All Related Articles

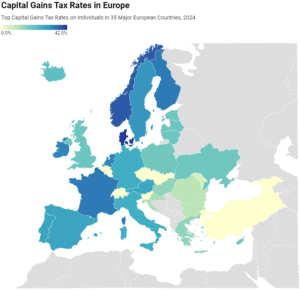

Capital Gains Tax Rates in Europe, 2024

In many European countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income.

2 min read

Portugal’s Corporate Taxes Stifle Investment and Economic Growth

Portugal has the second highest top corporate tax rate in the OECD at 31.5 percent, including multiple top-up taxes. Unlike most OECD countries, Portugal imposes a highly progressive tax structure on corporate income.

6 min read

Launching Tax Foundation Europe

As the world of tax policy becomes more interconnected, the Tax Foundation is stepping up, recognizing the pressing need for informed and principled tax policy education in an ever-evolving landscape.

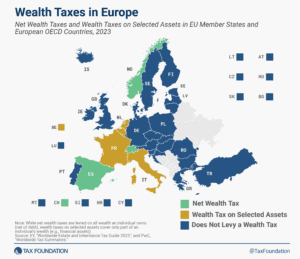

Wealth Taxes in Europe, 2024

Only three European countries levy a net wealth tax—Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets.

4 min read

Savings and Investment: The Tax Treatment of Stock and Retirement Accounts in the OECD and Select EU Countries

Tax-preferred private retirement accounts often have complex rules and limitations. Universal savings accounts could be a simpler alternative—or addition—to many countries’ current system of private retirement savings accounts.

19 min read

Tax Foundation Europe Launches Website and Prepares Brussels Office

The landscape of tax policy is changing—and we at the Tax Foundation are changing with it.

3 min read

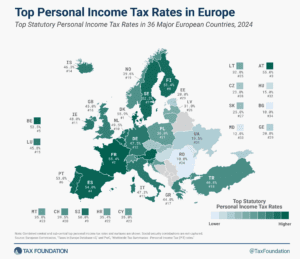

Top Personal Income Tax Rates in Europe, 2024

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

Mind the Gap, Please! How Portugal Could Reform Its VAT System

Portugal’s value-added tax (VAT) policy is a treasure trove of tax oddities. Thankfully, VAT base broadening is an ideal instrument to give the Portuguese government the fiscal room to implement pro-growth tax reforms

5 min read

VAT Rates in Europe, 2024

A few European countries have made changes to their VAT rates, including the Czech Republic, Estonia, Switzerland, and Turkey.

3 min read

Testimony: Capital Gains Taxation in the EU

It is essential to understand that the taxation of capital gains places a double tax on corporate income.