With the release of his first biennial budget, introduced as Senate Bill 59, Wisconsin’s new Governor Tony Evers (D) has proposed dozens of miscellaneous taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. changes. While the budget offers targeted income tax cuts for certain low- and middle-income taxpayers, these cuts are far outweighed by tax increases elsewhere, such as business taxes and excise taxes. Taken as a whole, these changes would make Wisconsin’s tax code more complex and less neutral, missing an opportunity to provide tax relief within the context of pro-growth structural reform.

Individual Income TaxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. Changes

The most notable of the proposed individual income tax changes is the creation of a credit to reduce tax liability for individuals making less than $100,000 and families making less than $150,000. This proposal comes as no surprise, as Gov. Evers campaigned on a 10 percent tax cut for taxpayers with income below those thresholds, but the budget provides new details about the credit’s structure.

Under the proposal, a “Family and Individual Reinvestment” or “FAIR” credit would be available only to taxpayers with Wisconsin adjusted gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” (WAGI) below $100,000 (single filers) or $150,000 (married filing jointly). This nonrefundable credit would be claimed after most other credits are applied, reducing tax liability by 10 percent or $100 ($50 for married taxpayers filing separately), whichever is greater. This credit would begin to phase out once income reaches $80,000 (single filers) or $125,000 (married filers), phasing out completely at $100,000 and $150,000, respectively. Expected to cost $833.5 million over two years, this credit would become Wisconsin’s second-largest individual income tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. after the School Property TaxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. Credit.

The budget also proposes increasing the Earned Income Tax Credit (EITC). Currently, Wisconsin taxpayers who are eligible to claim the federal EITC may claim a percentage of the federal credit against their state tax liability. The refundable state credit is offered at 4 percent for families with one child, 11 percent for families with two children, and 34 percent for families with three or more children. The governor’s proposal would increase the credit to 11 percent for families with one child and 14 percent for families with two children, while keeping it at 34 percent for families with three or more children.

Further, the budget would create a new child and dependent care credit in lieu of Wisconsin’s existing “subtraction for child and dependent care expenses.” Taxpayers eligible for the federal child and dependent care tax credit would be eligible to claim 50 percent of the same amount on their Wisconsin tax return.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeBeyond that, the governor’s budget would replace a scheduled across-the-board income tax rate reduction with a rate reduction to the lowest bracket only. Following the U.S. Supreme Court’s decision in South Dakota v. WayfairSouth Dakota v. Wayfair was a 2018 U.S. Supreme Court decision eliminating the requirement that a seller have physical presence in the taxing state to be able to collect and remit sales taxes to that state. It expanded states’ abilities to collect sales taxes from e-commerce and other remote transactions. , Inc., Wisconsin began requiring online retailers to collect and remit Wisconsin’s sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. . In December 2018, Act 368 was signed into law, allocating any increased revenue from “out-of-state retailers” collected between October 1, 2018 and September 30, 2019 to across-the-board individual income tax rate reductions. The Wisconsin Department of Revenue has projected an estimated $60 million increase in online sales tax collections during that period, which would allow for a 0.04 percentage point rate reduction to each of Wisconsin’s four marginal income tax rates in tax year 2019. However, the governor’s budget proposes changing that law so only the 4 percent income tax rate, which applies to only the first $11,760 in marginal taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. , would be reduced.

Finally, the budget proposes changes to the tax treatment of capital gains. Wisconsin’s tax code allows a 30 percent deduction on net capital gains for assets held for more than one year (for farm assets, it’s 60 percent of net capital gains). This income is excluded from a taxpayer’s capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. basis to help ensure investors are taxed on their real gains, not their nominal gains. This exclusion is currently available to all investors, but the governor’s proposal would limit the exclusion so it can only be claimed on capital gains income when a taxpayer’s combined noncapital gains income and capital gains income is below $100,000 (single filers) or $150,000 (married filers).

The aforementioned changes would provide income tax relief to low- and middle-income taxpayers, but would do so by narrowing the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , making the tax code less neutral, and adding unnecessary complexity to the income tax system. It’s important to keep in mind that Wisconsin already offers numerous income tax credits and deductions to provide targeted tax relief to low- and middle-income residents. Provisions like the refundable EITC and refundable homestead credit allow many lower-income Wisconsin residents to receive a net income tax refundA tax refund is a reimbursement to taxpayers who have overpaid their taxes, often due to having employers withhold too much from paychecks. The U.S. Treasury estimates that nearly three-fourths of taxpayers are over-withheld, resulting in a tax refund for millions. Overpaying taxes can be viewed as an interest-free loan to the government. On the other hand, approximately one-fifth of taxpayers underwithhold; this can occur if a person works multiple jobs and does not appropriately adjust their W-4 to account for additional income, or if spousal income is not appropriately accounted for on W-4s. . The sliding-scale standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. , available only to those with incomes less than $103,500 (single) or $121,009 (married), reduced tax collections by $857 million in FY 2018. With provisions like these already exclusively benefiting low- and middle-income residents, the introduction of a new credit into the mix would be duplicative and further complicate tax filing. A simpler, more neutral approach to individual income tax relief would be to reduce tax rates within the existing framework, or better yet, reduce tax rates while creating a more growth-friendly tax structure.

