This week, Senator Elizabeth Warren (D-MA) reintroduced the Buffett Rule under the name the “Fair Share TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. .” This tax would be used to pay for a program that allows students to refinance their higher education loans at lower interest rates.

Generally, the “Fair Share Tax,” or Buffett Rule is a 30 percent minimum tax (income tax plus payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. minus charitable deductions) on individuals who make $1,000,000 or more.

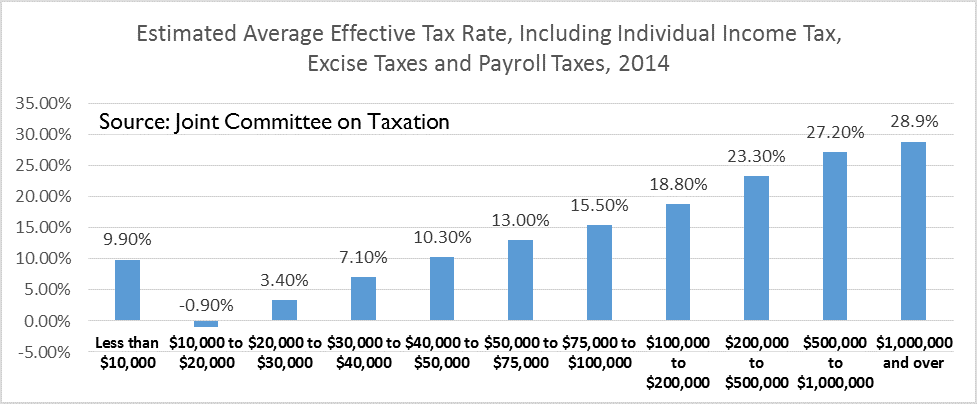

High Income Individuals Already Pay High Effective Tax Rates and Pay a Disproportionately Large Share of the Income Tax that the Federal Government Collects

The whole idea of the “Fair Share Tax” is based on the belief the high income individuals are not paying enough in taxes, or are paying lower effective tax rates than those who earn less. Warren Buffett famously claimed that his employees paid rates that average 36 percent while he only paid an effective tax rate of 17 percent.

Anecdotes aside, this is not how the U.S. tax system works. Our progressive taxA progressive tax is one where the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, while low- and middle-income taxpayers shoulder a relatively small tax burden. system taxes people at higher rates as they earn more. A recent Joint Committee on Taxation (JCT) study showed that those who make $1,000,000 or more pay an effective tax rate of 27 percent on just their federal individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. . Although not an effective tax rate of 30 percent, it is still higher than any other income group.