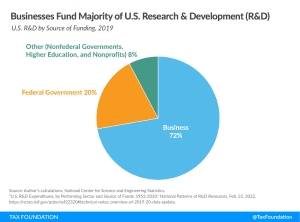

The Tax Foundation’s Taxes and Growth Model

In an attempt to provide a realistic, data-driven analysis of federal tax policy, the Tax Foundation has developed a General Equilibrium Model to simulate the effects of tax policies on the economy and on government revenues and budgets.

6 min read