Lawmakers in Kansas, Nebraska, and Utah never voted to taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. GILTI—and now their respective tax committees are getting a chance to decide whether they really should. Committee chairs in Nebraska and Utah are seeking a decisive “no” to their states’ respective taxation of international income, while Kansas lawmakers will consider the matter this coming Monday. Kansas H.B. 2553, Nebraska LB 1203, and Utah S.B. 53 all decouple from the inclusion of Global Intangible Low-Taxed Income (GILTI) in their income tax bases. Nebraska’s bill does it by giving GILTI the benefit of the state’s 100 percent dividends received deduction, and the others through a subtraction modification eliminating GILTI from the tax base.

These states’ taxes on GILTI are accidents of the conformity process which undermine their economic competitiveness and raise serious constitutional issues that may have to be resolved in court. Alternatively, legislatures can take control of the process, choosing to decouple from a provision which has never made sense in a state context.

Taxation of GILTI is a byproduct of state conformity with the Internal Revenue Code after the implementation of the Tax Cuts and Jobs Act. At the federal level, GILTI is one of two guardrails, along with the Base Erosion Anti-Abuse Tax (the BEAT), which can return some international income to the federal tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. despite the federal government’s broader transition from a global to a territorial tax regime. In other words, the federal government is moving away from the taxation of international income, with certain exceptions, whereas these and other states, by conforming to one of those exceptions, have inadvertently broadened their reach to new sources of international income.

The federal provision is intended to discourage the practice of locating intangible property (like patents and trademarks from which royalties are generated) in low-tax countries in order to “profit shift” toward places where those profits will face lower taxes than in the United States. It does this by imposing a tax on high returns on foreign investment, with those so-called supernormal returns used as a proxy for returns to intangible rather than tangible property. (The idea is that you rarely get an annual return on investment in excess of 10 percent from tangible property, though that is obviously not invariably true.) That tax is at a reduced effective rate due to a deduction that flows through to some but not all states, and targets profit shifting rather than more traditional foreign investment—again, very imprecisely—by imposing it on “low-taxed income” by means of a credit which reduces or eliminates liability in the U.S. depending on how much foreign tax the company paid on that income.

State tax codes lack that all-important credit for foreign taxes paid, without which, despite the name, the tax has nothing to do with “low-taxed income.” Consequently, not only does conformity to GILTI involve state taxation of international income, but it yields a far more aggressive international tax regime than the one implemented by the federal government. Moreover, its purpose—to discourage profit shiftingProfit shifting is when multinational companies reduce their tax burden by moving the location of their profits from high-tax countries to low-tax jurisdictions and tax havens. by parking intangible property in low-tax jurisdictions overseas—is not served by inclusion in state tax codes.

Because state tax codes were not constructed with the taxation of international income in mind, the inclusion of GILTI in the absence of any legislative design gives rise to anomalous and constitutionally suspect treatment of the income. The income of controlled foreign corporations (CFCs) would be apportioned to a given state if the parent company is domiciled in that state or, failing that, if that income is related to activity the parent company performs in there.

Take Nebraska, a single sales factor apportionmentApportionment is the determination of the percentage of a business’ profits subject to a given jurisdiction’s corporate income or other business taxes. U.S. states apportion business profits based on some combination of the percentage of company property, payroll, and sales located within their borders. state, as an example. In Nebraska, which has begun taxing GILTI based on a Department of Revenue determination, relevant sales are included in the numerator of the apportionment formula. However, only the net taxable national GILTI of the company is included in the denominator, which means that the taxable activity is wrongly—and excessively—apportioned, which unconstitutionally discriminates against foreign commerce.

The federal constitutional issue exists in Kansas and Utah as well—really, any state that fails to provide proper factor representation of GILTI. But there’s a second, related issue in Nebraska: not only did the state legislature (the Unicameral) never expressly authorize the taxation of GILTI, but to the extent that there was anticipatory law, it called for the exclusion of foreign income. The rationale for that law is particularly important here: in 1984, the state supreme court ruled that the state could only include foreign-source income in the tax base if it included the factors of the foreign entities from which the income is derived. The dividends received deduction was the legislative response, yet GILTI, which raises an identical legal issue, is not currently receiving the benefit of that deduction.

Even setting aside the legal issues, the mere fact of GILTI inclusion is economically harmful, moreover, since multinational businesses are penalized for locating in a state imposing the tax and would not face similar taxation of their international income were they to domicile in another state.

