All Related Articles

Tax Files Under New Council of EU Presidency: Czechia

As the Czech EU presidency considers a plan to manage various tax-related files, it would be wise to consider principled tax policy that broadens the tax base and reduces the tax wedge on strategic investment.

4 min read

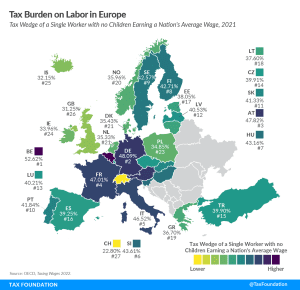

Tax Burden on Labor in Europe, 2022

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

Impact of Elections on French Tax Policy and EU Own Resources

The French election results are paralyzing for French pro-growth tax reforms, pessimistic for EU own resources, and dire for overall economic certainty.

5 min read

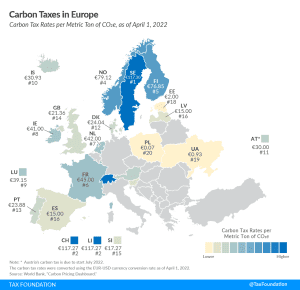

Carbon Taxes in Europe, 2022

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems, and carbon taxes. In 1990, Finland was the world’s first country to introduce a carbon tax.

3 min read

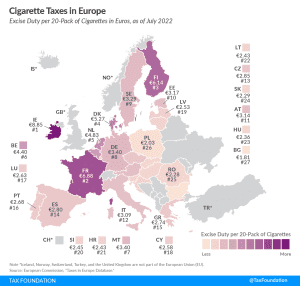

Cigarette Taxes in Europe, 2022

Ireland and France levy the highest excise duties on cigarettes in the EU, at €8.85 ($10.47) and €6.88 ($8.13) per 20-cigarette pack, respectively.

3 min read

Europe Opened the Pandora Box of Reduced VAT Rates

With this new VAT directive, the EU has invited member states to adopt policies that create new complexities, are poorly targeted, and undermine an Own Resource.

5 min read

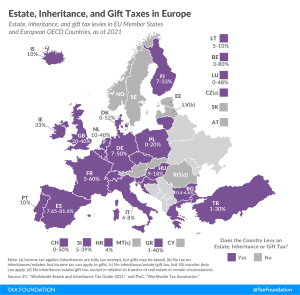

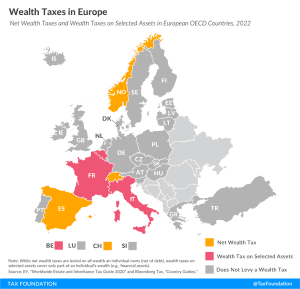

Wealth Taxes in Europe, 2022

Only three European OECD countries levy a net wealth tax, namely Norway, Spain, and Switzerland.

3 min read

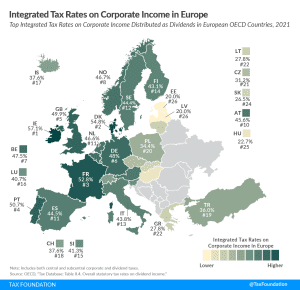

Integrated Tax Rates on Corporate Income in Europe, 2022

In most European OECD countries, corporate income is taxed twice, once at the entity level and once at the shareholder level.

4 min read