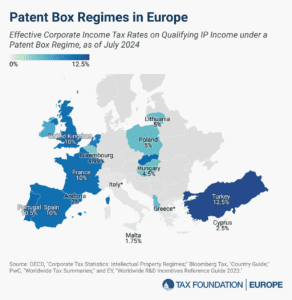

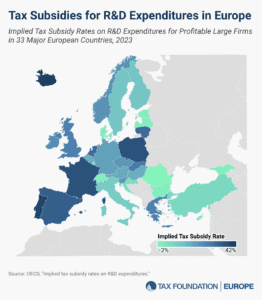

Tax Subsidies for R&D Expenditures in Europe, 2025

Many countries incentivize business investment in research and development (R&D), intending to foster innovation. A common approach is to provide direct government funding for R&D activity. However, a significant number of jurisdictions also offer R&D tax incentives.

4 min read