The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

What Does the Wayfair Decision Really Mean for States, Businesses, and Consumers?

Various interpretations of the recent Wayfair decision from the U.S. Supreme Court has led to confusion about its impact for online sellers and consumers. We clear up that confusion with this Q&A.

8 min read

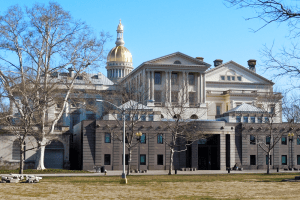

Taxation, Representation, and the American Revolution

James Otis’s rallying cry of “taxation without representation is tyranny!” became the watchwords of the American Revolution and remain familiar to our ears. American independence, which we celebrate each year, was born of a tax revolt.

6 min read