For the fifth year in a row, the TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Foundation’s International Tax Competitiveness Index (ITCI) ranks France at 35th out of the 35 countries in the Organisation for Co-operation and Development (OECD) included in this year’s Index. This worst ranking is due to a multitude of weaknesses in the French tax code including the highest tax burden on labor among OECD countries as well as the highest corporate income tax rate.

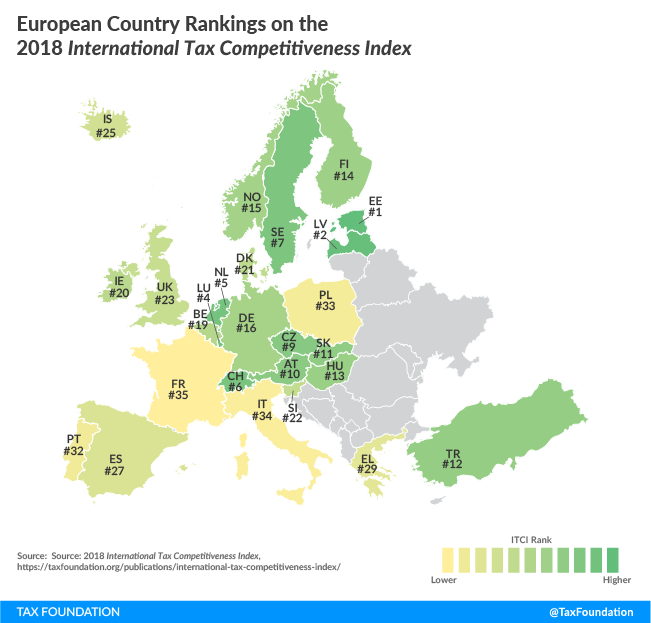

France shares a border with several countries that also rank poorly on the Index including Spain (27th) and Italy (34th). It also borders countries that rank rather well on the Index including Luxembourg (4th) and Switzerland (6th).

[global_newsletter_inline_widget campaign=”//TaxFoundation.us1.list-manage.com/subscribe/post?u=fefb55dc846b4d629857464f8&id=6c6b782bd7&SIGNUP=ITCI”]

To its credit, the French government led by President Macron has introduced policies that could improve the competitiveness of the French tax system, but the politics surrounding some of the proposals may make it difficult to enact the changes.

The challenges that workers and businesses face in the French tax system are many. Even if, for example, France followed through on plans to reduce its statutory corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate from 33.33 percent to 31 percent by the end of 2019 (to a new combined rate of 32.02 percent), it would still remain ranked last on the overall Index. This change would allow France to move from 35th to 33rd on the corporate taxation component, however.

With this in view, France should continue to reduce its corporate tax rate as planned, arriving at a combined rate of 25.83 percent in 2022.

Lowering the corporate tax rate is a move in the right direction, and it will pair nicely with the current provisions in the French tax code that allow businesses to write off most of the costs of their investments in machinery and intangible property. Write-off provisions for buildings should be improved to make France more attractive to new and growing businesses.

France also recently adopted a flat rate of 30 percent on capital gains and dividend income for individuals, a change not reflected in the 2018 Index. This change replaces the system where capital gains received similar treatment to personal income and dividends were also taxed in a progressive manner. The new flat rate on capital gains and dividends would still be well above average for OECD countries, so neither France’s overall ranking nor its ranking on the individual tax component would improve due to this change.

Planned cuts to payroll taxes could impact France’s ranking on the Index, though it is currently unclear how much the tax burden on labor would be reduced by those changes.

With a broad tax treaty network, France is well-positioned to have a competitive tax climate for multinational corporations and should move to fully exempt foreign dividends and capital gains taxes from taxation.

Most ripe for reform are the provisions that tax various forms of property. France has multiple distortionary property taxes with separate levies on real estate, net wealth, estates, assets, and financial transactions. These taxes regularly result in taxing the same income multiple times, leading to very high marginal tax rates. Taxes like these can also operate as sand in the gears for the financial system, leading individuals to avoid selling certain types of property when they otherwise would want to invest in something else.

As far as the Index is concerned, France has plenty of room to improve.

Share this article