The corporate income tax should taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. only the profits of a corporation; however, profitability can vary for businesses. A business’s yearly profit may not capture its true profitability. Businesses in particularly cyclical industries may experience substantial profits during boom years, but also experience substantial losses during bust years. Over time, that same business might actually have an average profit margin.

The deduction for net operating losses (NOL) helps structure the corporate tax code so that the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. is levied on average profitability. As we explain in our State Business Tax Climate Index, “Without the NOL deduction, corporations in cyclical industries pay much higher taxes than those in stable industries, even assuming identical average profits over time. Simply put, the NOL deduction helps level the playing field among cyclical and non-cyclical industries.”

The federal government allows 20 years of NOL carryforwards and two years of NOL carrybacks, but states vary widely – some don’t allow the deductions at all, while others conform to the federal standards. States that levy gross receipts taxes as their primary corporate tax – Nevada, Ohio, Texas, and Washington – do not, by definition, offer NOL deductions. (Delaware levies both a gross receipts taxGross receipts taxes are applied to a company’s gross sales, without deductions for a firm’s business expenses, like compensation, costs of goods sold, and overhead costs. Unlike a sales tax, a gross receipts tax is assessed on businesses and applies to transactions at every stage of the production process, leading to tax pyramiding. and corporate income tax.)

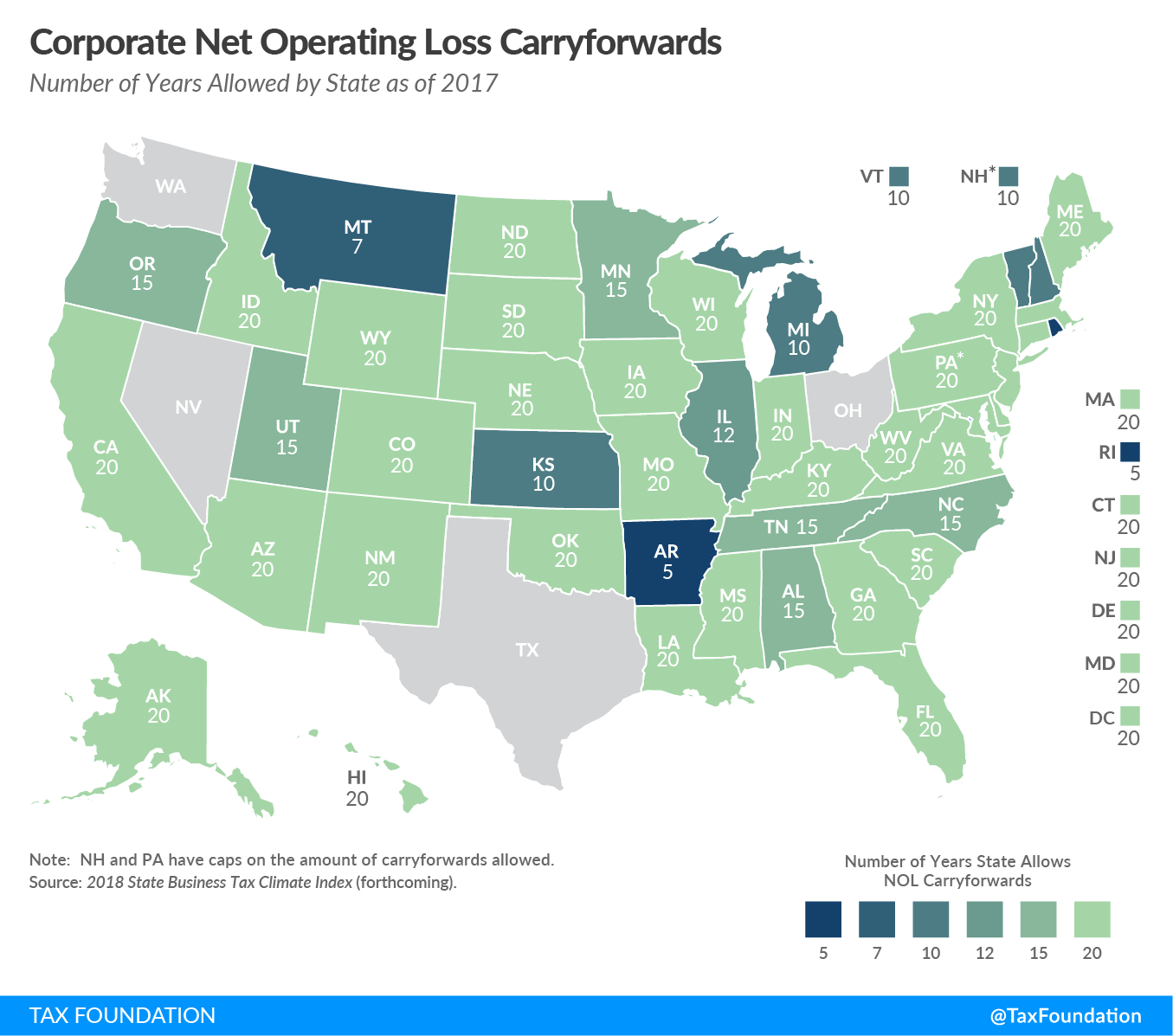

The first map below shows the number of NOL carryforward years allowed by states. Thirty-two states and D.C. offer the full 20 years of carryforwards. Rhode Island and Arkansas offer the least generous policies, offering only 5 years of carryforwards. New Hampshire and Pennsylvania are the only two states to place a cap on the net operating losses businesses are permitted to carryforward at $10,000,000 and $5,000,000 respectively.

