All Related Articles

Testimony: Capital Gains Taxation in the EU

It is essential to understand that the taxation of capital gains places a double tax on corporate income.

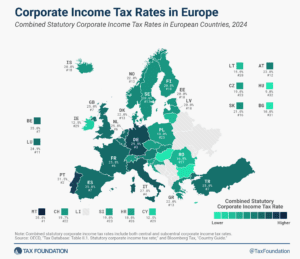

Corporate Income Tax Rates in Europe, 2024

Like most regions around the world, European countries have experienced a decline in corporate income tax rates over the past four decades, but the average corporate income tax rate has leveled off in recent years.

2 min read

Tax Files under New Council of EU Presidency: Belgium

In such a determinant semester for Europe, principled tax policy can be an important tool for a more competitive European Union.

5 min read

Spanish Regions Are Not Surrendering Their Tax Competitiveness without a Fight

Spain’s central government could learn some valuable lessons from its regional governments about sound tax policy.

7 min read

European Tax Policy Scorecard: How Competitive is Ukraine’s Tax System Relative to EU Member States?

In the end, the best way for the EU to support Ukraine’s post-war recovery is to guarantee its tax sovereignty, not just its territorial sovereignty.

5 min read

An Introduction to the History of Taxes

Taxes have played a major role throughout history, and even date back to around 5,000 years ago. Taxes will continue to affect our lives and shape our societies just like they have for thousands of years.

Tax Reform Is Key to Ukraine’s Economic Health, Now and after the War

What historical lessons of wartime finance can Ukrainian and EU policymakers learn to put Ukraine’s economy on a path to success during, and especially after, the war?

5 min read

What’s Next for Tax Competition?

The rules of tax competition are changing with the recent agreement on a global minimum tax and other changes to tax rules around the world, but that does not mean the contest is over.

5 min read

Assessing the EU Tax Observatory’s View on Profit Shifting and the Global Minimum Tax

The EU Tax Observatory has taken an extreme view in assessing the global minimum tax. The rules were not meant to immediately reduce the stock of shifted profits or align profitability levels more closely with employment costs. The rules do change incentives for multinationals, but profits may continue to remain in low-tax jurisdictions for many years.

6 min read

Is EU VAT Compliance Actually Improving?

While the European Commission focuses on improving VAT compliance, policy is a major contributor to VAT revenue losses. The VAT actionable policy gap is 15.65 percent, more than triple the compliance gap.

5 min read