All Related Articles

Tax Ideas for the EU Green Transition

The past few years have brought a renewed push from countries across the globe to combat climate change. In the European Union, policymakers have put a timeline on their climate agenda. By 2050, the EU wants to achieve a net-zero economy. Sean Bray, director of European policy, breaks down how much it would cost to achieve this goal.

Testimony: The Role of Corporate Taxation in the European Union’s Future Tax Policy Mix

As policymakers shift their focus away from tax rates and look to harmonize the EU’s corporate tax base, they should understand the benefits of full expensing.

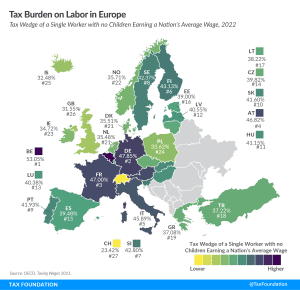

Tax Burden on Labor in Europe, 2023

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

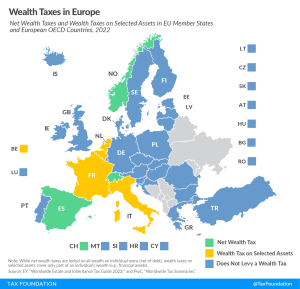

Wealth Taxes in Europe, 2023

Instead of reforming and hiking the wealth tax, perhaps policymakers should consider whether the tax is serving its intended objectives, and, if not, consider repealing the tax altogether.

4 min read

The Role of Pro-Growth Tax Policy and Private Investment in the European Union’s Green Transition

Permanent full expensing is an efficient and neutral tax policy that will allow markets to allocate private investment effectively while moving the economy towards the climate goals of the EU.

33 min read

Reforming EU Own Resources: Competitiveness versus Raising Revenue

When it comes to EU-level tax policy ideas, competitiveness seems to be less of a priority than raising revenue or pursuing social objectives.

4 min read

What the EU’s Carbon Border Adjustment Mechanism Means for Europe and the United States

The Carbon Border Adjustment Mechanism (CBAM) is a key aspect of the EU’s broader Fit for 55 package which aims to cut 55 percent of net greenhouse gas (GHG) emissions in the EU by 2030. The growing number of competing climate policies between the EU and U.S., such as tax provisions in the Inflation Reduction Act, could present policymakers on both sides of the Atlantic an opportunity to work together.

5 min read

Tax Policy and Economic Downturns in Europe

While some temporary policies can help in a crisis, policymakers should focus their efforts on sustainable policies that support growth and the resilience of businesses (and government coffers) over the long term.

6 min read

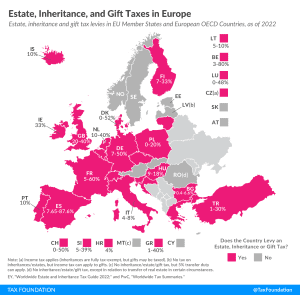

Estate, Inheritance, and Gift Taxes in Europe, 2023

As tempting as inheritance, estate, and gift taxes might look—especially when the OECD notes them as a way to reduce wealth inequality—their limited capacity to collect revenue and their negative impact on entrepreneurial activity, saving, and work should make policymakers consider their repeal instead of boosting them.

3 min read

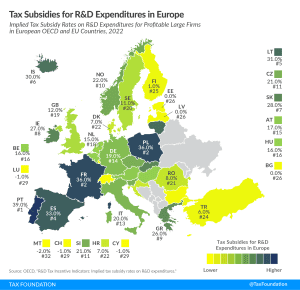

Tax Subsidies for R&D Expenditures in Europe, 2023

Many countries incentivize business investment in research and development (R&D), intending to foster innovation. A common approach is to provide direct government funding for R&D activity. However, a significant number of jurisdictions also offers R&D tax incentives.

4 min read