Congress Passes $900 Billion Coronavirus Relief Package

The coronavirus relief package represents the second-largest recovery legislation, behind only the CARES Act, for a combined total of more than $3 trillion in support.

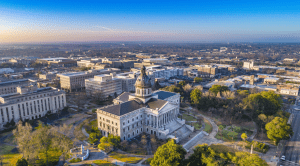

8 min readHow does South Carolina’s tax code compare? South Carolina has a graduated state individual income tax, with rates ranging from 0.00 percent to 6.40 percent. South Carolina has a 5.0 percent corporate income tax rate. South Carolina also has a 6.00 percent state sales tax rate and an average combined state and local sales tax rate of 7.50 percent. South Carolina has a 0.46 percent effective property tax rate on owner-occupied housing value.

South Carolina does not have an estate tax or inheritance tax. South Carolina has a 28.75 cents per gallon gas tax rate and a $0.57 cigarette excise tax rate. The State of South Carolina collects $4,375 in state and local tax collections per capita. South Carolina has $7,260 in state and local debt per capita and has a 60 percent funded ratio of public pension plans. Overall, South Carolina’s tax system ranks 29th on our 2024 State Business Tax Climate Index.

Each state’s tax code is a multifaceted system with many moving parts, and South Carolina is no exception. The first step towards understanding South Carolina’s tax code is knowing the basics. How does South Carolina collect tax revenue? Click the tabs below to learn more! You can also explore our state tax maps, which are compiled from our annual publication, Facts & Figures 2024: How Does Your State Compare?

The coronavirus relief package represents the second-largest recovery legislation, behind only the CARES Act, for a combined total of more than $3 trillion in support.

8 min read

On Monday, members of the bipartisan Gang of Eight negotiating an end-of-year pandemic relief package announced that they had settled on language and had divided the package into two bills: a pandemic aid package and a $160 billion state and local support package.

6 min read

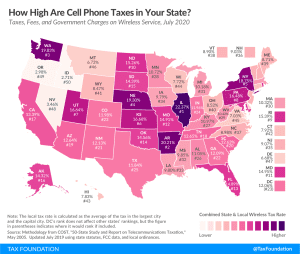

A typical American household with four phones on a “family share” wireless plan can expect to pay about $270 per year (or 22 percent of their cell phone bill) in taxes, fees, and surcharges.

36 min read

President Joe Biden’s tax plan would yield combined top marginal state and local rates in excess of 60 percent in three states: California, Hawaii, and New Jersey (also New York City).

4 min read

State tax revenue collections were down 5.5 percent in FY 2020, driven by a dismal final quarter (April through June) as states began to feel the impact of the COVID-19 pandemic. While these early losses are certainly not desirable, they are manageable and far better than many feared.

16 min read

Nineteen states had notable tax changes take effect on July 1, 2020. Pandemic-shortened sessions contributed to less—and different—activity on the tax front than is seen in most years, and will likely yield an unusually active summer and autumn, with many legislatures considering new measures during special sessions.

12 min read

Another 1.4 million Americans filed initial regular unemployment benefit claims, the eleventh week of a decline in the rate of new claims, but still among the highest levels in U.S. history. The total number of new and continued claims now stands at 19.3 million, a marked decline from the peak of 24.9 million a month ago.

7 min read

Our updated 2020 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read