Business Tax Changes

The governor’s budget includes tax changes that would impact businesses in certain industries. Specifically, the proposal would make the nonrefundable Manufacturing and Agriculture Credit (MAC) less generous while making the refundable Research Credit more generous.

Wisconsin’s MAC is a nonrefundable credit available to pass-through businesses and traditional corporations and can be claimed in an amount equal to 7.5 percent of income derived from manufacturing or agricultural activities, not to exceed a business’s total tax liability. In the governor’s proposal, the credit for manufacturers could be claimed against only the first $300,000 in income derived from manufacturing activities in a year. However, the proposal would not impose a cap on the amount of the credit that can be claimed by agricultural producers. Capping the manufacturing portion of the MAC would increase taxes on manufacturers by an estimated $516.6 million over two years.

Meanwhile, the proposal would make Wisconsin’s refundable Research Credit more generous. Currently, this credit can be claimed on amounts equal to 11.5 percent of a taxpayer’s expenses related to research and development activities in Wisconsin. If the credit amount exceeds tax liability, a tax refund can be claimed in amounts up to 10 percent of the total credit value. Under the governor’s proposal, the refundable portion of the credit would be increased so claimants could receive a refund up to 20 percent, rather than 10 percent, of the credit value.

These tax changes would further accentuate the unequal tax treatment of different industries under Wisconsin’s income tax laws. Instead, policymakers ought to consider how Wisconsin’s high corporate and individual income tax rates detract from the state’s attractiveness as a location for business investment. Ultimately, broad-based, low-rate taxes create the most favorable environment for business investment and growth across all industries.

Sales Tax Changes

Also included in the budget is a proposal to subject two new business inputs to the sales tax. An ideal sales tax system excludes business inputs, not to give businesses a special tax break, but to prevent tax pyramidingTax pyramiding occurs when the same final good or service is taxed multiple times along the production process. This yields vastly different effective tax rates depending on the length of the supply chain and disproportionately harms low-margin firms. Gross receipts taxes are a prime example of tax pyramiding in action. . When business inputs are subject to the sales tax, the costs of production rise, and much of the intrinsic sales tax burden gets passed along to consumers in the form of higher retail prices. Wisconsin already properly excludes most business inputs from the sales tax, so handpicking certain inputs for taxation would be a step in the wrong direction.

Further, this proposal would require online marketplace facilitators to collect and remit sales taxes on behalf of third-party sellers who use these platforms to connect with customers. Current Wisconsin law requires remote sellers who make $100,000 worth of sales or 200 transactions in-state to collect sales taxes from buyers and remit those taxes to the state. The purposes of this de minimis threshold is to allow a safe harbor for remote sellers making only occasional sales in a state.. In instances in which sales tax is not collected at the point of sale, the consumer is responsible for calculating the sales tax owed and remitting that amount to the state. Unsurprisingly, compliance is notoriously low, as many consumers assume a sales tax is only owed when collected at the point of sale. Several states have enacted laws requiring marketplace facilitators to collect sales taxes as a way to boost compliance with state sales and use tax laws. The governor’s budget estimates this would increase collection of taxes already owed by $93.9 million over two years.

Marijuana, Tobacco, and Vapor Tax Changes

Governor Evers’ proposal also includes changes to various excise taxes, including taxes on tobacco, vapor, and medical marijuana products.

Currently, Wisconsin’s cigarette tax is 12.6 cents per cigarette, or $2.52 for a pack of 20., the 12th highest cigarette tax in the country. Other tobacco products, like chewing tobacco, are generally taxed at 71 percent of the manufacturer’s list price. The governor’s budget proposes imposing taxes on e-cigarettes and vapor products at 71 percent of the manufacturer’s list price, regardless of whether said vapor products contain nicotine. Under this proposal, Wisconsin would follow Minnesota and the District of Columbia in having one of the highest vapor taxes in the country.

The governor’s proposal would also raise additional revenue by taxing “little cigars” like cigarettes, and by creating a medical marijuana program, with sales taxes and a 10 percent excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. levied on medical marijuana.

