All Related Articles

Tariffs Are Taxes Too

Even though tariffs are invisible, their effects clearly are not. They might be sold as a tool to strengthen the economy, but tariffs are just taxes that make everyone worse off.

The Future of Tobacco Taxation in Europe

Later this week, the European Union is expected to release a new Tobacco Tax Directive, the first update in more than a decade. Early reports indicate that the EU will propose a significant increase to the existing minimum cigarette tax rates levied across the Union and expand the product categories that are taxed, including a block-wide vaping tax.

7 min read

How the Inflation Reduction Act and Pillar Two Could Shape the Future of EU Competitiveness

French President Macron is coming to Washington, D.C., this week to ask President Biden the question on the minds of European leaders: “Why did you do this to us?”

6 min read

EU “Fiscal Fairness”

Europe is facing difficult times. Governments are balancing the need for more resources with the need to maintain peace and prosperity domestically. To properly strike this balance, EU policymakers must incorporate “Fiscal Fairness” into the debate.

2 min read

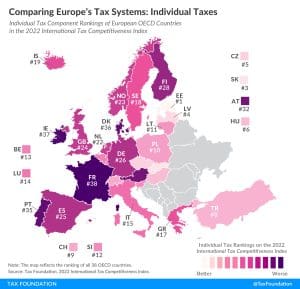

Comparing Europe’s Tax Systems: Individual Taxes

France’s individual income tax system is the least competitive among OECD countries. France’s top marginal tax rate of 45.9 percent is applied at 14.7 times the average national income. Additionally, a 9.7 surtax is applied to those at the upper end of the income distribution. Capital gains and dividends are both taxed at comparably high top rates of 34 percent.

2 min read

How the Inflation Reduction Act Affects the Future of U.S.-EU Tax and Trade Cooperation

the Inflation Reduction Act gives us a glimpse into a future where the U.S. and EU opt for protectionist tax and trade policies rather than implementing principled tax policies and reducing trade barriers between allies.

5 min read

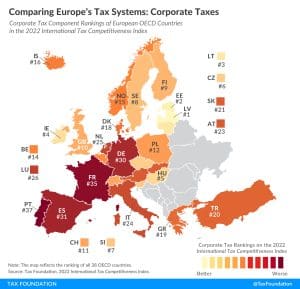

Comparing Europe’s Tax Systems: Corporate Taxes

According to the corporate tax component of the 2022 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

3 min read

A Carbon Tax, Explained

Every policy has trade-offs, but a well-designed carbon tax has the potential to protect the environment without harming consumers, jobs, or businesses.

The UK’s Tax Battles, Part One: How We Got Here

This episode of The Deduction is part one in our ongoing coverage of the UK’s tax battles. Jesse chats with Tom Clougherty, research director and head of tax at the Centre for Policy Studies in London about what went down in the UK this fall: from the leadership elections to the countless U-turns the new prime minister has made to try and reform the country’s tax code.

What the EU Gets Wrong About “Tax Fairness” and How Principled Tax Policy Can Help

A more principled EU tax system will increase economic growth across the economy and provide the government with stable finances for spending priorities.

7 min read