The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Wisconsin Losing Ground to Tax-Friendly Peers

While Wisconsin has long been one of the highest-tax states in the nation, that distinction is increasingly detrimental as businesses and individuals enjoy increased economic and geographic mobility.

6 min read

Two Dozen States Show Why the Kansas Critique of Income Tax Cuts Is Mistaken

The Kansas experience is so infamous that “what about Kansas?” is almost guaranteed to be a question—sometimes as a retort, but often a genuine expression of concern—any time any state explores tax relief. But what about the other two dozen states that have cut their income taxes since then?

6 min read

Oklahoma Should Prioritize Pro-Growth Relief, Not Gimmicky Rebate Checks

If Sooner State policymakers want to use a portion of their higher revenues to make the economy work better for all Oklahomans, they should consider repealing the franchise tax, trimming the income tax, or both—paired, if desired, with targeted aid to those in the greatest need—not writing a single round of gimmicky checks.

5 min read

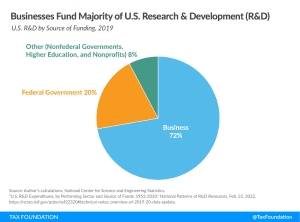

Delaying R&D Amortization Generates Short-Term Revenue but No Long-Term Economic Benefit

Starting this year, firms must amortize their research and development (R&D) expenses over five years rather than immediately deduct them from taxable income, a policy change designed to raise federal tax revenue in the short term.

5 min read

Time for an Updated Impact Assessment of the Global Tax Deal

Treasury Secretary Janet Yellen offered estimates from the EU Tax Observatory as evidence that the Polish government would benefit from supporting the global tax deal. Unfortunately, evidence was, at best, out of date.

2 min read

Europe Opened the Pandora Box of Reduced VAT Rates

With this new VAT directive, the EU has invited member states to adopt policies that create new complexities, are poorly targeted, and undermine an Own Resource.

5 min read

U.S.-China Trade War Hurt American Industries and Workers

While the U.S. tariffs were intended to protect American industries, they have largely hurt the U.S. economy. Rather than pass on the tariffs to Chinese consumers, analysis shows that most U.S. firms simply bore the costs.

5 min read

Evaluating Wyoming’s Business Tax Competitiveness

Wyoming’s low taxes are highly attractive, but policymakers are still hard at work helping the state achieve broader economic development goals.

13 min read

The Aftermath of Arizona’s Proposition 208 and the Potential for a Flat Tax

Arizona now joins a growing cohort of states that are moving toward a flat income tax. Pending revenue triggers, the income tax rate will be reduced to 2.5 percent giving Arizona one of the lowest individual income tax rates in the country.

7 min read