The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Spanish Taxpayers to Be Hit by Two Major Taxes in 2021

Spain’s upper house passed two major tax bills today: the financial transaction tax (FTT) and the digital service tax (DST). Both taxes will go into effect in January 2021.

3 min read

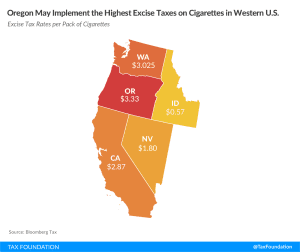

Taxation of Tobacco and Vapor Products on the Ballot in Oregon

Oregon’s Measure 108 introduces a risk of increased tax avoidance and evasion activity as consumers of the products often procure cigarettes from lower tax jurisdictions. At $3.33 per pack, Oregon would have the highest excise tax on cigarettes in the region.

5 min read

State and Local Tax Ballot Measures to Watch on Election Day 2020

Here are the state tax ballot measures to watch on Election Day 2020. Explore the most notable 2020 state tax ballot measures in 15 states.

4 min read

Colorado Proposition 116: Will Voters Reduce the State Income Tax Rate?

This Election Day, Colorado voters will weigh in on Proposition 116, which would permanently reduce the state’s flat income tax rate from 4.63 to 4.55 percent.

2 min read

Seventh Time’s the Charm: New Jersey Passes Millionaires Tax

After six unsuccessful tries at passage, it appears the coronavirus crisis has tipped the scales in favor of Gov. Phil Murphy’s (D) millionaires tax. New Jersey may be feeling the financial squeeze right now, but this large income tax change will not solve budget problems and may exacerbate funding issues by making the state even unfriendlier to businesses.

3 min read

Colorado Voters to Decide Fate of Longstanding Property Tax Limit

One of the many policy questions Colorado voters will be tasked with deciding this November is whether to amend the state constitution to repeal the Gallagher Amendment, a provision within the Colorado constitution that, since 1982, has limited residential property to 45 percent of the statewide property tax base. Repealing the Gallagher Amendment would cause residential property taxes to rise over time but would also enhance the neutrality and overall competitiveness of the tax code.

4 min read

Voters in Four States to Vote on Recreational Marijuana

Legalizing recreational marijuana is a hot topic in many states where the state budgets are in disarray because of the coronavirus pandemic and new revenue sources are being sought.

7 min read

Countries Eye Environmental Taxation

A recent OECD report on 2020 tax reforms reveals an increase in the number of environmentally-related tax policies, including gas taxes, carbon taxes, and taxes on electricity consumption.

5 min read

Designing a Global Minimum Tax with Full Expensing

The design and implementation of a global minimum tax is not simple and straightforward. There are dozens of challenging issues that policymakers will need to consider. So, when it comes to the way the minimum tax treats new investment, it seems clear that incorporating full expensing into the design would have significant benefits.

6 min read

Sweden’s 2021 Budget: Permanent Income Tax Cuts

Sweden’s 2021 budget outlines an aggressive plan to both cut income taxes in a permanent manner alongside multiple other tax cuts and spending increases

3 min read