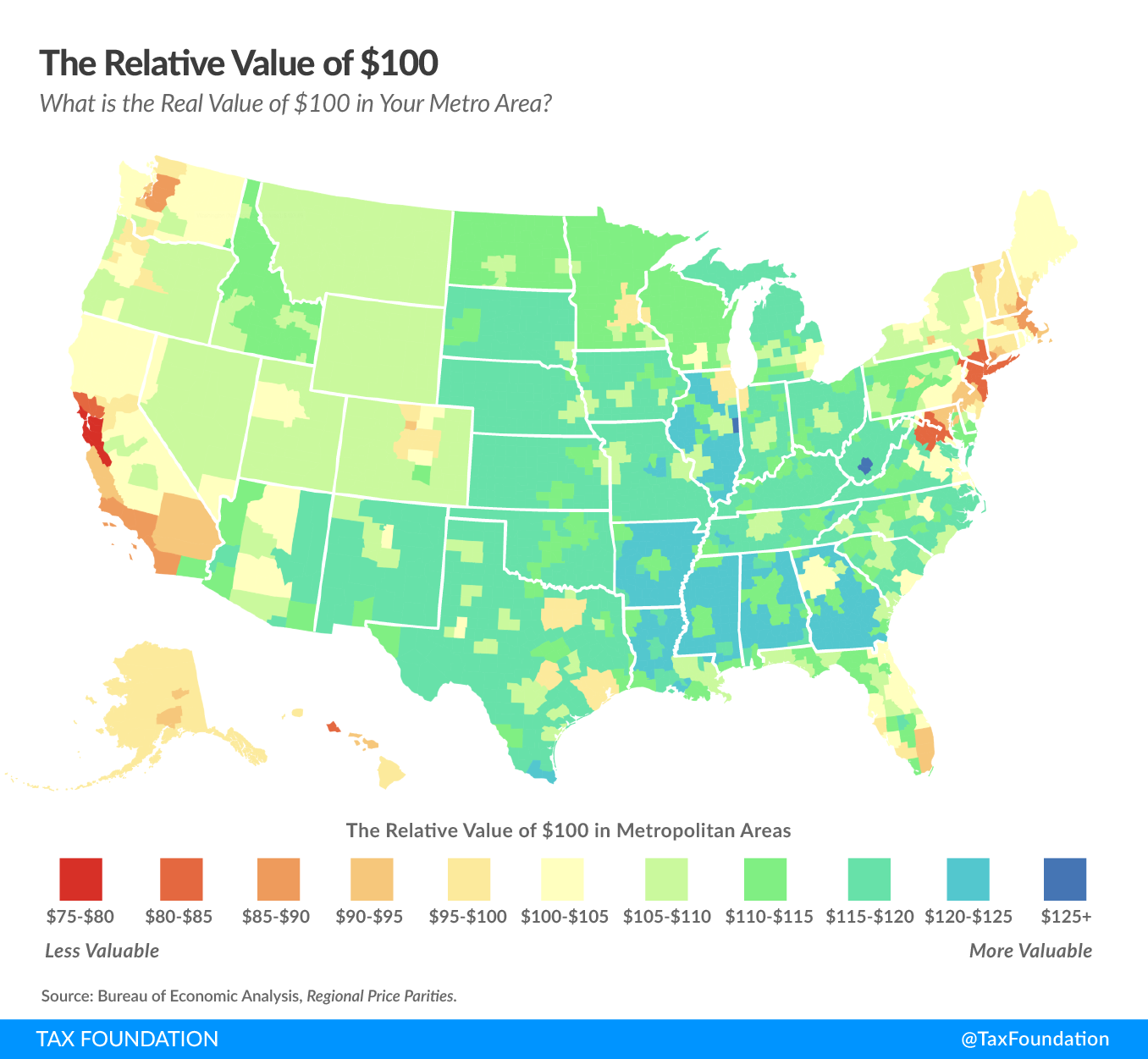

In May, the Bureau of Economic Analysis (BEA) released its annual data showing the differences in purchasing power across American metropolitan and non-metropolitan areas in 2018. This data compares how much $100 can buy in different regions and metropolitan areas across the country, which can have a significant effect on the relative impact of different economic and tax policies.

