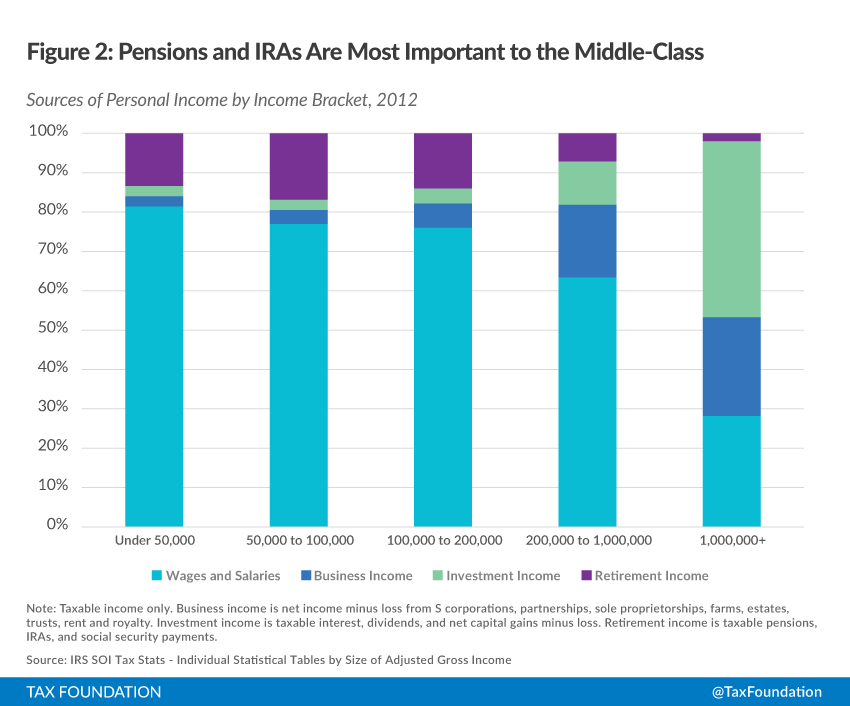

In my recent report on personal income, I made sure to devote a section to the role that pensions, annuities, and IRAs play as a substantial source of income for the middle class. In 2012, taxpayers reported a total of $612 billion from pensions and annuities, and another $231 billion in IRA distributions.

I claimed that this income is often forgotten in analysis of income data, so I wanted to give an example of that happening in practice.

The Congressional Budget Office released a report in 2011 on trends in the distribution of income. It was a good report that carefully accounted for all the sources of income, including some non-taxable sources. It divided income into categories – largely the same kinds that I did in my report. It sorted pensions into a separate category from labor income and capital income, mostly because it’s impossible to allocate the pension income precisely between labor and capital. (The initial contributions were made with labor income, obviously.) However, since things tend to sit in retirement accounts for a long time, the income leans mostly on the capital side for most workers. The CBO report sorted retirement income into a category called “other.” It found that category accounted for about 7% of all personal income in 2007. (I found these categories to be about 9% of taxable income in 2012; the difference comes largely from the fact that the CBO included employer health premiums in personal income, and I did not.)

New York Times columnist Paul Krugman took an interest in this report and published a blog post where he reported one of the CBO’s findings: that the distribution of capital income, as the CBO defined it, had grown more and more concentrated as time had gone on. But Krugman made the erroneous assumption that the definition of capital income included pensions. This would be a fair definition of capital income, given that pension income largely comes from capital, but it was not correct in this case. Krugman posed a rhetorical question: “Aren’t more and more Americans asset owners, for example through their retirement accounts? And the answer is no. In fact, the concentration of income from capital in a few hands has risen sharply. Tucked deep inside the CBO report on trends in the US distribution of income are data on the concentration of various types of income; here’s the one percent’s share of capital income.”

Krugman then posted a graph showing the top one percent’s share of “capital income,” according to the CBO report.

Had Dr. Krugman properly read the CBO’s methodology, he would have found the graph he used did not include retirement accounts, and wasn’t appropriate for answering his rhetorical question. The category that did include retirement accounts, incidentally, increased from four per cent of income in 1979 to seven per cent in 2007. While Dr. Krugman cited the CBO to answer his rhetorical question with a “no,” the report clearly answers the question in the affirmative. Quite literally, more and more Americans are asset owners through their retirement accounts.

You should always read appendices and methodologies, no matter how smart you are. You may find things that surprise you. The United States is much more of an ownership society than it gets credit for. In fact, the retirement income Dr. Krugman asked about is most beneficial to the middle class.

Retirement income is as substantial a source of income, overall, as taxable capital gains and dividends. But it is a lot more evenly distributed, and that is worth mentioning.

For more on the sources of personal income, my full report can be found here.

Share this article