State Aid in American Rescue Plan Act Is 116 Times States’ Revenue Losses

Here’s each state’s estimated revenue gains or losses in 2020, alongside the state and local aid that would be allocated to each under the American Rescue Plan Act.

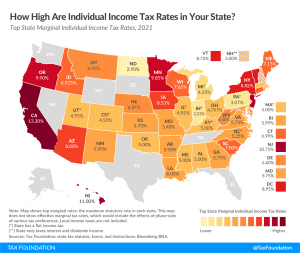

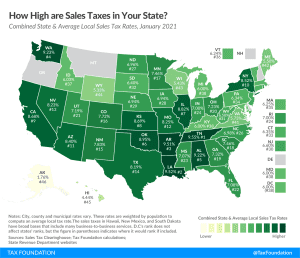

8 min readHow does Vermont’s tax code compare? Vermont has a graduated state individual income tax, with rates ranging from 3.35 percent to 8.75 percent. Vermont has a graduated corporate income tax, with rates ranging from 6.0 percent to 8.5 percent. Vermont also has a 6.00 percent state sales tax rate and an average combined state and local sales tax rate of 6.36 percent. Vermont has a 1.56 percent effective property tax rate on owner-occupied housing value.

Vermont has an estate tax. Vermont has a 32.61 cents per gallon gas tax rate and a $3.08 cigarette excise tax rate. The State of Vermont collects $7,527 in state and local tax collections per capita. Vermont has $7,299 in state and local debt per capita and has a 63 percent funded ratio of public pension plans. Overall, Vermont’s tax system ranks 43rd on our 2024 State Business Tax Climate Index.

Each state’s tax code is a multifaceted system with many moving parts, and Vermont is no exception. The first step towards understanding Vermont’s tax code is knowing the basics. How does Vermont collect tax revenue? Click the tabs below to learn more! You can also explore our state tax maps, which are compiled from our annual publication, Facts & Figures 2024: How Does Your State Compare?

Here’s each state’s estimated revenue gains or losses in 2020, alongside the state and local aid that would be allocated to each under the American Rescue Plan Act.

8 min read

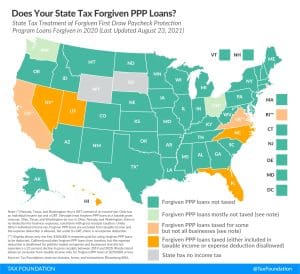

Congress chose to exempt forgiven Paycheck Protection Program (PPP) loans from federal income taxation. Many states, however, remain on track to tax them by either treating forgiven loans as taxable income, denying the deduction for expenses paid for using forgiven loans, or both.

7 min read

Individual income taxes are a major source of state government revenue, accounting for 37 percent of state tax collections in fiscal year (FY) 2017. Several states had notable individual income tax changes in 2020: Arizona, Arkansas, Massachusetts, Michigan, Minnesota, North Carolina, Ohio, Tennessee, Virginia, and Wisconsin.

22 min read

While many factors influence business location and investment decisions, sales taxes are something within lawmakers’ control that can have immediate impacts.

12 min read

Twenty-six states and the District of Columbia had notable tax changes take effect on January 1, 2021. Because most states’ legislative sessions were cut short in 2020 due to the COVID-19 pandemic, fewer tax changes were adopted in 2020 than in a typical year.

24 min read

The coronavirus relief package represents the second-largest recovery legislation, behind only the CARES Act, for a combined total of more than $3 trillion in support.

8 min read

On Monday, members of the bipartisan Gang of Eight negotiating an end-of-year pandemic relief package announced that they had settled on language and had divided the package into two bills: a pandemic aid package and a $160 billion state and local support package.

6 min read

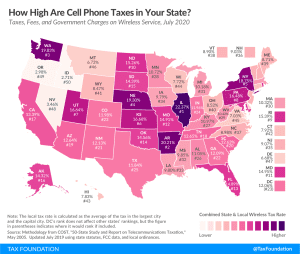

A typical American household with four phones on a “family share” wireless plan can expect to pay about $270 per year (or 22 percent of their cell phone bill) in taxes, fees, and surcharges.

36 min read

President Joe Biden’s tax plan would yield combined top marginal state and local rates in excess of 60 percent in three states: California, Hawaii, and New Jersey (also New York City).

4 min read