The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Options for Improving Cost Recovery for Structures

If lawmakers are looking to maximize the positive economic effects from a tax bill, then improving tax depreciation for structures should probably be part of the conversation. Here are a few options.

10 min read

What Would the “Big Six” Framework Mean for Lower-Middle Income Households?

Based on the details we have, the Big Six tax plan would lower taxes on the bottom 80% of taxpayers, and raise the tax burden on the top 20% of taxpayers.

7 min read

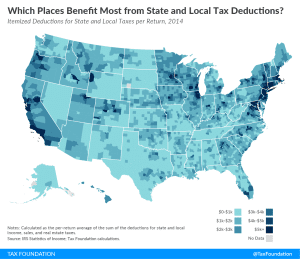

Eliminating the SALT Deduction Under the “Big Six” Tax Plan

The state and local tax deduction favors high-income individuals in high-tax states. Six states—California, New York, New Jersey, Illinois, Texas, and Pennsylvania—claim more than half of the value of the deduction.

2 min read

Details of the “Big Six” Tax Framework

Republican leadership in the House, Senate, and White House released a framework for a tax proposal that would lower taxes on businesses and individuals and simplify a number of aspects of the federal tax code. Here are the details we know right now.

3 min read

Is the State and Local Tax Deduction in Place to Protect Against Double Taxation?

Repealing the state and local tax deduction will be an important part of pro-growth tax reform. Eliminating the deduction would free up $1.8 trillion to use for lowering rates across the board. Special interest groups will want you to think this deduction protects you against double taxation. Don’t fall for it.

2 min read