All Related Articles

2022 Spanish Regional Tax Competitiveness Index

The 2022 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

8 min read

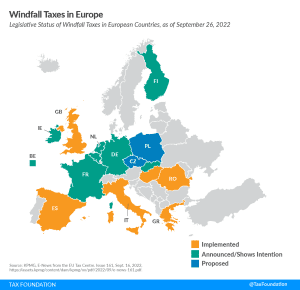

Windfall Profit Taxes in Europe, 2022

It’s unlikely these implemented and proposed windfall taxes will achieve their goals of addressing high gas and energy prices and raising additional revenues. They would more likely raise prices, penalize domestic production, and punitively target certain industries without a sound tax base.

9 min read

Impact of Italian Elections on National Tax Policy and EU Fiscal Policy

In the EU, Italy plays an important role in economic policy. If the EU wants to further develop own resources, it will need the backing of the Italian government—which seems unlikely at the moment.

4 min read

After the UK Super-Deduction: Assessing Proposals for the Reform of Capital Allowances

For many years, the UK has adopted a strikingly ungenerous approach to capital cost recovery – the ability of firms to write off investment against tax. This has coincided with consistently low levels of business investment. The super-deduction, which has temporarily made the UK tax system much more supportive of capital investment in plant and machinery is set to expire.

34 min read

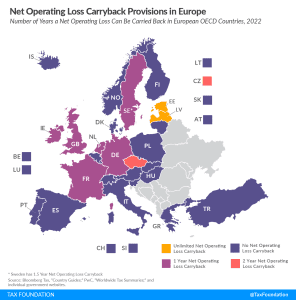

Net Operating Loss Carryforward and Carryback Provisions in Europe, 2022

Carryover tax provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

4 min read

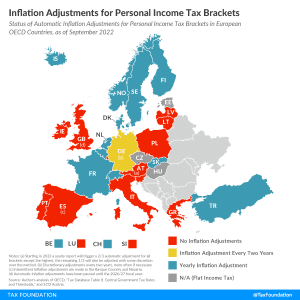

Inflation and Europe’s Personal Income Taxes

With continued concerns over inflation, individuals may be wondering how their tax bills will be impacted. Less than half of OECD countries in Europe automatically adjust income tax brackets for inflation every year.

3 min read

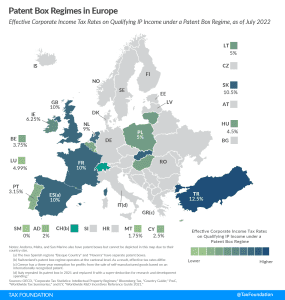

Patent Box Regimes in Europe, 2022

Patent box regimes (also referred to as intellectual property, or IP, regimes) provide lower effective tax rates on income derived from IP. Most commonly, eligible types of IP are patents and software copyrights. Currently, 13 of the 27 EU member states have a patent box regime.

4 min read

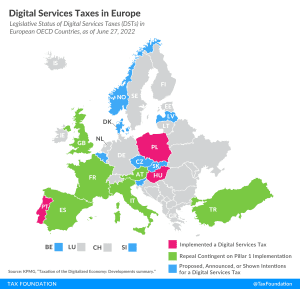

Digital Services Taxes in Europe, 2022

About half of all European OECD countries have either announced, proposed, or implemented a digital services tax.

7 min read

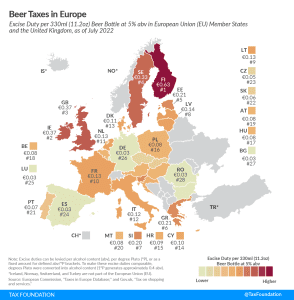

Beer Taxes in Europe, 2022

’Tis the season to crack open a cold one. Ahead of International Beer Day on August 5th, let’s take a minute to discover how much of your cash is actually going toward the cost of a brew with this week’s tax map, which explores excise duties on beer.

3 min read

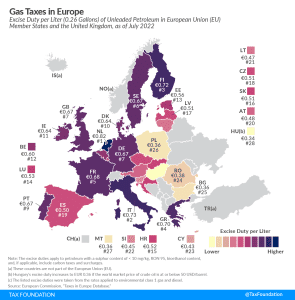

Gas Taxes in Europe, 2022

The Netherlands has the highest gas tax in the European Union, at €0.82 per liter ($3.69 per gallon). Italy applies the second highest rate at €0.73 per liter ($3.26 per gallon), followed by Finland at €0.72 per liter ($3.24 per gallon).

5 min read