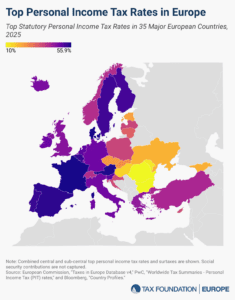

Top Personal Income Tax Rates in Europe, 2025

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) levy the highest top personal income tax rates in Europe.

4 min readProviding journalists, taxpayers, and policymakers with the latest data on taxes and spending is a cornerstone of the Tax Foundation’s educational mission.

As a nonpartisan, educational organization, the Tax Foundation has earned a reputation for independence and credibility. Our global tax policy team regularly provides accessible, data-driven insights, including a survey of corporate tax rates around the world, from sources such as the Organisation for Economic Co-Operation and Development (OECD), the European Commission, and others.

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) levy the highest top personal income tax rates in Europe.

4 min read

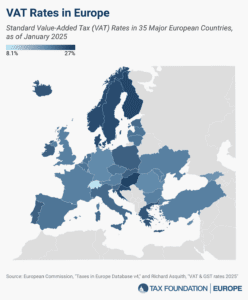

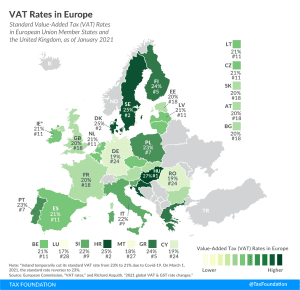

More than 175 countries worldwide—including all major European countries—levy a value-added tax (VAT) on goods and services. EU Member States’ VAT rates vary across countries, though they’re somewhat harmonized by the EU.

5 min read

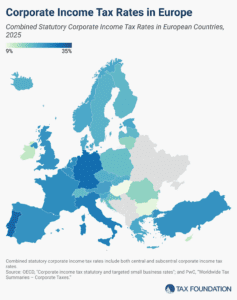

Some European countries have raised their statutory corporate rates over the past year, including Czechia, Estonia, Iceland, Lithuania, and Slovenia.

3 min read

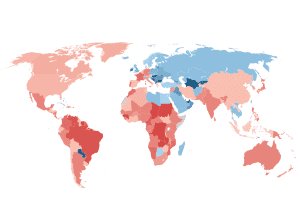

The worldwide average statutory corporate tax rate has consistently decreased since 1980 but has leveled off in recent years. In the US, the 2017 Tax Cuts and Jobs Act brought the country’s statutory corporate income tax rate from the fourth highest in the world closer to the middle of the distribution.

18 min read

Developed countries raise tax revenue through individual income taxes, corporate income taxes, social insurance taxes, taxes on goods and services, and property taxes—the combination of which determines how distortionary or neutral a tax system is.

4 min read

To recover from the pandemic and put the global economy on a trajectory for growth, policymakers need to aim for more generous and permanent capital allowances. This will spur real investment and can also contribute to more environmentally friendly production across the globe.

33 min read

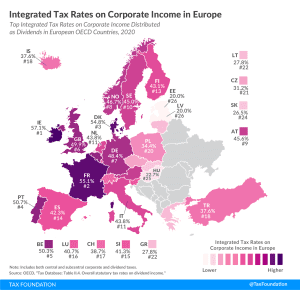

The integrated tax rate on corporate income reflects both the corporate income tax and the dividends or capital gains tax—the total tax levied on corporate income. For dividends, Ireland’s top integrated tax rate was highest among European OECD countries, followed by France and Denmark

4 min read

More than 140 countries worldwide—including all European countries—levy a Value-Added Tax (VAT) on goods and services.

4 min read

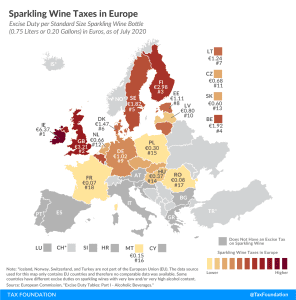

This week, people around the world will celebrate New Year’s Eve, with many opening a bottle of sparkling wine to wish farewell to—a rather consequential—2020 and offer a warm welcome to the—by many of us, long-awaited—new year 2021.

1 min read

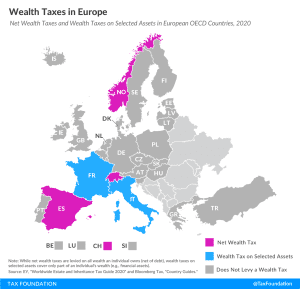

Net wealth taxes are recurrent taxes on an individual’s wealth, net of debt. The concept of a net wealth tax is similar to a real property tax. But instead of only taxing real estate, it covers all wealth an individual owns. As today’s map shows, only three European countries covered levy a net wealth tax, namely Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets but not on an individual’s net wealth per se.

3 min read

Corporate tax rates have been declining in every region around the world over the past four decades as countries have recognized their negative impact on business investment. Our new report explores the latest corporate tax trends and compares corporate tax rates by country.

22 min read

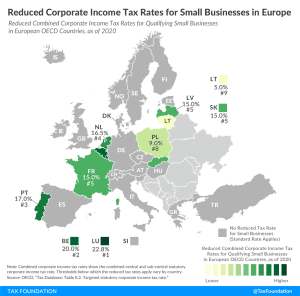

Corporate income taxes are commonly levied as a flat rate on business profits. However, some countries provide reduced corporate income tax rates for small businesses

2 min read