There are large differences in price level by region. For example, $100 tends to buy the least in large cities in the Northeast, California, and the Pacific Northwest. On the other hand, $100 goes the furthest in rural areas in the Southeast and Midwest.

Price levels tend to be lower in nonmetropolitan areas, even in states with higher-than-average prices overall. For example, $100 in California tends to buy $86.66 worth of goods on average. However, this varies within California: in the Los Angeles area, $100 can purchase about $85.40 worth of goods and services, while rural Californians can purchase $103.20 worth.

The Relative Value of $100

What is the Real Value of $100 in Your Metro Area?

Source: Bureau of Economic Analysis, Regional Price Parities.

The above map is interactive — hover the mouse over a given county to see the relative value of $100 in metropolitan areas. Click here to see a larger version.

Table 1 shows the 15 most expensive metropolitan areas in the United States, where the real value of $100 is the lowest. The San Francisco Bay Area was the most expensive metropolitan region in 2018, where $100 would buy goods and services that would cost just $75.99 in a metropolitan area at the national average price level. Put another way, residents of the San Francisco-Oakland-Hayward area had, at least in terms of purchasing power, about a 25 percent lower standard of living than their nominal incomes alone may suggest.

| Metropolitan Area | Real Value of $100 |

|---|---|

| San Francisco-Oakland-Hayward, CA | $75.99 |

| San Jose-Sunnyvale-Santa Clara, CA | $77.28 |

| Santa Cruz-Watsonville, CA | $79.68 |

| Urban Honolulu, HI | $80.52 |

| New York-Newark-Jersey City, NY-NJ-PA | $80.58 |

| Santa Rosa, CA | $81.63 |

| Napa, CA | $81.97 |

| Vallejo-Fairfield, CA | $83.68 |

| Washington-Arlington-Alexandria, DC-VA-MD-WV | $84.89 |

| Los Angeles-Long Beach-Anaheim, CA | $85.40 |

| Oxnard-Thousand Oaks-Ventura, CA | $85.40 |

| San Diego-Carlsbad, CA | $85.91 |

| Bridgeport-Stamford-Norwalk, CT | $86.73 |

| Boston-Cambridge-Newton, MA-NH | $87.57 |

| Seattle-Tacoma-Bellevue, WA | $88.57 |

| Source: U.S. Bureau of Economic Analysis, Regional Price Parities. | |

Metropolitan areas have higher population densities than nonmetropolitan and rural areas. Higher population densities tend to drive up real property prices, as residents seek to occupy a limited amount of available land. This is a large driver of the higher prices that residents face in metropolitan areas. Residents of metropolitan areas also tend to have higher average incomes, making it important to compare their incomes in real terms.

Some metropolitan areas are more affordable. Table 2 shows the 15 least expensive metropolitan areas in the United States, which tend to be in the southeastern U.S. and are smaller than their more expensive counterparts.

| Metropolitan Area | Real Value of $100 |

|---|---|

| Beckley, WV | $130.55 |

| Danville, IL | $127.23 |

| Jackson, TN | $123.46 |

| Pine Bluff, AR | $122.85 |

| Jefferson City, MO | $122.40 |

| Morristown, TN | $121.95 |

| Florence-Muscle Shoals, AL | $121.51 |

| Gadsden, AL | $121.51 |

| McAllen-Edinburg-Mission, TX | $120.92 |

| Rome, GA | $120.77 |

| Albany, GA | $120.63 |

| Brownsville-Harlingen, TX | $120.48 |

| Anniston-Oxford-Jacksonville, AL | $120.34 |

| Jonesboro, AR | $120.05 |

| Valdosta, GA | $120.05 |

| Source: U.S. Bureau of Economic Analysis, Regional Price Parities. | |

The two metropolitan areas with the greatest disparity in price levels are the San Francisco-Oakland-Hayward, California region and Beckley, West Virginia. The real value of $100 in San Francisco is $75.99, compared to $130.55 in Beckley. This means that the purchasing power in the Beckley area is 72 percent greater than in the San Francisco-Oakland-Hayward area.

Differences in price levels between metropolitan areas have large implications for economic policy, as many policies, such as minimum wage levels, tax brackets, and means-tested public benefit income thresholds, are denominated in nominal dollars. Because each metropolitan area and state has a different price level, these amounts are not equivalent in purchasing power. This is an important consideration when policymakers consider changes to taxes and spending.

Share this article