All Related Articles

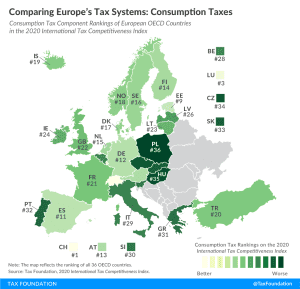

Comparing Europe’s Tax Systems: Consumption Taxes

How do consumption tax codes compare among European OECD countries? Explore our new map to see how consumption tax systems in Europe compare.

2 min read

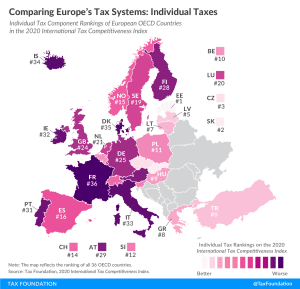

Comparing Europe’s Tax Systems: Individual Taxes

How do individual income tax codes compare among European OECD countries? Explore our new map to see how individual income tax systems in Europe compare.

3 min read

A Framework for the Future: Reforming the UK Tax System

Our new guide identifies key areas for improvement in UK tax policy and provides recommendations that would support long-term growth without putting a dent in government revenues.

24 min read

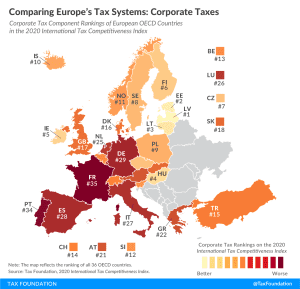

Comparing Europe’s Tax Systems: Corporate Taxes

A tax code that is competitive and neutral promotes sustainable economic growth and investment while raising sufficient revenue for government priorities.

3 min read

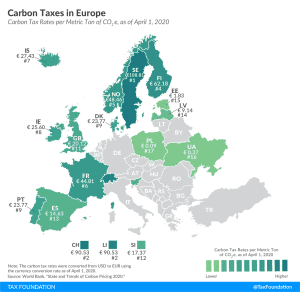

Carbon Taxes in Europe, 2020

17 European countries have implemented a carbon tax, ranging from less than €1 per metric ton of carbon emissions in Ukraine and Poland to over €100 in Sweden.

3 min read

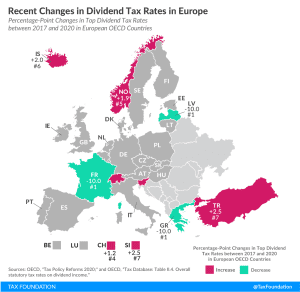

Recent Changes in Dividend Tax Rates in Europe

Over the last three years, eight European OECD countries have made changes to their dividend tax rates. Iceland, Norway, Slovenia, Switzerland, and Turkey increased their rates, each between roughly one and three percentage points. France, Greece, and Latvia cut their rates by 10 percentage points.

2 min read

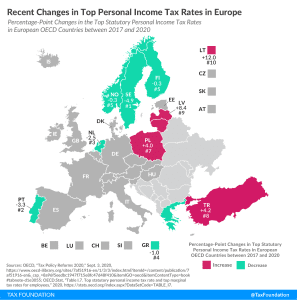

Recent Changes in Top Personal Income Tax Rates in Europe

Ten European OECD countries recently changed their top personal income tax rates. Of the ten countries, six cut their top personal income tax rates while the other four raised their top rates.

4 min read

Looking Back on 30 Years of Carbon Taxes in Sweden

Implemented in 1991, Sweden’s carbon tax was one of the first in the world. Since then, Sweden’s carbon emissions have been declining, while there has been steady economic growth. Today, Sweden levies the highest carbon tax rate in the world and its carbon tax revenues have been decreasing slightly over the last decade.

21 min read

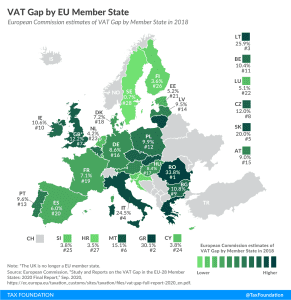

New European Commission Report: VAT Gap

Just as COVID-19 is putting pressure on other sources of revenue, the loss of VAT revenues resulting from the crisis will force governments to evaluate their VAT systems.

3 min read

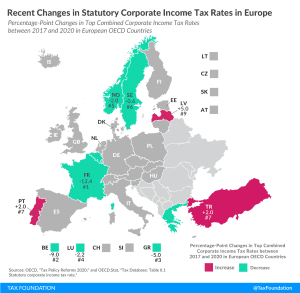

Recent Changes in Statutory Corporate Income Tax Rates in Europe

Over the last two decades, corporate income tax rates have declined around the world. Our new map shows the most recent changes in corporate tax rates in European OECD countries, comparing how combined statutory corporate income tax rates have changed between 2017 and 2020.

3 min read