Taxes and the American Revolution

The American Revolution was a tax revolt over the power to tax, not over tax burdens. It serves as a reminder that tax policy can have impacts (big and small) that last for centuries.

The American Revolution was a tax revolt over the power to tax, not over tax burdens. It serves as a reminder that tax policy can have impacts (big and small) that last for centuries.

Summer has arrived, and states are beginning to implement policy changes that were enacted during this year’s legislative session (or that have delayed effective dates or are being phased in over time).

28 min read

New Jersey’s residents deserve tax relief, and the state must stem the tide of out-migration. Affordable reforms in the near term could pave the way for more sweeping, and competitive, reforms to take root in the future.

Between Russia’s war in Ukraine, President Trump’s uncertain policies towards Europe, and Poland’s attempt to increase domestic defense capabilities, raising revenue has become one of the most critical topics in the campaign.

7 min read

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

Florida’s latest property tax debate highlights the familiar challenge of prioritizing pro-growth tax policy while tackling rising property tax burdens.

6 min read

Developed countries raise tax revenue through individual income taxes, corporate income taxes, social insurance taxes, taxes on goods and services, and property taxes—the combination of which determines how distortionary or neutral a tax system is.

4 min read

Sean Bray interviewed Professor of Business Accounting and Taxation at the University of Kiel, Jost Heckemeyer, about the future of the EU tax mix. The interview shows that there is a trade-off between stability and flexibility in European tax policymaking. It also shows that there ought to be a balance between fairness and competitiveness when thinking about improving tax policy.

16 min read

With such important changes to Montana’s property tax system at stake, it’s important that lawmakers get the details right.

5 min read

As home values have spiked, Florida and other states are weighing elimination of property taxes.

According to the latest economic data from the US Census Bureau, the average per capita state and local tax burden is $7,109. However, collections vary widely by state, reflecting differences in tax rates and bases, natural resource endowments, the scale and scope of taxable economic activity in each state, and residents’ political preferences.

5 min read

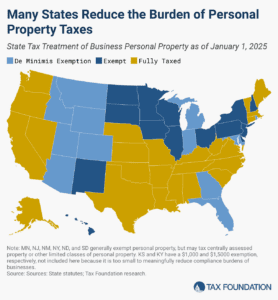

Does your state have a small business exemption for machinery and equipment?

4 min read

Policymakers may consider a broader, more comprehensive property tax reform that creates a uniform system with effective levy limits to prevent unauthorized increases in property tax revenues and, in most cases, property tax bills.

4 min read

North Dakota’s financial position provides it with a rare capacity to deliver meaningful property tax relief. However, policymakers must balance immediate relief with fiscal sustainability and ensure that local governments remain adequately funded in the years ahead.

5 min read

This legislative session, local taxes are a major topic of debate in Indiana. Although the state’s property tax system is already nationally competitive, dramatic increases in assessed values have created discontent in recent years.

8 min read

Montana’s 2025 legislative session has seen a flurry of property tax reform proposals, a response to the surge in property valuations in the state. Unfortunately, hasty decision-making can result in suboptimal policy outcomes.

6 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

With such an important change to Iowa’s property tax system, it’s important that lawmakers get the details right.

33 min read

Policymakers are right that Kansas has an opportunity to reform property taxes while providing long-term relief. But one idea gaining traction in the statehouse — which would introduce assessment limits that artificially cap valuation increases — would be a step backward.

As the property tax debate continues in Kansas, two new proposals have emerged that are much better structured, and would be more effective, than the assessment limits. However, policymakers should consider additional modifications.

7 min read