This post has been updated to reflect new details released in the House and Senate plans.

With a projected surplus of $1.65 billion, some policymakers in Minnesota want tax reform. Several plans are being discussed in the state legislature, ranging from a $300 million taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. cut proposed in the updated budget of Governor Mark Dayton (D) to a $1.35 billion tax cut proposed by House Republicans.

The first plan from Senate Republicans can be largely broken down into two parts – individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. cuts and business tax cuts. It ultimately ends up as a $900 million tax cut. On the individual income tax side, they plan to cut the state’s lowest marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. of 5.35 percent to 5.15 percent. They also propose to phase out the tax on Social Security income, create a tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. for college graduates paying student loans, and raise the estate tax exemption (currently $1.6 million in the state) to an amount closer to the federal exemption level by 2023.

The Senate Republican plan also reforms business taxes in several ways. They propose exempting the first $100,000 of market value for “main street” businesses from the statewide business property tax, and more importantly, repealing the automatic inflator. They also plan to create a property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. credit for agricultural land and change the Section 179 depreciation schedules.

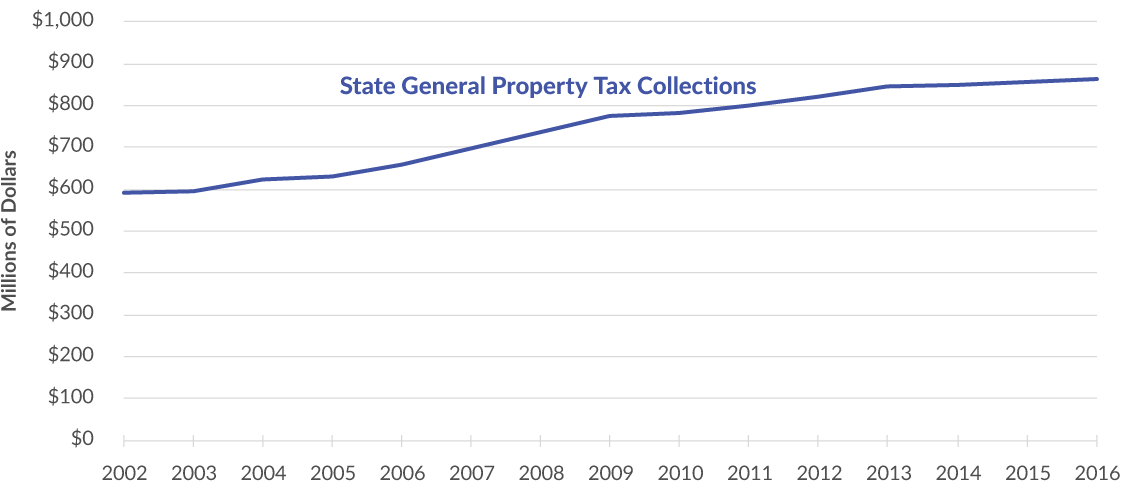

As we highlighted in our book Minnesota Illustrated, the statewide business property tax, which is in addition to the regular property tax paid by residents and businesses, is both unique and problematic for the state. Commercial and industrial properties pay 95 percent of the tax, while cabins pay the remaining 5 percent. The tax mandates an automatic increase of taxes collected, and revenue from the tax has increased 46 percent from 2002 to 2016. Collections from the tax are growing faster than inflation. Repealing the automatic inflator is a step in the right direction for the state.

Source: Minnesota Illustrated

Source: Minnesota Illustrated

House Republicans are seeking a bigger tax cut to the tune of $1.35 billion. The plan does not include any cuts to income tax rates, but instead focuses on targeted cuts for Social Security recipients, farmers, business owners, and college graduates with high debt levels. The plan immediately raises the estate tax exemptionA tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the Internal Revenue Service (IRS), preventing them from having to pay income tax. level to the federal amount and excludes the first $200,000 in property value from the statewide business property tax. The plan also repeals the cigarette tax inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. adjustment to make the $3.04 per pack tax on cigarettes permanent. It also includes a variety of tax credits and establishes a private letter ruling program. Minnesota is one of only two states that does not issue private letter rulings.

Governor Dayton has put forward a more modest plan, citing concerns about future state revenues under the new Trump administration. The governor’s plan does not include sweeping tax reform, but rather a $300 million package targeted at low-income residents and child care support.

Senate Republicans

- Cut lowest marginal individual income tax rate to 5.15 percent

- Phase out of tax on Social Security income

- Tax credit for student loans

- Exempt first $100,000 of value for “main street businesses” under statewide business property tax

- Repeal automatic inflator of statewide business property tax

- Change depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. schedule

- Property tax credit for agricultural land

- Conform the estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. exemption to the federal level by 2023

House Republicans

- Immediately raises estate tax exemption level to federal level

- Excludes first $200,000 of value under statewide business property tax

- Targeted tax cuts to Social Security recipients, college graduates with debt, families with children, and farmers

- Establishes private letter ruling program

- Repeals inflation adjustment on cigarette taxes

Governor Mark Dayton

- Targeted relief for low-income residents and child care support

The final plan will likely face challenges. Governor Dayton has previously signaled that he does not want to see broad, structural changes to the tax code.

Minnesota needs broad tax reform. The state currently levies the third highest individual and corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rates in the country. Its property tax system is unnecessarily complex and burdensome to businesses. The state ranks 46th in our State Business Tax Climate Index.

While the Senate Republican plan comes the closest to broad tax reform, work is needed on all three plans. Targeted credits and carveouts will not boost economic growth in the state. Instead, policymakers should look to real reform that will improve the tax code for everyone in the state.

Share this article