Colorado Tax Rates, Collections, and Burdens

How does Colorado’s tax code compare? Colorado has a flat 4.40 percent individual income tax rate. There are also jurisdictions that collect local income taxes. Colorado has a 4.40 percent corporate income tax rate. Colorado also has a 2.90 percent state sales tax rate and an average combined state and local sales tax rate of 7.81 percent. Colorado has a 0.45 percent effective property tax rate on owner-occupied housing value.

Colorado does not have an estate tax or inheritance tax. Colorado has a 29 cents per gallon gas tax rate and a $1.94 cigarette excise tax rate. The State of Colorado collects $6,387 in state and local tax collections per capita. Colorado has $11,972 in state and local debt per capita and has a 71 percent funded ratio of public pension plans. Overall, Colorado’s tax system ranks 27th on our 2024 State Business Tax Climate Index.

Each state’s tax code is a multifaceted system with many moving parts, and Colorado is no exception. The first step towards understanding Colorado’s tax code is knowing the basics. How does Colorado collect tax revenue? Click the tabs below to learn more! You can also explore our state tax maps, which are compiled from our annual publication, Facts & Figures 2024: How Does Your State Compare?

State Tax Data

Individual Taxes

Business Taxes

Sales Taxes

All Related Articles

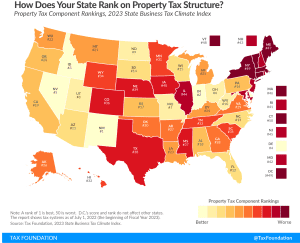

Ranking Property Taxes on the 2023 State Business Tax Climate Index

States are in a better position to attract business investment when they maintain competitive real property tax rates and avoid harmful taxes on tangible personal property, intangible property, wealth, and asset transfers.

3 min read

Compare Tobacco Tax Data in Your State

In the United States, tobacco is taxed at both the federal and state and sometimes even local levels. These layers of taxes often result in very high levels of taxation—the highest of any consumer item. The retail price of cigarettes, for instance, is more than 40 percent taxes on average. In some states, like Minnesota and New York, more than 50 percent of the price paid by consumers comes from taxes.

2 min read

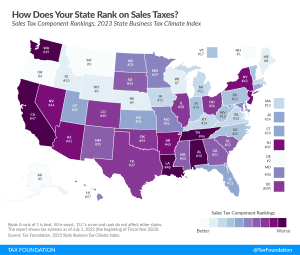

Ranking Sales Taxes on the 2023 State Business Tax Climate Index

An ideal sales tax applies to a broad base of final consumer goods and services, with few exemptions, and is levied at a low rate.

5 min read

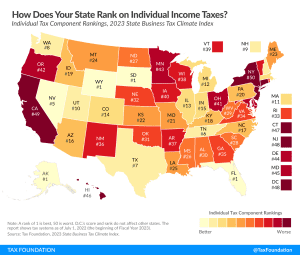

Ranking Individual Income Taxes on the 2023 State Business Tax Climate Index

Individual income tax rates can influence location decision-making, especially in an era of enhanced mobility, where it is easier for individuals to move without jeopardizing their current job, or without limiting the scope of their search for a new one.

5 min read

Does Your State Tax Recreational Marijuana?

Recreational marijuana taxation is one of the hottest policy issues in the U.S. Currently, 21 states have implemented legislation to legalize and tax recreational marijuana sales.

5 min read

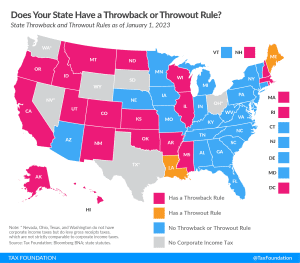

Throwback and Throwout Rules by State, 2023

While throwback and throwout rules in states’ corporate tax codes may not be widely understood, they have a notable impact on business location and investment decisions and reduce economic efficiency.

4 min read

America’s Progressive Tax and Transfer System: Federal, State, and Local Tax and Transfer Distributions

The overall U.S. tax and transfer system is overwhelmingly progressive, and understanding the extent—and source—of that progressivity is essential for lawmakers considering the trade-offs associated with each tax policy decision.

23 min read

Close to Home: A Short Guide to Property Taxes

As housing prices are rapidly increasing, and property tax bills along with them, the property tax has come into the spotlight in many states. The design of a state’s property tax system can affect how attractive that state is to businesses and residents.

9 min read

Facts & Figures 2023: How Does Your State Compare?

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read