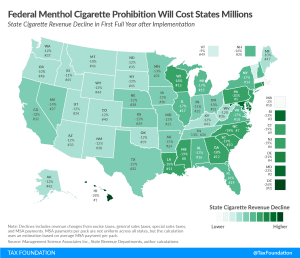

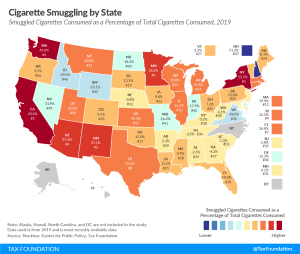

Federal Menthol Cigarette Ban May Cost Governments $6.6 Billion

The FDA’s expected announcement of a national ban on menthol-flavored cigarettes and cigars with a characterizing flavor would carry significant revenue implications for both the federal government and state governments, with likely limited benefits in smoking cessation.

6 min read