All Related Articles

Fiscal Forum: Future of the EU Tax Mix with Dr. Stefanie Geringer

Tax Foundation Europe’s Sean Bray had the opportunity to interview Dr. Stefanie Geringer, a postdoctoral researcher at the Faculty of Law at the University of Vienna and Masaryk University Brno, a certified tax advisor and manager of tax at BDO Austria, about the future of the EU tax mix.

14 min read

Tax Subsidies for R&D Expenditures in Europe, 2025

Many countries incentivize business investment in research and development (R&D), intending to foster innovation. A common approach is to provide direct government funding for R&D activity. However, a significant number of jurisdictions also offer R&D tax incentives.

4 min read

Fiscal Forum: Future of the EU Tax Mix with Dr. Dominika Langenmayr

Tax Foundation Europe’s Sean Bray had the opportunity to interview Dr. Dominika Langenmayr, Professor of Economics at Catholic University of Eichstätt-Ingolstadt, about the future of the EU tax mix.

15 min read

Tax Burden on Labor in Europe, 2025

To make the taxation of labor more efficient, policymakers should understand their country’s tax wedge and how their tax burden funds government services.

5 min read

Presidential Election in Poland: Tailoring Tax Policy to Poland’s Strategic Needs

Between Russia’s war in Ukraine, President Trump’s uncertain policies towards Europe, and Poland’s attempt to increase domestic defense capabilities, raising revenue has become one of the most critical topics in the campaign.

7 min read

What Are the Goals of Retaliatory Tax Policies?

The US Ways and Means Committee’s “Big Beautiful Bill” includes a retaliatory provision called Section 899, along with an expansion of the base erosion and anti-abuse tax (BEAT).

7 min read

Fiscal Forum: Future of the EU Tax Mix with Dr. Jost Heckemeyer

Sean Bray interviewed Professor of Business Accounting and Taxation at the University of Kiel, Jost Heckemeyer, about the future of the EU tax mix. The interview shows that there is a trade-off between stability and flexibility in European tax policymaking. It also shows that there ought to be a balance between fairness and competitiveness when thinking about improving tax policy.

16 min read

Net Operating Loss Carryforward and Carryback Provisions in Europe, 2025

Carryover provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

5 min read

A Distributed Profits Tax in Poland

The Polish government is considering converting its traditional corporate income tax into a tax on distributed profits. We estimate that this reform would result in greater investment, a larger productive capital stock, and higher economic output in the long run.

29 min read

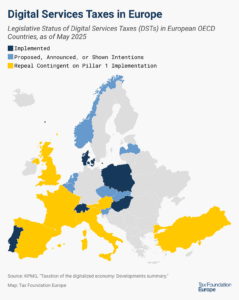

Digital Services Taxes in Europe, 2025

Currently, about half of all European OECD countries have either announced, proposed, or implemented a digital services tax. Because these taxes mainly impact US companies and are thus perceived as discriminatory, the US responded with retaliatory tariff threats.

5 min read