All Related Articles

Tax Trends in European Countries

In recent years, European countries have undertaken a series of tax reforms designed to maintain tax revenue levels while protecting households and businesses from high inflation.

8 min read

BEFIT: One-Stop-Shop or One-More-Stop?

On 12 September, the European Commission released a proposal called “Business in Europe: Framework for Income Taxation” (BEFIT) and two associated proposals on transfer pricing and a Head of Office tax system.

6 min read

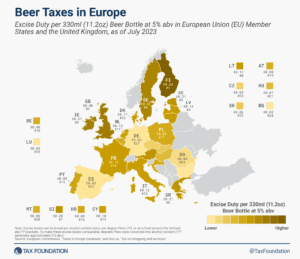

Beer Taxes in Europe, 2023

As Oktoberfest celebrations kick off around the world, let’s look at how much tax European Union (EU) countries add to the world’s favorite alcoholic beverage.

2 min read

The Tax Policy Implications of the Spanish Elections at the Regional, National, and European Levels

The Spanish election results are moving the country away from pro-growth tax reforms while launching the government’s tax agenda, and the agenda of the Spanish presidency of the Council of the European Union, into uncertainty.

7 min read

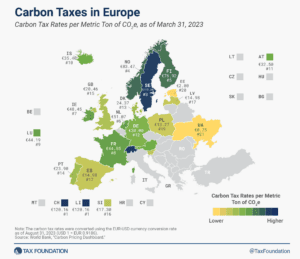

Carbon Taxes in Europe, 2023

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems, and carbon taxes. In 1990, Finland was the world’s first country to introduce a carbon tax.

4 min read

Why Italy’s Latest Windfall Profits Tax Is Still Bad Tax Policy

For many Italian banks, there hasn’t been a significant “windfall” to tax. The profit margins of Italian banks have been lower compared to other industries for the past two decades.

5 min read

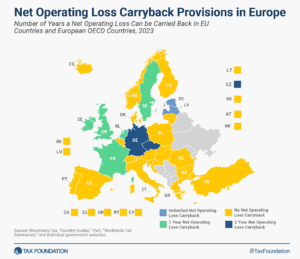

Net Operating Loss Carryforward and Carryback Provisions in Europe, 2023

Carryover tax provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

3 min read

Not All Taxes Are Created Equal

Discover why there are better and worse ways for governments to raise a dollar of revenue. That’s because no two taxes impact the economy the same.

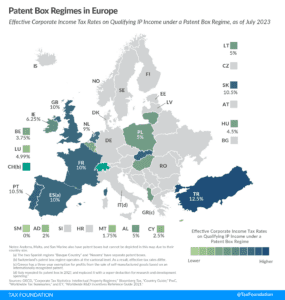

Patent Box Regimes in Europe, 2023

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.

3 min read

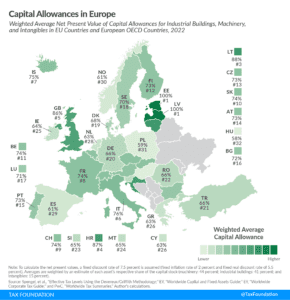

Capital Allowances in Europe, 2023

Capital allowances play an important role in a country’s corporate tax base and can impact investment decisions—with far-reaching economic consequences.

4 min read