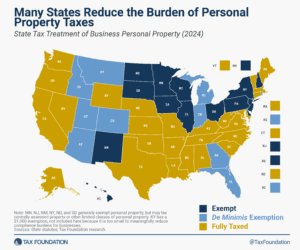

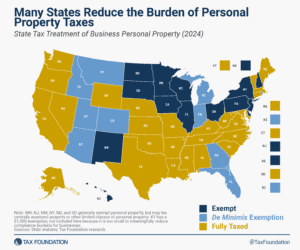

Tangible Personal Property De Minimis Exemptions by State, 2024

Does your state have a small business exemption for machinery and equipment?

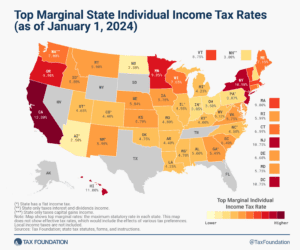

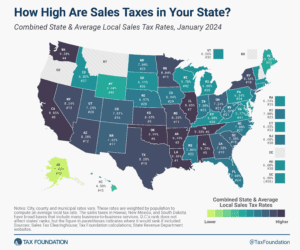

3 min readHow does Colorado’s tax code compare? Colorado has a flat 4.40 percent individual income tax rate. There are also jurisdictions that collect local income taxes. Colorado has a 4.40 percent corporate income tax rate. Colorado also has a 2.90 percent state sales tax rate and an average combined state and local sales tax rate of 7.81 percent. Colorado has a 0.45 percent effective property tax rate on owner-occupied housing value.

Colorado does not have an estate tax or inheritance tax. Colorado has a 29 cents per gallon gas tax rate and a $1.94 cigarette excise tax rate. The State of Colorado collects $6,387 in state and local tax collections per capita. Colorado has $11,972 in state and local debt per capita and has a 71 percent funded ratio of public pension plans. Overall, Colorado’s tax system ranks 27th on our 2024 State Business Tax Climate Index.

Each state’s tax code is a multifaceted system with many moving parts, and Colorado is no exception. The first step towards understanding Colorado’s tax code is knowing the basics. How does Colorado collect tax revenue? Click the tabs below to learn more! You can also explore our state tax maps, which are compiled from our annual publication, Facts & Figures 2024: How Does Your State Compare?

Does your state have a small business exemption for machinery and equipment?

3 min read

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

8 min read

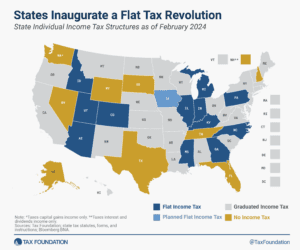

In 2021 and 2022 alone, more states enacted laws converting graduated-rate individual income tax structures into single-rate income tax structures than did so in the whole 108-year history of state income taxation up until that point.

10 min read

Working from home is great. The tax complications? Not so much.

4 min read

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state tax collections and 13 percent of local tax collections (24 percent of combined collections).

9 min read

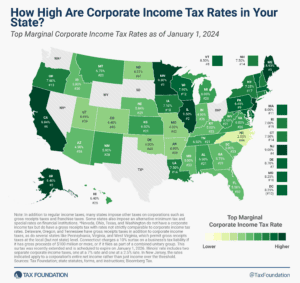

Graduated corporate rates are inequitable—that is, the size of a corporation bears no necessary relation to the income levels of the owners.

7 min read

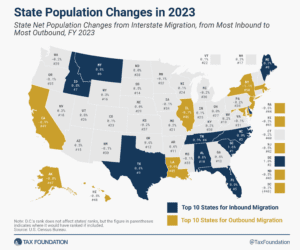

The pandemic has accelerated changes to the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

5 min read

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

Marijuana taxation is one of the hottest policy issues in the United States. Twenty-one states have implemented legislation to legalize and tax recreational marijuana sales.

16 min read

All policy choices involve trade-offs—but occasionally, the ratio of costs and benefits is shockingly lopsided. Adopting a de minimis exemption for tangible personal property (TPP) taxes is just such a policy: one which massively reduces compliance and administrative burdens at trivial cost.

18 min read