The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Reducing the Bias Against Long-term Investments

Other countries have shown that providing deductions in line with invested capital costs can have positive impacts both on investment and on debt bias.

7 min read

Alabama, Missouri Bills Would Exempt CARES Relief from Income Tax Calculation

Alabama and Missouri are considering excluding the CARES Act Economic Impact Payments from being taxed and exclude them from state income tax calculations.

2 min read

Gov. Hogan Vetoes Maryland Digital Advertising Tax Legislation

Gov. Hogan vetoed a proposed first-in-the-nation digital advertising tax that would have imposed rates of up to 10 percent on digital advertising served to Marylanders.

3 min read

Watch: Coronavirus: A Path to Economic Recovery

What challenges should we expect to face as the U.S. economy begins to re-open? When is the right time for legislators to start focusing on long-term recovery vs. short-term needs? What policies should federal legislators pursue to clear a path to recovery?

1 min read

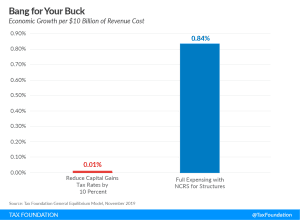

White House Considers Neutral Cost Recovery for Structures

When considering long-term policies for increasing long-run levels of investment and economic growth, full expensing and neutral cost recovery are better targeted than policies like a capital gains cut.

6 min read

Chaos to the Left of Me. Chaos to the Right of me.

The OECD recently announced that the negotiation timeline for new digital tax proposals has now been pushed back to October due to the COVID-19 pandemic, although the end-of-year deadline for the overall project is still in place.

5 min read

Reviewing the Economic and Revenue Implications of Cost Recovery Options

Permanent full expensing for all types of investment is an effective policy change lawmakers can use to encourage additional investment and economic growth.

9 min read

Reviewing the Benefits of Full Expensing for the Post-Pandemic Economic Recovery

One of the most cost-effective policy changes would be to make full expensing of machinery and equipment permanent and extend this important tax treatment to structures as well as for firms in a net operating loss position.

7 min read