The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Improving the Tax Treatment of Residential Buildings Will Stretch Affordable Housing Assistance Dollars Further

By updating the tax code to allow developers to more fully cover their investments, construction costs will fall, which, in turn, means that federal affordable housing assistance dollars will go that much further in helping low-income tenants.

3 min read

European Countries Might Consider Scrapping the Bank Tax for Greater Financial Support

In the wake of the coronavirus crisis, some governments are seeking to cut bank taxes to enhance financial support to businesses and public investment projects.

2 min read

Three Reasons Expanding Credits Aren’t the Best Pandemic Response for the Vulnerable

While reforming certain tax credits may make sense, there are far better ways to provide individuals and families with more liquidity during this crisis.

6 min read

Why Neutral Cost Recovery Is Good for Workers

Studies have shown that accelerated depreciation helps increase wage growth. A recent report found that states that implemented accelerated depreciation in their tax codes led to a 2.5 percent increase in compensation per employee in manufacturing, relative to states that did not.

3 min read

Global Tax Relief Efforts Vary in Scope and Time Frame in Response to COVID-19

Countries around the world have implemented and continue to implement emergency tax measures to support their economies during the coronavirus (COVID-19) crisis.

5 min read

Full Expensing is Good for the Short Run and the Long Run

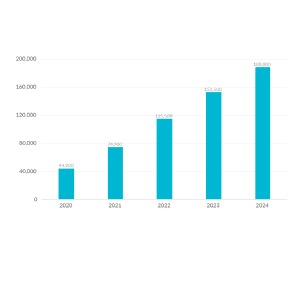

In the first year of enactment alone, we estimate the combination of full expensing and neutral cost recovery would increase full-time equivalent employment by more than 44,000 jobs. The cumulative impact by year five of the policy would be nearly 200,000 new jobs.

4 min read

Michigan Vapor Tax Bill Gets It Half-Right

In line with the nationwide trend of taxing vapor products, the Michigan Senate has passed a new 18 percent tax on vapor products. These taxes are often intended to achieve a two-fold goal: deterring youth use and raising revenue. The Michigan bill is no exception.

4 min read

CARES Act Conformity Would Promote Economic Recovery in Nebraska

Nebraska lawmakers may ultimately opt for a package that includes both property tax relief and the renewal of business incentives, but they should avoid doing so at the expense of decoupling from the CARES Act’s liquidity-enhancing provisions.

6 min read

Cautionary Notes from CBO on the Effects of Federal Investment

Based on the CBO’s assessment of the economic and budgetary effects of federal investment, lawmakers should look to spur private sector investment rather than try to enact a massive federal infrastructure bill.

5 min read