All Related Articles

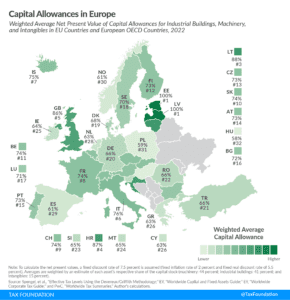

Capital Allowances in Europe, 2023

Capital allowances play an important role in a country’s corporate tax base and can impact investment decisions—with far-reaching economic consequences.

4 min read

Benefits of Principled Tax Policy: EU VAT Reform Results

The EU’s recent VAT reform is an example of a win for governments, consumers, and companies. Charting a new path toward a more successful tax system.

4 min read

A Mis-STEP for the European Union: The New Subsidy Race to the Bottom

Enhancing the European Union’s competitiveness is necessary, but the European Commission’s latest attempt is the wrong approach.

4 min read

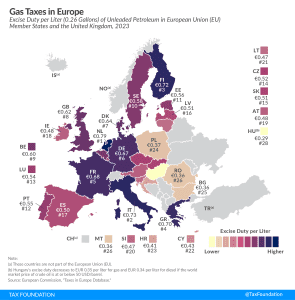

Diesel and Gas Taxes in Europe, 2023

As the EU pursues massive changes in public policy as part of its green transition, expect fuel taxes to be central to any policy discussions.

5 min read

Examining the EU Corporate Own Resources Proposal: Implications and Challenges

The European Commission proposed a new source of revenue as part of its second basket of own resources: a “temporary statistical own resource based on company profits.” This is an attempt to bolster the EU’s budget as it repays its debt.

5 min read

The Wealth Tax Discussion Is Back

Given that wealth taxes collect little revenue and have the potential to disincentivize entrepreneurship and investment, perhaps European countries should repeal them rather than implement one across the continent.

4 min read

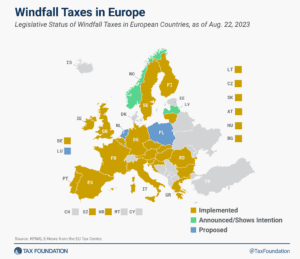

Windfall Profit Taxes in Europe, 2023

It’s unlikely these implemented and proposed windfall taxes will achieve their goals of raising additional revenues without distorting the market. Instead, they would penalize domestic production and punitively target certain industries without a sound tax base.

13 min read

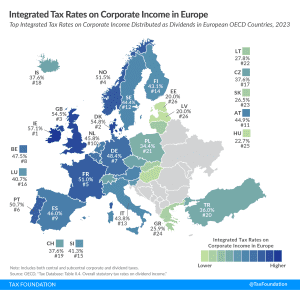

Integrated Tax Rates on Corporate Income in Europe, 2023

In most European OECD countries, corporate income is taxed twice, once at the entity level and once at the shareholder level.

4 min read

Tax Ideas for the EU Green Transition

The past few years have brought a renewed push from countries across the globe to combat climate change. In the European Union, policymakers have put a timeline on their climate agenda. By 2050, the EU wants to achieve a net-zero economy. Sean Bray, director of European policy, breaks down how much it would cost to achieve this goal.