No one would consider New Jersey a low-taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. state, with the sixth-highest corporate tax rate (9 percent), fifth-highest top income tax rate (8.97 percent), eighth-highest state sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. (6.625 percent), tenth-highest gasoline tax (37.1 cents per gallon), tenth-highest cigarette tax ($2.70 per pack), and highest property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. ($3,074 average per capita). But officials facing an end-of-month budget deadline are urging tax increases, although they disagree on the type.

Gov. Phil Murphy (D) wants to increase in the top income tax rate from 8.97 to 10.75 percent, for income over $1 million. This would apply both to an estimated 20,000 individuals and 5,000 businesses. He has threatened to veto any budget that does not include the tax.

Senate President Stephen Sweeney (D) and Assembly Speaker Craig Coughlin (D) instead want a corporate tax rate increase, to 11.5 percent on income over $1 million and 13 percent on income over $25 million.

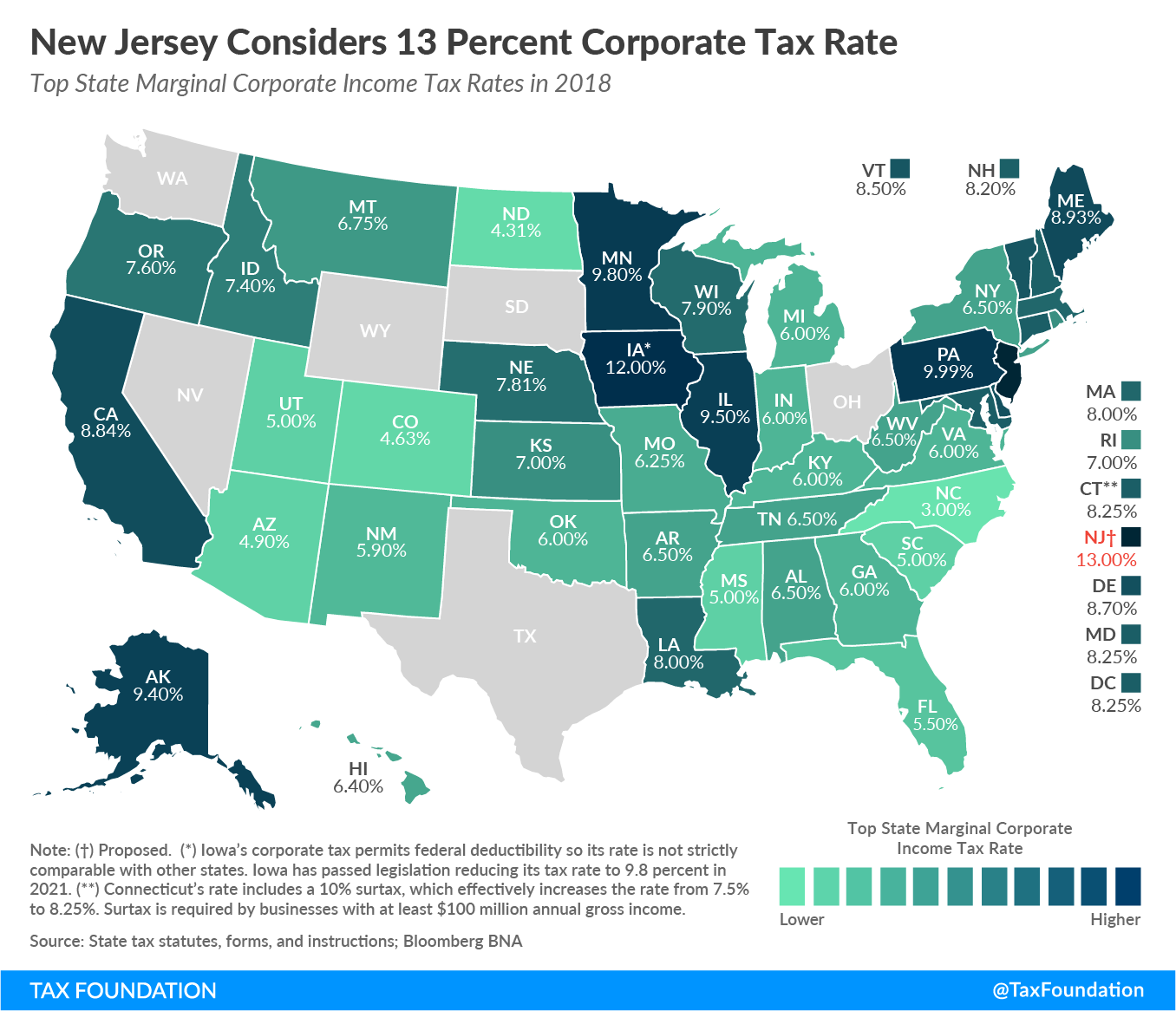

The 13 percent top rate would easily be the highest in the country (see map). When added to the federal 21 percent corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. , New Jersey corporations would pay a combined 31 percent statutory rate (after adjusting for tax deductions). This would stand out quite unfavorably to the average rates among European (18.35 percent) and African nations (28.2 percent) and rank just below the South American average tax rateThe average tax rate is the total tax paid divided by taxable income. While marginal tax rates show the amount of tax paid on the next dollar earned, average tax rates show the overall share of income paid in taxes. of 32.93 percent. Large New Jersey corporations would pay a rate six points higher—and small corporations four and a half points higher—than France’s planned 25 percent corporate tax rate.

In the United States, the only other double-digit rate is Iowa’s 12 percent. However, Iowa currently permits federal deductibility so it’s real tax rate is somewhere around 9.8 percent. In 2021, Iowa is repealing federal deductibility and reducing its rate to 9.8 percent; but even before then New Jersey’s proposed 11.5 percent and 13 percent rates will be higher in effective terms than Iowa’s. No other state has a double digit corporate tax rate.

As we noted about an earlier 12 percent corporate rate proposal:

While corporations are indeed getting a tax cut relative to last year, New Jersey’s state tax policies are still evaluated by prospective businesses relative to 49 other states.

Corporate capital is highly mobile; that is, if you tax it too much, it tends to move (and then you can’t get any revenue out of it, [some states] are already using state revenue windfalls created by federal tax reform as an opportunity to lower corporate and individual income tax rates.

According to a recent report by the New Jersey Business and Industry Association, “Regional competitors New York (6.5 percent) and Massachusetts (8 percent) have decreased their [corporate business tax] and currently have the most competitive rates in the region.”

More about New Jersey here.

Share this article