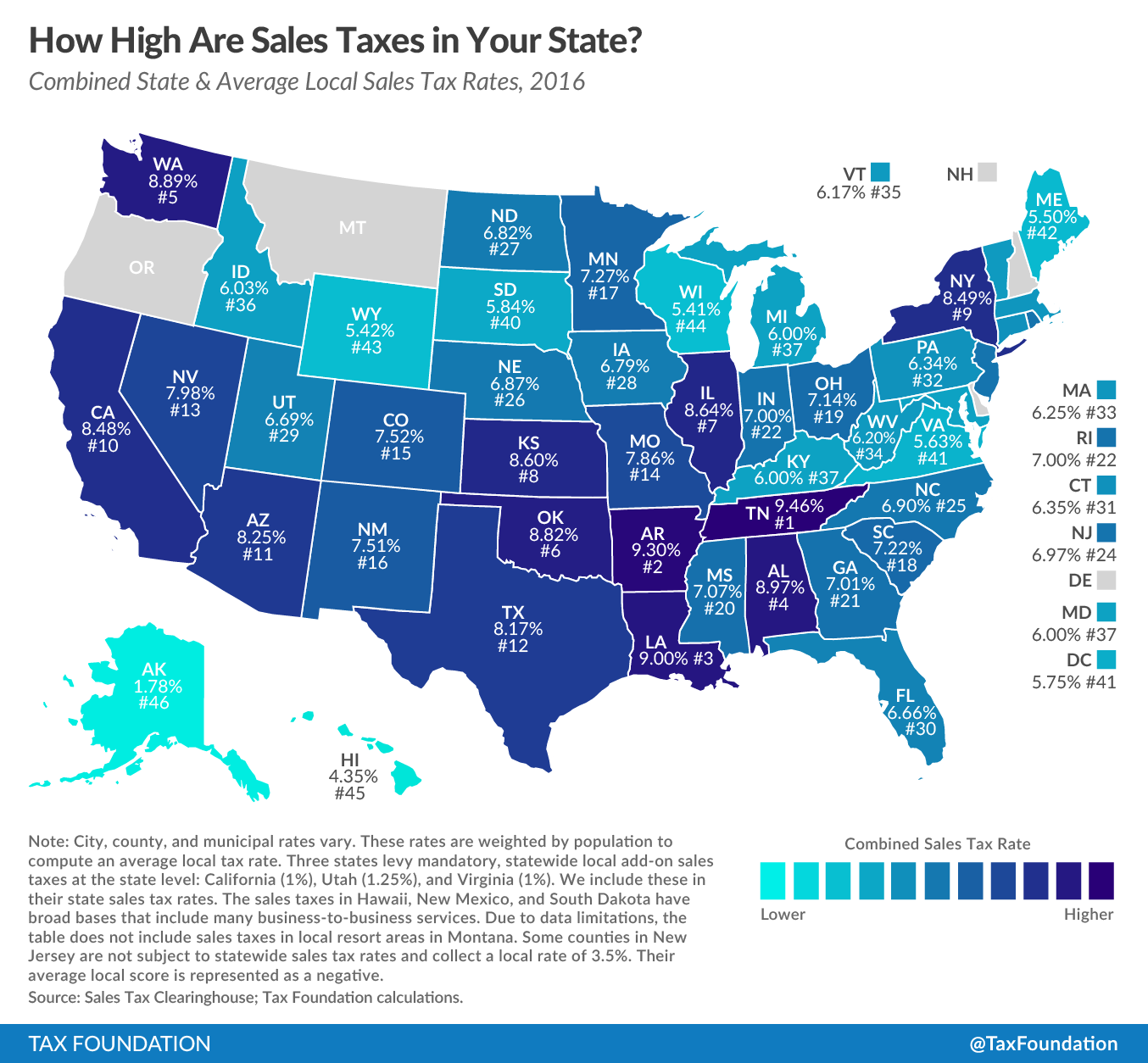

This week’s taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. map shows state and local sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. rates in each state as of January 1, 2016 and comes from our larger report on sales taxes released earlier today. While consumers might be aware of the statewide sales tax rate, local sales taxes can differ widely, so our population-weighted average allows for comparability across states.

The five states with the highest average combined state-local sales tax rates are:

- Tennessee (9.46%)

- Arkansas (9.30%)

- Louisiana (9.00%)

- Alabama (8.97%)

- Washington (8.89%)

The five states with the lowest average combined state-local sales tax rates are:

Sales tax rates are important, but are only half of the equation. Sales tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. s (e.g., the structure of sales taxes, defining what is taxable and non-taxable) are also a major consideration. For instance, most states exempt groceries from the sales tax, others tax groceries at a limited rate, and still others tax groceries at the same rate as all other products. Some states exempt clothing or tax it at a reduced rate.

Tax experts generally recommend that sales taxes apply to all final retail sales of goods and services but not intermediate business-to-business transactions in the production chain. These recommendations would result in a tax system that is not only broad based but also “right-sized,” applying once and only once to each product the market produces. Despite agreement in theory, the application of most state sales taxes is full report on state and local sales tax rates to learn more.

Share