All Related Articles

New Report Identifies Challenges with Global Minimum Tax Implementation in the EU

European Union Member States are in the process of implementing the global minimum tax in line with a directive unanimously agreed to at the end of 2022.

3 min read

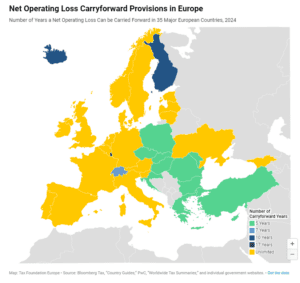

Net Operating Loss Carryforward and Carryback Provisions in Europe, 2024

Carryover provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

3 min read

Trade Tax Rates in Germany

Varying local trade tax rates impact business investment and local government revenue across Germany’s municipalities.

4 min read

The European Election and Tax Policy: Mapping Tax Policy Visions across European Political Groups

On Europe Day, our experts explore how the decisions made in the upcoming elections will shape the trajectory of the continent for years to come.

4 min read

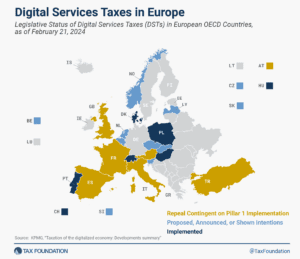

Digital Services Taxes in Europe, 2024

About half of all European OECD countries have either announced, proposed, or implemented a DST. Because these taxes mainly impact U.S. companies and are thus perceived as discriminatory, the United States responded to the policies with retaliatory tariff threats, urging countries to abandon unilateral measures.

4 min read

Trump, Biden and the American Protectionist Matrix

Trump’s protectionist measures and the continuation of most of them under the Biden administration already form the matrix of American trade policy after the 2024 elections.

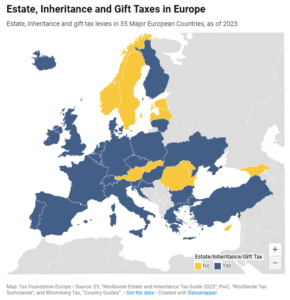

Estate, Inheritance, and Gift Taxes in Europe, 2024

As tempting as inheritance, estate, and gift taxes might look—especially when the OECD notes them as a way to reduce wealth inequality—their limited capacity to collect revenue and their negative impact on entrepreneurial activity, saving, and work should make policymakers consider their repeal instead of boosting them.

2 min read

Macron’s Deficit Dilemma Depends on Sound Tax Policy

Trapped in a stalemate between raising taxes or cutting spending, France instead should consider the revenue potential of principled tax policy design.

Excise Duties on Electricity in Europe, 2024

EU Member States should seek to minimize the rate and broaden the base of electricity duties, consolidating their rates to the required minimum rate.

3 min read

Portugal’s Personal Income Tax System: High Top Rate, Threshold, and Tax Credits

Portugal’s personal income tax system levies high tax rates on an unusually narrow set of high earners, striking a poor balance between earnings incentives and revenue contributions.

4 min read