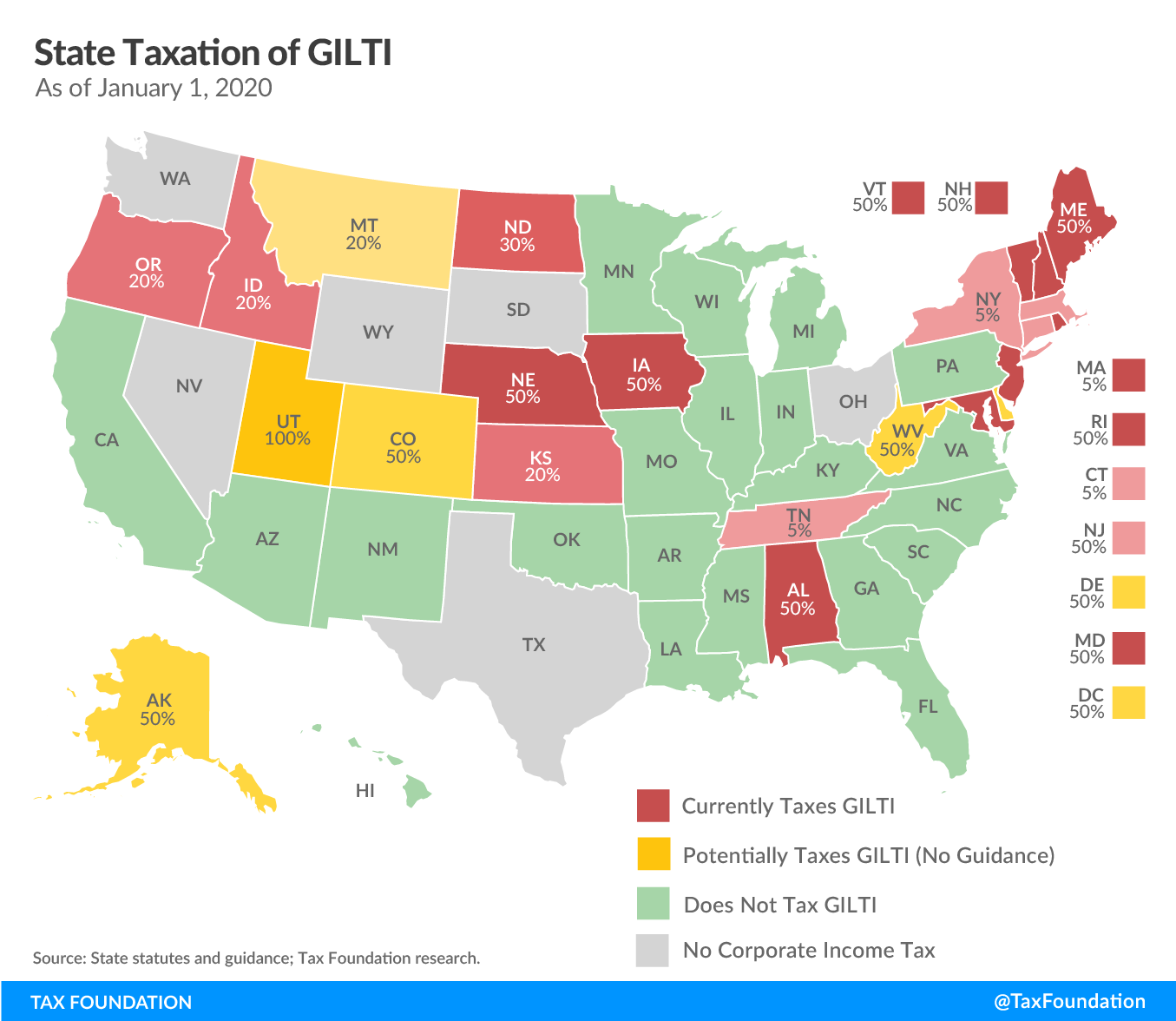

Twenty-four states tax or potentially tax GILTI, of which 17 have issued guidance asserting that such tax liability exists and offering compliance and filing information—a list which includes Kansas and Nebraska, but not Utah. But most states which are home to any significant number of multinational firms have embraced the legal and economic case for either dramatically limiting or eliminating GILTI from their tax codes. That conclusion should be the universal one, since taxing GILTI puts states at a competitive disadvantage compared to their peers—all for a tax that makes very little sense at the state level, and which legislators never sought in the first place.

Share this article