States Should Make Full Expensing Permanent to Help Curb Inflation

In times of high inflation, states should consider adopting permanent full expensing because it boosts long-run productivity, economic output, and wages.

7 min readHow does Wyoming’s tax code compare? Wyoming does not have an individual income tax. Wyoming also does not have a corporate income tax. Wyoming has a 4.00 percent state sales tax rate and an average combined state and local sales tax rate of 5.44 percent. Wyoming has a 0.55 percent effective property tax rate on owner-occupied housing value.

Wyoming does not have an estate tax or inheritance tax. Wyoming has a 24 cents per gallon gas tax rate and a $0.60 cigarette excise tax rate. The State of Wyoming collects $5,194 in state and local tax collections per capita. Wyoming has $3,475 in state and local debt per capita and has a 94 percent funded ratio of public pension plans. Overall, Wyoming’s tax system ranks 1st on our 2024 State Business Tax Climate Index.

Each state’s tax code is a multifaceted system with many moving parts, and Wyoming is no exception. The first step towards understanding Wyoming’s tax code is knowing the basics. How does Wyoming collect tax revenue? Click the tabs below to learn more! You can also explore our state tax maps, which are compiled from our annual publication, Facts & Figures 2024: How Does Your State Compare?

In times of high inflation, states should consider adopting permanent full expensing because it boosts long-run productivity, economic output, and wages.

7 min read

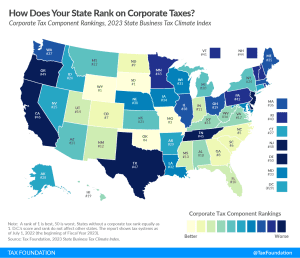

All corporate income taxes fall on capital investment, but the structure should not make matters worse, and policymakers should take care not to distort investment decisions through the use of targeted incentives for select firms or activities instead of a lower rate for all businesses.

2 min read

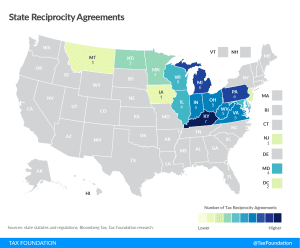

Remote and flexible work opportunities are here to stay, whether states like it or not. With enhanced opportunities to take their job with them wherever they please, more workers can factor tax burdens into their decision of where to live.

15 min read

While there are many ways to show how much is collected in taxes by state governments, our Index is designed to show how well states structure their tax systems by focusing on the how more than the how much in recognition of the fact that there are better and worse ways to raise revenue.

129 min read

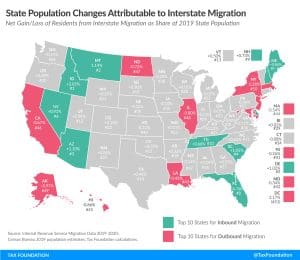

IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

12 min read

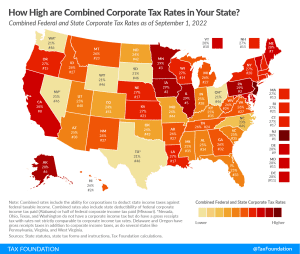

When examining tax burdens on businesses, it is important to consider both federal and state corporate taxes. Corporate taxes are one of the most economically damaging ways to raise revenue and are a promising area of reform for states to increase competitiveness and promote economic growth, benefiting both companies and workers.

2 min read

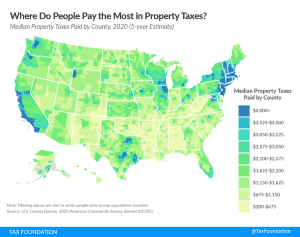

Property taxes are the primary tool for financing local government and generating state-level revenue in some states as well.

5 min read

The mix of tax sources states choose can have important implications for both revenue stability and economic growth, and the many variations across states are indicative of the different ways states weigh competing policy goals.

29 min read

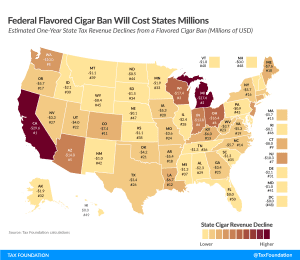

The FDA’s proposal to ban flavored cigars would carry significant revenue implications for many state governments.

7 min read

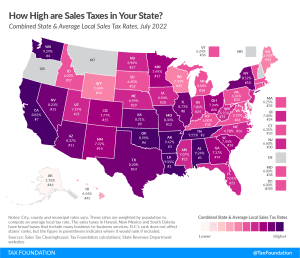

While many factors influence business location and investment decisions, sales taxes are something within policymakers’ control that can have immediate impacts.

12 min read