained-CPI that would push people into higher tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. faster over time. Plus, there is the move to “reform” the international corporate tax system by raising taxes on American companies operating abroad, which is opposite the reforms occuring in every other major country.

But the tax increase that is most novel is the $3 million cap on tax-free retirement accounts. The administration figures this would produce a retirement annuity of $205,000 a year on average, and that is enough. Forget the fact that millions of savers have been sacrificing for years to save money under the assumption that these retirement accounts would not be capped. This is not a good precedent, and not the sort of thing that inspires confidence in our laws going forward. What if the cap is lowered? What if these retirement accounts are further raided to pay down the national debt?

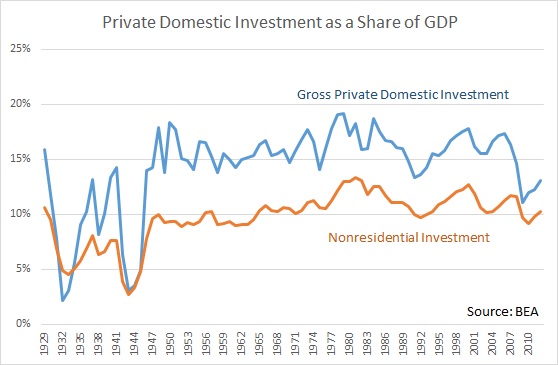

Nor is this good for saving and investment, i.e. the kind that grows organically in the private sector. Obama proposes various public investment initiatives, with names like “Fix-it-First” and “Rebuild America Partnership”, but what America lacks is robust private investment and the personal savings to support it. The personal savings rate was 3.9 percent in 2012, down from more than 10 percent in the 1970s and 1980s (see first chart below). Private investment is in even worse shape. While it is up somewhat over the last four years, gross private domestic investment continues to be lower as a share of GDP than at any time since the Great Depression (see second chart below). Much of the investment collapse over the last four years has been the bursting of the real estate bubble, but even nonresidential investment continues to be well below the average since 1970.

Apparently, the $3 million cap would affect about 1 percent of retirement accounts, directly. But it would affect a much larger percentage of dollars invested, directly, and it would essentially affect all investors indirectly through lower asset prices. As after-tax investment returns go down, we can expect lower investment, lower saving, and through that, lower economic growth.

Follow William McBride on Twitter @EconoWill

Share this article