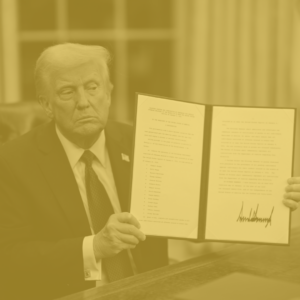

The One Big Beautiful Tax Bill: What’s In It, What’s Out

Congress is racing to pass the One Big Beautiful Tax Bill before the July 4 deadline. In this episode, Kyle Hulehan and Erica York break down what just happened over the weekend, what’s actually in the bill, and what comes next as the House and Senate try to reconcile their differences.