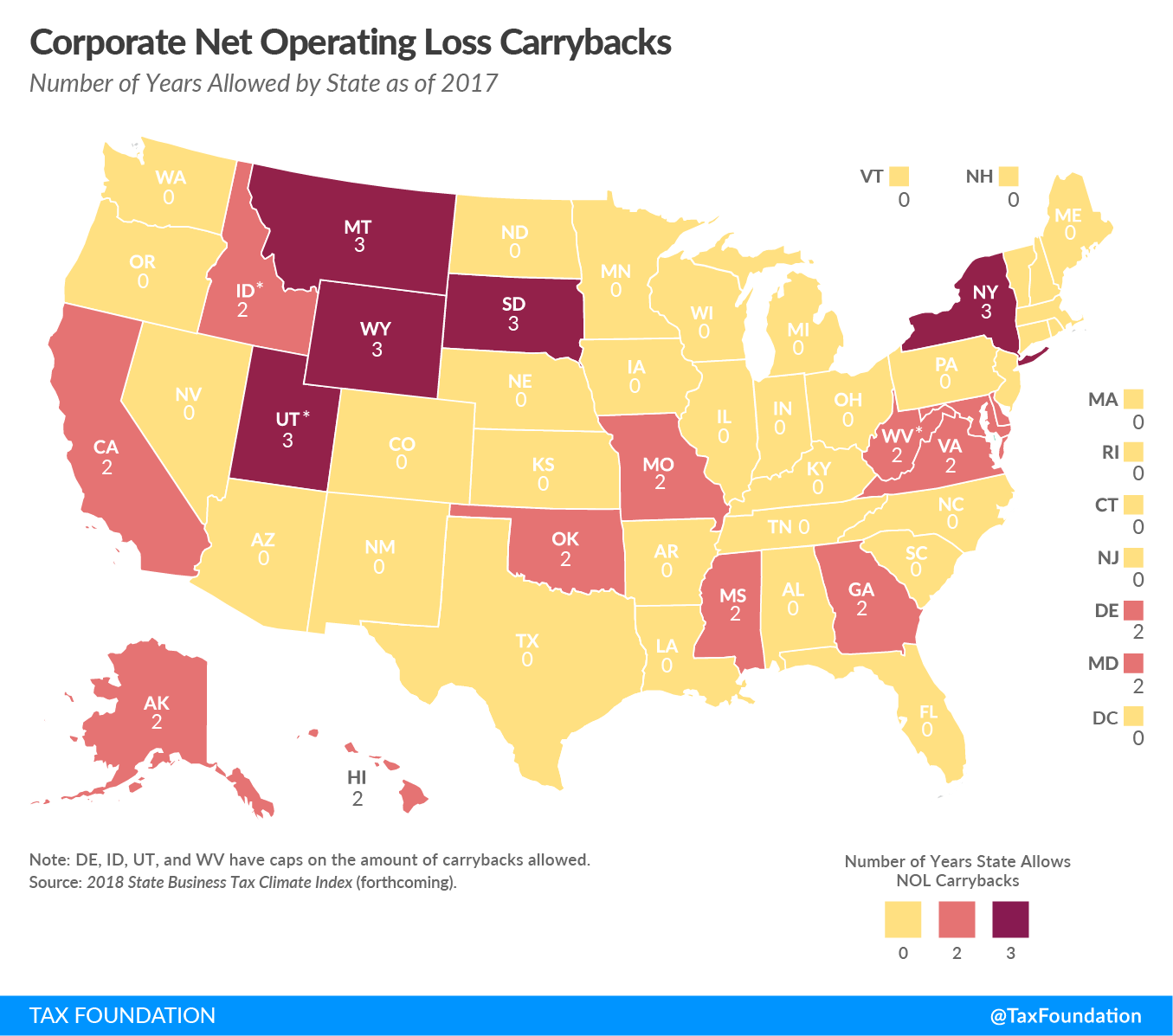

The second map below shows the number of NOL carryback years allowed by states. Five states, Montana, New York, South Dakota, Utah, and Wyoming, offer three years of carrybacks, more than the federal government permits. Twelve states offer two years, and the remaining states and D.C. do not offer carrybacks at all. Delaware, Idaho, Texas, and West Virginia all cap their carryback provisions.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe