Facts & Figures 2025: How Does Your State Compare?

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

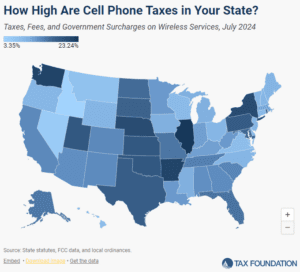

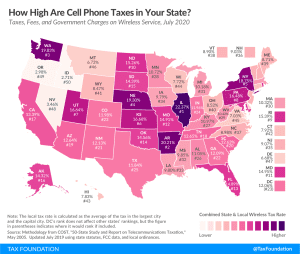

Wireless taxes and fees set a new record high in 2024.

23 min read

A higher tax burden for private infrastructure investments like wireless spectrum, 5G technology, and machinery and equipment makes an existing problem worse—especially against the backdrop of outright state subsidies in countries like China.

6 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

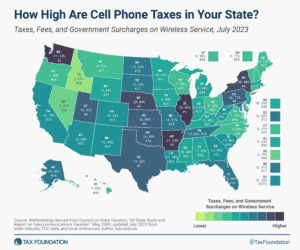

To alleviate the regressive impact on wireless consumers, states should examine their existing communications tax structures and consider policies that transition their tax systems away from narrowly based wireless taxes and toward broad-based tax sources.

18 min read

The tax base around the world is shrinking for traditional excise taxes, including taxes on tobacco, alcohol, and motor fuel. But newer excise taxes on things like carbon, cannabis, and ride-sharing are on the rise. What makes a good design for these taxes and where may excise taxes go in the future as the traditional “sin tax” base continues to shrink?

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

While the wireless market has become increasingly competitive in recent years, resulting in steady declines in the average price for wireless services, the price reduction for consumers has been partially offset by higher taxes.

41 min read

The mix of tax sources states choose can have important implications for both revenue stability and economic growth, and the many variations across states are indicative of the different ways states weigh competing policy goals.

29 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

One unintended consequence of the tax proposals in the Build Back Better Act is a higher potential burden on wireless spectrum investments, which could slow the build out of 5G technology as the U.S. races to compete with other countries—moving in the opposite direction of countries like China that are actively subsidizing 5G expansion.

5 min read

Through 10 ballot measures across four states—Colorado, Louisiana, Texas, and Washington—voters will decide significant questions of state tax policy.

7 min read

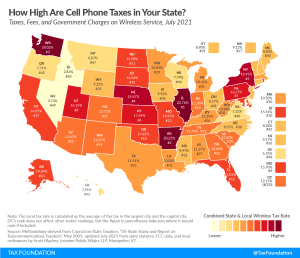

As of 2020, there were 448 million active cell phone and wireless plans in the U.S. than there were Americans. The taxes on those plans brought in approximately $11.3 billion and constituted a record 24.96 percent of the cost of an average cell phone bill. Explore why cellphone taxes are climbing, the places they’re the highest, the consumers they impact the most, and how things can be improved.

Taxes and fees on the typical American wireless consumer increased again this year, to a record 24.96 percent.

32 min read

The excise tax family is growing. Over the last decade, several products have become subject to excise taxes or are in the process of becoming so. Given this development, it is more crucial than ever that lawmakers, businesses, and consumers understand the possibilities and, more importantly, limitations of excise tax application.

77 min read

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

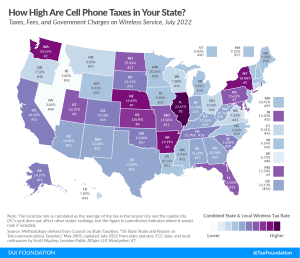

A typical American household with four phones on a “family share” wireless plan can expect to pay about $270 per year (or 22 percent of their cell phone bill) in taxes, fees, and surcharges.

36 min read

Zoom Video Communications announced that, come November, the company will start collecting and remitting local utility and communications taxes in California, New York, Maryland, and Virginia.

5 min read

Wireless taxes, fees, and surcharges make up over 20% of the average customer’s bill–the highest rate ever. Illinois has the highest wireless taxes in the country at over 30%, followed by Washington, Nebraska, New York, and Utah. How high are cell phone taxes in your state?

36 min read