Online shopping is nothing new in our increasingly digital world, but 2020’s extended lockdowns due to the coronavirus pandemic have made it even more popular. You can order groceries, get a hot meal delivered, or even buy a kite for socially-distanced fun, all without leaving your couch. The system is simple and streamlined—at least for those doing the ordering.

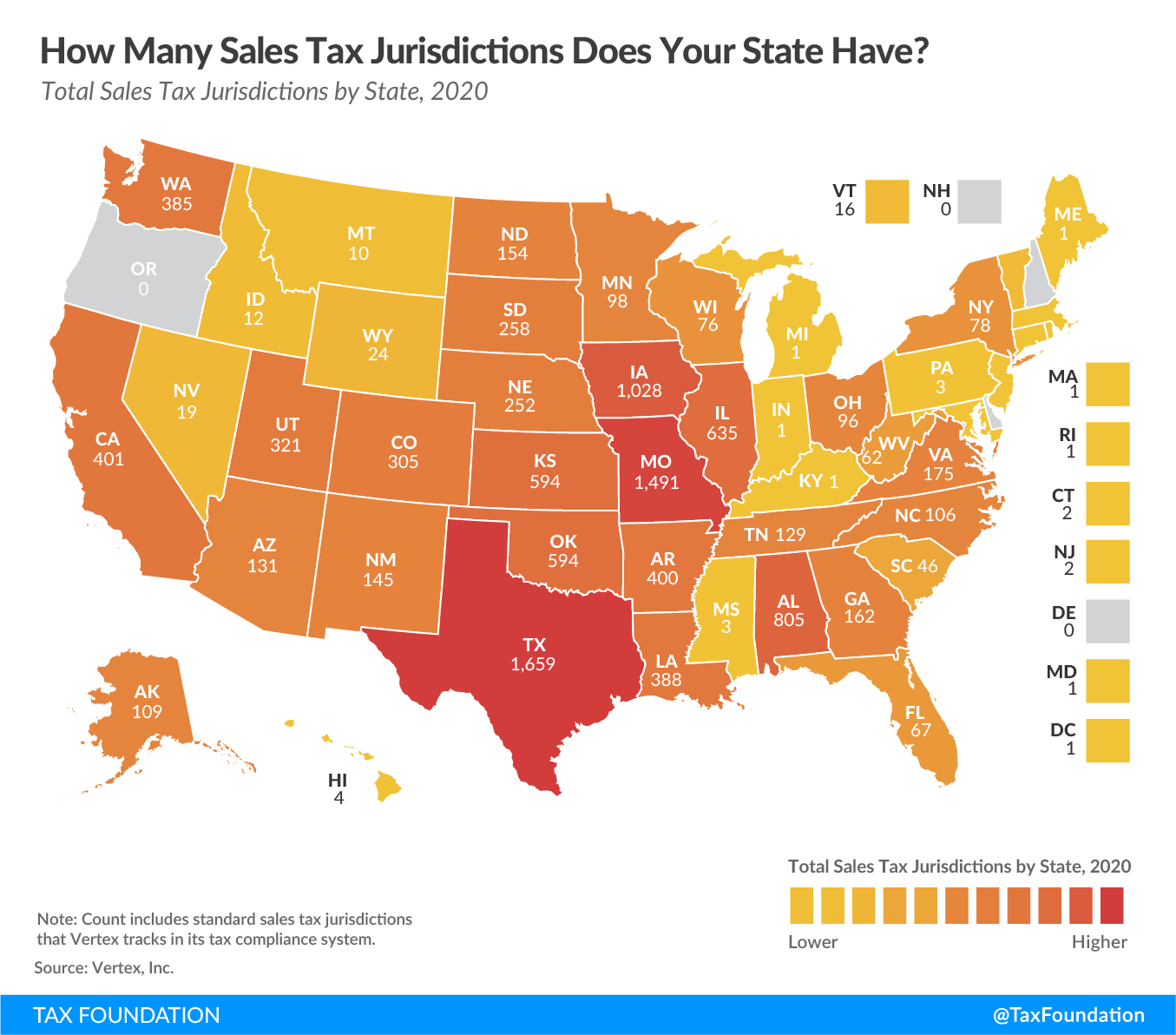

But sellers face a vast landscape of rates and jurisdictions that can make compliance a challenge. There are over 11,000 standard sales tax jurisdictions in the United States in 2020, according to software company Vertex Inc. Each jurisdiction has a distinct aggregate sales tax rate based on a unique combination of factors, including sales taxes levied by taxing authorities at the state, county, city, and district levels.

But not all states have the same number of jurisdictions. This week’s map shows how the distribution breaks down.

The number of jurisdictions varies widely by state. New Jersey, despite having hundreds of municipalities, has just two sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. jurisdictions, while Texas has over 1,600. But having fewer jurisdictions doesn’t always translate to less complexity, as states and localities have their own laws and practices for sales taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. administration, audits, enforcement, and notices of rate changes.

Following the Wayfair decision, states’ move to tax online sales has increased the importance of simplicity in sales tax systems, as sellers now have to deal with differing regulations in multiple states. With various taxing authorities making an average of 577 sales tax rate changes a year, things can get complicated quickly.

While local sales taxes are entirely consistent with Wayfair, all jurisdictions in a state should use the same sales tax base, with a single point of administration.

Arizona lacks a uniform sales tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. and Alabama lacks centralized administration, but Louisiana and Colorado lack both of these. It’s worth noting, however, that Louisiana has been working to solve part of the administration problem by implementing an online collection and rate lookup system for remote sellers. The Uniform Local Sales Tax Board has also recently created a collection portal for in-state sellers. Although it is very new and is still filling in some gaps, such a system will go a long way to simplify compliance in the Pelican State.

Twenty-four states are members of the Streamlined Sales and Use Tax Agreement (SSUTA), which requires states to have common base definitions, a uniform state base, and a single point of administration. The project also provides an online system for tax remittance, which aids sellers by allowing them to do business with multiple states in one place.

Remote sellers—especially small businesses—face the momentous task of complying with many sales tax codes at once. States should look to unity and uniformity to keep from unduly burdening those sellers.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe