Last week, German Finance Minister Olaf Scholz finalized his proposal for a new research and development (R&D) tax credit. The German federal cabinet is expected to pass the measure in mid-May, after which both houses of the German Parliament will vote on it.

The bill would allow businesses to claim a tax credit worth 25 percent of the wages and salaries paid to research staff, starting in 2020. The base is capped at €2 million (USD $2.3 million), translating to a maximum tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. of €500,000 ($565,000). All businesses doing basic research, industrial research, and experimental development qualify for the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. credit. The measure would not be limited to four years as initially proposed but instead be made permanent, with an impact evaluation after four years.

According to estimates included in the bill, tax revenue would decline by approximately €5 billion ($5.7 billion) over the first four years. This loss in tax revenue would be split between the federal and state governments.

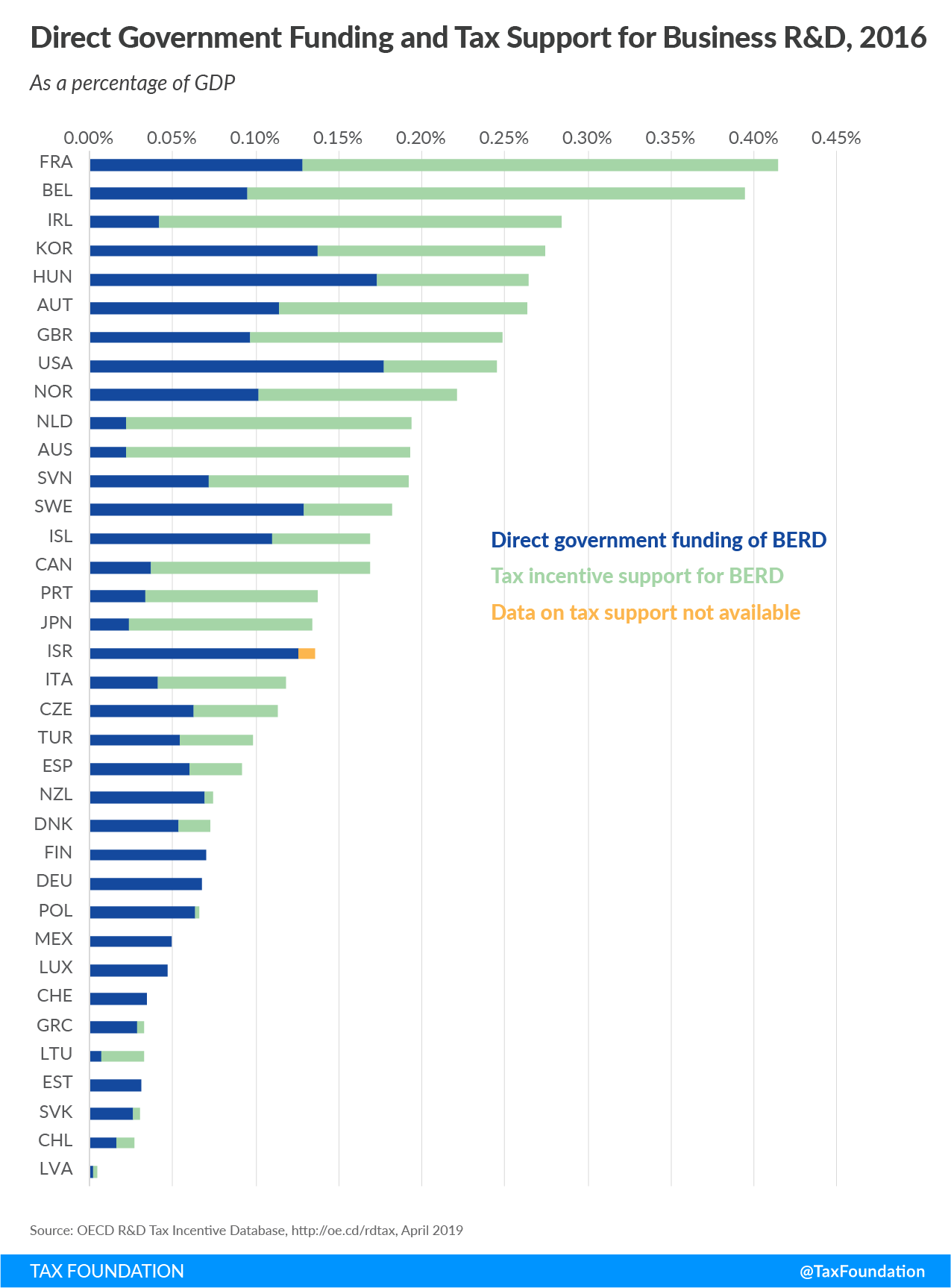

Germany currently only provides direct government funding for research and development, making it one of just seven out of 36 OECD countries without R&D tax incentives. Over the last years, many OECD countries have shifted from directly funding business R&D to providing R&D tax incentives. The volume of R&D tax incentives increased by 70 percent between 2006 and 2016 in the OECD, reaching €37.5 billion ($42.4 billion). In the same period, direct government support for business R&D increased by only 10 percent, reaching €43.3 billion ($48.9 billion) in 2016.

Direct government funding and tax support for business enterprise R&D (BERD) varies substantially across OECD countries, with France being the top supporter of R&D at about 0.41 percent of GDP in 2016. Implementing the proposed R&D tax credit in Germany would raise its share of direct and indirect R&D support by approximately 0.04 percentage points to 0.11 percent of GDP.

Share this article