Transportation Tax Changes

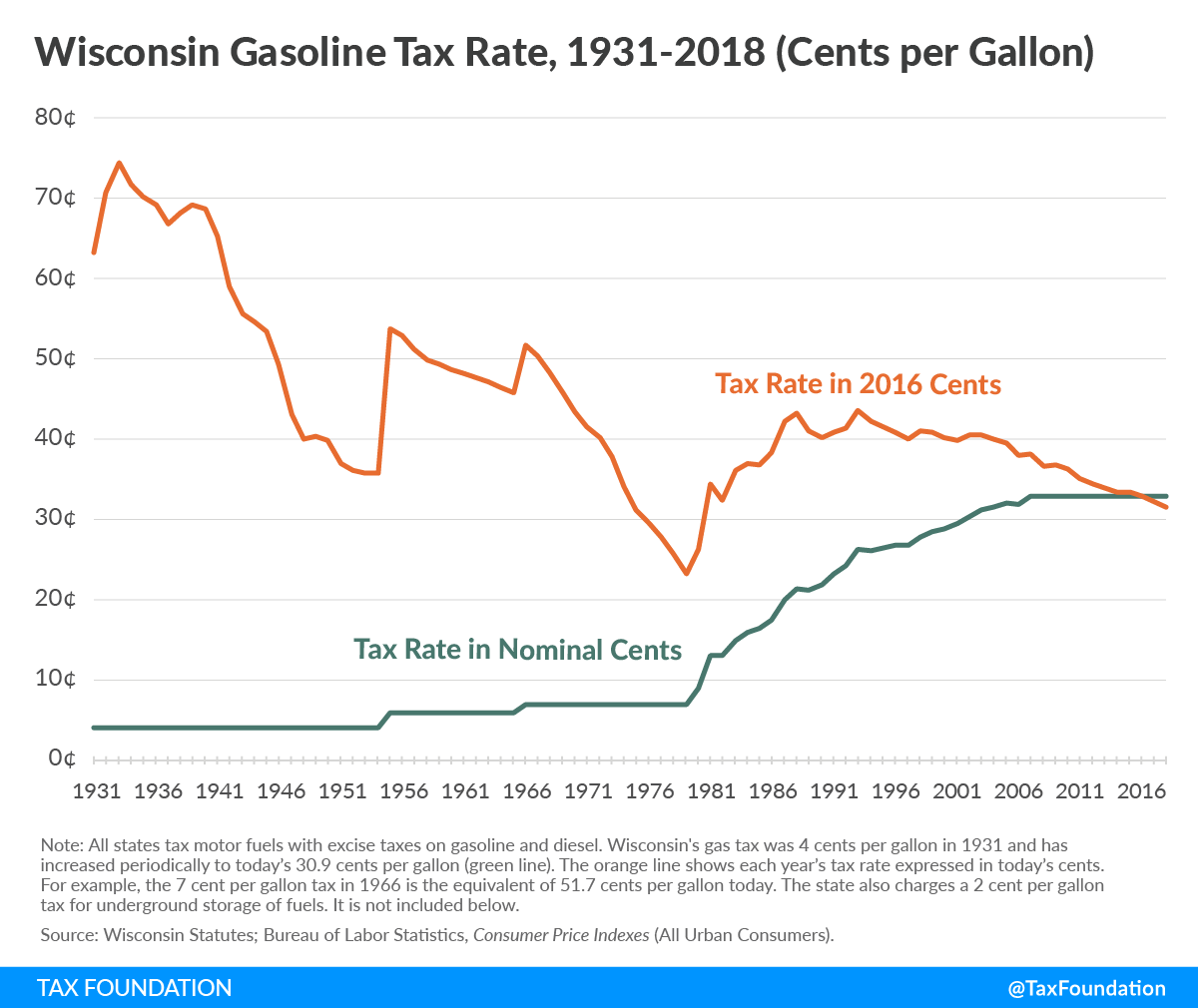

The governor’s transportation tax proposals would put a greater emphasis on user taxes and fees while reducing reliance on general tax revenue to fund transportation. Most notably, the plan would increase the gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline. by 8 cents per gallon and begin indexing it for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. . Currently, the state-levied gas tax totals 32.9 cents per gallon (cpg), including a 30.9 cpg excise tax and a 2 cpg tax on underground storage of fuels. Wisconsin’s 32.9 cpg gas tax has remained constant since 2006, but the value of the tax has declined in real terms every year since 2003. Additionally, as vehicles become more fuel-efficient, fewer gallons of gas are needed to travel the same distance, further eroding the value of the gas tax.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeTo offset some of the gas tax increase, the governor’s proposal would eliminate the minimum markup on motor fuels. Currently, Wisconsin’s minimum markup law requires gasoline retailers to raise the price of gasoline 9.18 percent above the wholesale price. This Depression-era law was originally designed to prevent retailers from using predatory pricing to defeat their competitors and gain a monopoly, but there is little evidence price gouging would occur absent a minimum markup law.

Share